TIDMZEN

RNS Number : 6660U

Zenith Energy Ltd

06 December 2021

December 6, 2021

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Loan for African Development

Zenith Energy Ltd. ("Zenith" or the "Company") (LSE: ZEN; OSE:

ZENA), the Africa focused energy production and development company

, is pleased to announce that it has entered into a supplementary

loan agreement with Winance, a company registered under the laws of

the Cayman Islands with a single-family office based in Dubai (the

"Lender"), for an additional amount of EUR 3 million (approximately

GBP2.55 million or approximately NOK 31 million) (the "Loan

Agreement").

Terms

The Loan Agreement has a duration of eight months and does not

attract interest.

An upfront arrangement fee, equal to 5 percent of the total

drawdown amount, has been paid to the Lender in accordance with the

terms of the Loan Agreement.

The Company can confirm that it has now made a drawdown of EUR 1

million. Possible future drawdowns to be made under the Loan

Agreement will be solely at Zenith's discretion.

During each month prior to the maturity date, Zenith shall make

repayments in accordance with the Loan Agreement ("Instalments"),

with the first Instalment being payable by the close of December

2021.

Under the terms of the Loan Agreement, Zenith may elect to pay

each Instalment either by cash or by utilising the Reserve Shares,

by delivering to the Lender an amount of Reserves Shares equivalent

to the quotient obtained by dividing the Instalment Amount by 95

percent of the applicable VWAP (volume weighted average price) for

the period of ten business days prior to the due date for each

Instalment.

80,000,000 (eighty million) new common shares of no par value

(the "Reserve Shares") have been issued to the Lender at a price of

NOK 0.12 (equivalent to approximately GBP0.01) to be held in a

depositary institution designated by the Lender.

An application will be made for the Reserve Shares to be listed

on the standard segment of the FCA Official List and to be admitted

for trading on the London Stock Exchange Main Market for listed

securities ("Admission"), with Admission expected on or around

December 10, 2021.

Issue of Share Subscription Warrants ("Warrants")

In connection with the drawdown made under the Loan Agreement,

the Company has issued the Lender the following Warrants with a

duration of two years:

-- 55,176,667 million Warrants to acquire one common share for

each Warrant at an exercise price of NOK 0.14 (equivalent to

approximately GBP0.013).

Total Voting Rights

The Company wishes to announce, in accordance with the UK

Financial Conduct Authority's Disclosure Guidance and Transparency

Rules, as well as section 3.10 of the Euronext Growth Oslo Rule

Book Part II , the following revised Total Voting Rights

information following issuance of the Reserve Shares:

Class of share Total number Number Total number of voting

of shares of voting rights per class of

rights share

per share

Common Shares in issue

and admitted to trading

on the Main Market of

the London Stock Exchange

on Admission. 1,872,574,449 1 1,872,574,449

--------------- ------------ -------------------------

Common Shares in issue

and admitted to trading

on the Euronext Growth

Market of the Oslo Børs,

r epresenting the newly

enlarged outstanding share

capital of the Company. 1,872,574,449 1 1,872,574,449

--------------- ------------ -------------------------

Luca Benedetto, Chief Financial Officer of Zenith,

commented:

"We are pleased to further strengthen our relationship with

Winance, who have provided the Company with significant financial

support during 2021.

The Company plans to use the funds derived from the Loan

Agreement to finance certain potential near-term acquisitions in

Tunisia and beyond, as well as to strengthen our working capital

position.

It is our intention to minimise the use of the Reserve Shares to

fulfil our obligations arising from the Loan Agreement, and instead

deploy the Company's increasing energy production revenue to repay

the instrument."

Waqas Ibrahim, Director and CFO of Winance, commented:

"We are delighted to strengthen our relationship with a very

effective and ambitious management team such as that of Zenith

Energy. Winance, as a strategic partner, will continue to support

Zenith's growth aspirations for the foreseeable future by utilising

our extensive expertise to innovate and adapt to the evolving

funding requirements it may have as it enriches its portfolio and

grows in size."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"). Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Further Information:

Zenith Energy Ltd Tel: +1 (587) 315 9031

Andrea Cattaneo, Chief Executive E: info@zenithenergy.ca

Officer

Allenby Capital Limited - Financial Tel: + 44 (0) 203 328 5656

Adviser & Broker

Nick Harriss

Nick Athanas

------------------------------

Celicourt Communications (Financial Tel: +44 (0) 208 434 2643

PR) E: zenithenergy@celicourt.uk

Mark Antelme

Jimmy Lea

------------------------------

Notes to Editors :

Zenith Energy Ltd. is an international oil and gas production

company, listed on the London Stock Exchange (LSE:ZEN) and the

Euronext Growth Market of the Oslo Stock Exchange (OSE:ZENA).

Zenith's development strategy is to identify and rapidly complete

value-accretive hydrocarbon production opportunities in the oil

& gas sector, specifically in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBGBDDIXGDGBL

(END) Dow Jones Newswires

December 06, 2021 05:59 ET (10:59 GMT)

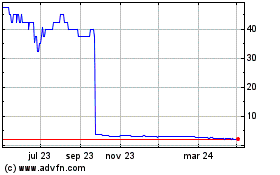

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

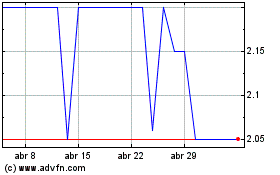

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024