TIDMZEN

RNS Number : 8045T

Zenith Energy Ltd

29 November 2021

November 29, 2021

ZENITH ENERGY LTD.

("Zenith" or the "Company")

Option Agreement for OML 141 RSC in Nigeria

Zenith Energy Ltd. ("Zenith" or the "Company") (LSE: ZEN; OSE:

ZENA), the Africa focused production and development energy

company, is pleased to announce that it has entered into an Option

Agreement (the "Option") with Noble Hill-Network Limited ("NHNL"),

a private Nigerian oil and gas company.

NHNL is the sole, 100% holder of a Risk Service Contract ("RSC")

for the development of the North-West Corner of OML 141 in Nigeria,

defined as the Risk Service Contract Area ("RSCA"), which covers

105 square kilometres of the Niger Delta region and contains the

potentially highly productive Barracuda and Elepa South oilfields,

as well one prospective field with an estimated 232.7 million

barrels of discovered oil (Degeconek 2019 CPR).

Terms of the Option

The object of the Option is to provide Zenith with the

opportunity to jointly develop the RSCA of OML 141 with NHNL.

Plans have already been finalised to drill, test, and complete

the Barracuda 5 well ("B-5"), which is situated between two

previously drilled wells that have both encountered significant

hydrocarbons. In the event of a successful outcome, production will

commence immediately using a barge-mounted Early Production

Facility to initially transport the produced oil to a nearby

floating storage and offloading vessel for subsequent

monetisation.

The Option gives Zenith the ability to purchase 42,000,000

(forty-two million) ordinary shares of Naira 1.00 in NHNL that are

available and unincumbered for issue to Zenith, representing an

interest of 42% (forty-two percent) in the outstanding share

capital of NHNL.

The consideration to exercise the Option and thereby acquire a

42% interest in NHNL has been agreed as US$20,000,000 (twenty

million United States Dollars) (the "Consideration"), payable in 7

instalments over 270 days each of US$3,000,000, except for the

first and the last which will satisfy the remaining Consideration

payable.

NHNL will use the Consideration to fund the drilling of B-5. The

Company has been informed that the drilling location for B-5 has

already been acquired by NHNL and all necessary civil works

(including dredging and clearing of the designated well location)

have been performed in preparation for the mobilisation of a

barge-mounted drilling rig.

A suitable and fully inspected drilling rig has been identified

and a site visit is planned in mid-December 2021, with the

expectation of signing a drilling contract in January 2022 to begin

operations during the first quarter of 2022. Production from the

Barracuda oilfield is expected to begin during the second quarter

of 2022 at a rate of approximately 4,000 barrels of oil per

day.

Further development and drilling activities are planned to

follow the drilling of B-5, with the locations for Barracuda wells

6,7 and 8 having already been identified. In the event the Option

was exercised, and Zenith thereby held 42% of NHNL, it would only

be required to fund its share of future development work.

The Option will expire on January 15, 2022.

Andrea Cattaneo, Chief Executive Officer of Zenith,

commented:

"We are delighted to have signed an Option to acquire an

exclusive material interest in NHNL, the sole holder of the RSC for

OML 141, containing the Barracuda and Elepa South Oilfields,

following our ongoing due diligence exercise.

The near-term drilling of B-5 is an opportunity for Zenith to

rapidly achieve a material progression in its development by

exploiting the considerable production potential of the Barracuda

oilfield. We view the risk profile of drilling B-5 as low to medium

primarily, amongst other factors, due to the strongly confirmed

presence of hydrocarbons in nearby wells accessing the same

formations.

Further, it should be noted that the Option, and its potential

exercise, are not subject to external approvals or other

bureaucratic procedures resulting in delays, meaning that Zenith

and NHNL can speedily progress in executing operational

activities.

We are confident in our ability to finance the Option by using

multiple sources of funding, specifically funding from pan-African

financial institutions .

Finally, while this transaction would represent the largest

single investment in Zenith's history, it will in no way divert

attention away from our development in Tunisia, and especially in

the Republic of the Congo, where we expect to finally achieve

significant progress in due course ."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"). Upon the publication of this announcement via a

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Further Information:

Zenith Energy Ltd Tel: +1 (587) 315 9031

Andrea Cattaneo, Chief Executive E: info@zenithenergy.ca

Officer

Allenby Capital Limited - Financial Tel: + 44 (0) 203 328 5656

Adviser & Broker

Nick Harriss

Nick Athanas

------------------------------

Celicourt Communications (Financial Tel: +44 (0) 208 434 2643

PR) E: zenithenergy@celicourt.uk

Mark Antelme

Jimmy Lea

------------------------------

Notes to Editors :

Zenith Energy Ltd. is an international oil and gas production

company, listed on the London Stock Exchange (LSE:ZEN) and the

Euronext Growth Market of the Oslo Stock Exchange (OSE:ZENA).

Zenith's development strategy is to identify and rapidly

complete value-accretive hydrocarbon production opportunities in

the oil & gas sector, specifically in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CNTBPBJTMTATTJB

(END) Dow Jones Newswires

November 29, 2021 02:00 ET (07:00 GMT)

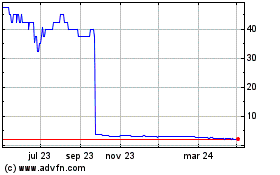

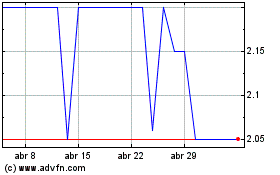

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zenith Energy (LSE:ZEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024