TIDMZYT

RNS Number : 1503Y

Zytronic PLC

11 May 2021

11 May 2021

Zytronic plc

("Zytronic" or the "Company" and, together

with its subsidiaries, the "Group")

Interim Results for the six months ended 31 March 2021

(unaudited)

Zytronic plc, a leading specialist manufacturer of touch

sensors, announces its consolidated interim results for the six

months ended 31 March 2021. Comparative data is given for the six

months ended 31 March 2020, except where indicated.

Overview

-- Group revenue of GBP4.8m (2020: GBP7.4m), impacted by the Coronavirus pandemic

-- EBITDA of GBP0.2m (2020: GBP1.0m)

-- Loss before tax of GBP0.3m (2020: profit of GBP0.5m)

-- Basic (loss)/earnings per share of (1.2)p (2020: 2.5p)

-- Positive operating cashflow of GBP0.4m (2020: GBP1.9m)

-- Net cash of GBP7.8m (30 September 2020: GBP14.0m), after

payment of GBP6.7m in respect of the return of capital

Commenting on the results, Tudor Davies, Chairman said:

"Whilst we are starting from a very low base compared with our

historic sales levels, the recent improvement in orders and sales

are an encouraging sign of the prospects for the second half and

for a return to profitability as more normal global trading resumes

post COVID-19."

Enquiries:

Zytronic plc

Mark Cambridge, Chief Executive

Claire Smith, Group Finance Director 0191 414 5511

N+1 Singer (Nominated Adviser

and Broker)

Aubrey Powell, Rachel Hayes, Amanda

Gray (Investment Banking) 020 7496 3000

Notes to Editors

Zytronic is the developer and manufacturer of a unique range of

internationally award-winning and patented touch sensor products,

operating from three modern factories totaling 80,000ft(2) near

Newcastle-upon-Tyne in the United Kingdom.

Zytronic touch products employ an embedded sensing solution and

are readily configurable to enable multi-user and multi-touch touch

sensing sizes from five inches to ultra-large 85", making them an

ideal solution for system designers' specific requirements,

offering significant durability, environmental stability and

optical enhancement benefits to touch interactivity for industrial,

self-service and public access equipment.

Chairman's statement

Introduction

In the January trading update, we explained that sales continued

to be badly affected by the Coronavirus pandemic, but the prior

year's reorganisation and cost reduction measures were enabling us

to maintain a positive EBITDA, and there were some signs of an

improvement in the order intake.

We are pleased to report a continuation of the improvement in

order intake and sales during the remainder of the first half to 31

March 2021, and now expect a gradual return to profitability as

long as the Coronavirus pandemic continues to be controlled in our

major markets of Europe, Asia and the Americas.

Trading

Revenues for the half year ended 31 March 2021 were GBP4.8m

(2020: GBP7.4m), with gross margin of 27.0% (2020: 30.3%), EBITDA

of GBP0.2m (2020: GBP1.0m) and after depreciation and amortisation

the loss before tax was GBP0.3m (2020: profit of GBP0.5m).

Whilst the drop in revenues of 35% is significant when compared

with the same period last year, the comparison with a pre-COVID-19

period only provides an indicator of more normal historic trading

levels. A better indicator of progress at this stage is the order

intake, and from April last year we had continued to experience a

consistently low order intake level. However, from January onwards

we have seen an improving monthly average order intake, and it is

particularly pleasing that the Gaming and Financial sectors have

made a major contribution to the improvement.

Cash position

The Board decided that the GBP14.0m cash balances as at 30

September 2020, arising from the Company's 16-year record of

unbroken profitability prior to the pandemic, and despite a 15-year

unbroken dividend, should provide the opportunity for shareholders

to either participate in a return of surplus cash, or to maintain

their shareholdings.

Following the conclusion of the Tender Offer on 25 February

2021, the number of shares in issue reduced by 28.8% to 11,419,152

as 4,624,889 shares were purchased at a price of 145p and a cost of

GBP6.7m.

We continue to be in a strong financial position with cash

balances of GBP7.8m (30 September 2020: GBP14.0m) and are pleased

that despite the considerable downturn we have generated

GBP0.4m.

Outlook

Whilst we are starting from a very low base compared with our

historic sales levels, the recent improvement in orders and sales

are an encouraging sign of the prospects for the second half and

for a return to profitability as more normal global trading resumes

post-COVID-19.

Tudor Davies

Chairman

11 May 2021

Consolidated statement of comprehensive income

Unaudited results for the six months to 31 March 2021

Six months Six months Year to

to to

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

----------------------------------------------- ------ ----------- ----------- -------------

Group revenue 4,784 7,378 12,680

Cost of sales (3,490) (5,146) (10,130)

----------------------------------------------- ------ ----------- ----------- -------------

Cost of sales excluding exceptional

items (3,490) (5,146) (9,015)

Exceptional items 3a - - (1,115)

----------------------------------------------- ------ ----------- ----------- -------------

Gross profit 1,294 2,232 2,550

Distribution costs (66) (135) (196)

Administration expenses (1,542) (1,679) (3,318)

----------------------------------------------- ------ ----------- ----------- -------------

Administration expenses excluding exceptional

items (1,542) (1,679) (3,060)

Exceptional items 3b - - (258)

----------------------------------------------- ------ ----------- ----------- -------------

Group trading (loss)/profit (314) 418 (964)

Exceptional other income 4 - - 500

----------------------------------------------- ------ ----------- ----------- -------------

Group operating (loss)/profit (314) 418 (464)

Finance revenue - 40 41

----------------------------------------------- ------ ----------- ----------- -------------

(Loss)/profit before tax (314) 458 (423)

Tax credit/(expense) 5 130 (64) 129

----------------------------------------------- ------ ----------- ----------- -------------

(Loss)/profit for the period (184) 394 (294)

----------------------------------------------- ------ ----------- ----------- -------------

(Loss)/earnings per share

Basic 6 (1.2)p 2.5p (1.8)p

Diluted 6 (1.2)p 2.5p (1.8)p

----------------------------------------------- ------ ----------- ----------- -------------

All activities are from continuing operations.

Consolidated statement of changes in equity

Unaudited results for the six months to 31 March 2021

Called

up

share Share Retained

capital premium earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- -------- --------- --------

At 1 October 2020 160 8,994 13,911 23,065

Loss for the period - - (184) (184)

Repurchase and cancellation of shares (46) - (6,660) (6,706)

--------------------------------------- -------- -------- --------- --------

At 31 March 2020 (unaudited) 114 8,994 7,067 16,175

--------------------------------------- -------- -------- --------- --------

Consolidated statement of financial position

Unaudited results at 31 March 2021

At At At

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------ ---------- ---------- -------------

Assets

Non-current assets

Intangible assets 875 1,208 1,043

Property, plant and equipment 5,490 6,126 5,820

---------------------------------- ------ ---------- ---------- -------------

6,365 7,334 6,863

---------------------------------- ------ ---------- ---------- -------------

Current assets

Inventories 1,621 2,713 2,332

Trade and other receivables 1,912 3,357 1,888

Derivative financial assets 8 - -

Cash and short term deposits 8 7,752 12,369 14,038

---------------------------------- ------ ---------- ---------- -------------

11,293 18,439 18,258

---------------------------------- ------ ---------- ---------- -------------

Total assets 17,658 25,773 25,121

---------------------------------- ------ ---------- ---------- -------------

Equity and liabilities

Current liabilities

Trade and other payables 489 650 591

Derivative financial liabilities - 93 -

Provisions - - 582

Accruals 489 636 376

Government grants 25 - 27

Tax liabilities - 125 -

---------------------------------- ------ ---------- ---------- -------------

1,003 1,504 1,576

---------------------------------- ------ ---------- ---------- -------------

Non-current liabilities

Deferred tax liabilities (net) 480 516 480

---------------------------------- ------ ---------- ---------- -------------

480 516 480

---------------------------------- ------ ---------- ---------- -------------

Total liabilities 1,483 2,020 2,056

---------------------------------- ------ ---------- ---------- -------------

Net assets 16,175 23,753 23,065

---------------------------------- ------ ---------- ---------- -------------

Capital and reserves 9

Equity share capital 114 160 160

Share premium 8,994 8,994 8,994

Retained earnings 7,067 14,599 13,911

---------------------------------- ------ ---------- ---------- -------------

Total equity 16,175 23,753 23,065

---------------------------------- ------ ---------- ---------- -------------

Consolidated cashflow statement

Unaudited results for the six months to 31 March 2021

Six months Six months Year to

to to

31 March 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

-------------------------------------------------- ------ ----------- ----------- -------------

Operating activities

(Loss)/profit before tax (314) 458 (423)

Finance income - (40) (41)

Depreciation and impairment of property,

plant and

equipment 333 365 718

Amortisation, impairment and write-off

of intangible assets 188 213 457

Amortisation of government grant (2) - (442)

Fair value movement on foreign exchange

forward contracts 8 72 (21)

Working capital adjustments

Decrease in inventories 711 321 702

Decrease in trade and other receivables 47 770 2,360

(Decrease)/increase in trade and other

payables and provisions (589) (170) 88

-------------------------------------------------- ------ ----------- ----------- -------------

Cash generated from operations 382 1,989 3,398

Tax received/(paid) 61 (127) (220)

-------------------------------------------------- ------ ----------- ----------- -------------

Net cashflow from operating activities 443 1,862 3,178

-------------------------------------------------- ------ ----------- ----------- -------------

Investing activities

Interest received - 31 41

Payments to acquire property, plant and

equipment (3) (106) (153)

Payments to acquire intangible assets (20) (122) (201)

-------------------------------------------------- ------ ----------- ----------- -------------

Net cashflow used in investing activities (23) (197) (313)

-------------------------------------------------- ------ ----------- ----------- -------------

Financing activities

Dividends paid to equity shareholders

of the Parent - (2,439) (2,439)

Receipt of government grants - - 469

Repurchase and cancellation of shares (6,706) - -

Net cashflow used in financing activities (6,706) (2,439) (1,970)

-------------------------------------------------- ------ ----------- ----------- -------------

(Decrease)/increase in cash and cash equivalents (6,286) (774) 895

-------------------------------------------------- ------ ----------- ----------- -------------

Cash and cash equivalents at the beginning

of the period 14,038 13,143 13,143

-------------------------------------------------- ------ ----------- ----------- -------------

Cash and cash equivalents at the end of

the period 8 7,752 12,369 14,038

-------------------------------------------------- ------ ----------- ----------- -------------

Notes to the interim report

Unaudited results for the six months to 31 March 2021

1. Basis of preparation

The financial information in these interim statements is

prepared under the historical cost convention and in accordance

with international accounting standards. It does not constitute

statutory accounts as defined in Section 435 of the Companies Act

2006 and does not reflect all the information contained in the

Group's annual report and financial statements.

The tax charge is calculated by applying the Directors' best

estimate of the annual tax rate to the profit for the period. Other

expenses are accrued in accordance with the same principles used in

the preparation of the annual report and financial statements.

The interim results for the six months to 31 March 2021 are not

reviewed by Crowe U.K. LLP and accordingly no opinion has been

given.

The interim financial statements have been prepared using the

same accounting policies and methods of computation used to prepare

the 2020 annual report and financial statements.

The financial information for the six months to 31 March 2021

and the comparative financial information for the six months to 31

March 2020 have not been audited. The comparative financial

information for the year ended 30 September 2020 has been extracted

from the 2020 annual report and financial statements.

The annual report and financial statements for the year ended 30

September 2020, which were approved by the Board of Directors on 7

December 2020, received an unqualified audit report, did not

contain a statement under Sections 498(2) or (3) of the Companies

Act 2006 and have been filed with the Registrar of Companies.

The Group has one reportable business segment comprising the

development and manufacture of customised optical products to

enhance electronic display performance. Products in this reportable

business segment include touch sensors, filters and other laminated

products. All revenue, profits or losses before tax and net assets

are attributable to this reportable business segment.

2. Basis of consolidation

The Group results consolidate the accounts of Zytronic plc and

all its subsidiary undertakings drawn up to 31 March 2021.

3. Exceptional costs

(a) Cost of sales

Six months Six months Year to

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- --------------

Costs of restructuring - - 652

Costs of Furlough - - 463

------------------------- -------------- -------------- --------------

Total exceptional costs - - 1,115

------------------------- -------------- -------------- --------------

These charges have arisen as a direct result of the COVID-19

impact on the Group whereby restructuring was necessary to align

headcount with operations.

(b) Administration expenses

Six months Six months Year to

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- --------------

Costs of restructuring - - 144

Costs of Furlough - - 114

------------------------- -------------- -------------- --------------

Total exceptional costs - - 258

------------------------- -------------- -------------- --------------

These charges have arisen as a direct result of the COVID-19

impact on the Group whereby restructuring was necessary to align

headcount with operations.

4. Exceptional other income

Six months Six months Year to

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------- -------------- -------------- --------------

Grant monies received - - 500

----------------------------- -------------- -------------- --------------

Total grant monies received - - 500

----------------------------- -------------- -------------- --------------

The income received and accrued as above is as a result of

claims made under the CJRS for when personnel were on Furlough

leave.

5. Tax charge on (loss)/profit on ordinary activities

The estimated tax rate for the year of 41% has been applied to

the half year's loss before tax, in accordance with the Auditing

Standards Board's statement on interim reports.

6. (Loss)/earnings per share ("LPS" / "EPS")

Basic LPS/EPS is calculated by dividing the (loss)/profit

attributable to ordinary equity holders of the Company by the

weighted average number of ordinary shares in issue during the

period. All activities are continuing operations and therefore

there is no difference between LPS/EPS arising from total

operations and LPS/EPS arising from continuing operations.

For the six months to 31 March 2021 and 2020

Weighted Weighted

average average

number number

Loss of shares LPS Earnings of shares EPS

31 March 31 March 31 March 31 March 31 March 31 March

2021 2021 2021 2020 2020 2020

GBP'000 Thousands Pence GBP'000 Thousands Pence

--------------------------- --------- ---------- --------- --------- ---------- ---------

(Loss)/profit on ordinary

activities after tax (184) 15,273 (1.2) 394 16,044 2.5

--------------------------- --------- ---------- --------- --------- ---------- ---------

Basic LPS/EPS (184) 15,273 (1.2) 394 16,044 2.5

--------------------------- --------- ---------- --------- --------- ---------- ---------

The weighted average number of shares for diluted LPS/EPS is

calculated by including the weighted average number of shares under

option.

Weighted Weighted

average average

number number

Loss of shares LPS Earnings of shares EPS

31 March 31 March 31 March 31 March 31 March 31 March

2021 2021 2021 2020 2020 2020

GBP'000 Thousands Pence GBP'000 Thousands Pence

--------------------------- --------- ---------- --------- --------- ---------- ---------

(Loss)/profit on ordinary

activities after tax (184) 15,273 (1.2) 394 16,044 2.5

Weighted average number - - - - - -

of shares under option

--------------------------- --------- ---------- --------- --------- ---------- ---------

Diluted LPS/EPS (184) 15,273 (1.2) 394 16,044 2.5

--------------------------- --------- ---------- --------- --------- ---------- ---------

For the year to 30 September 2020

Weighted

average

number

Loss of shares LPS

30 September 30 September 30 September

2020 2020 2020

GBP'000 Thousands Pence

--------------------------------------- ------------- ------------- -------------

Loss on ordinary activities after tax (294) 16,044 (1.8)

--------------------------------------- ------------- ------------- -------------

Basic LPS (294) 16,044 (1.8)

--------------------------------------- ------------- ------------- -------------

The weighted average number of shares for diluted LPS is

calculated by including the weighted average number of shares under

option.

Weighted

average

number

Loss of shares LPS

30 September 30 September 30 September

2020 2020 2020

GBP'000 Thousands Pence

------------------------------------------------ ------------- ------------- -------------

Loss on ordinary activities after tax (294) 16,044 (1.8)

Weighted average number of shares under option - - -

------------------------------------------------ ------------- ------------- -------------

Diluted LPS (294) 16,044 (1.8)

------------------------------------------------ ------------- ------------- -------------

7. Dividends

Under the present circumstances, the Directors consider that it

is appropriate to defer returns to shareholders until there is

clear evidence of a return towards normality. Accordingly, no

interim dividend is proposed for the period (2020: Nil). The table

below reflects historic dividend payments.

Six months Six months Year to

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- -------------- ------------- --------------

Ordinary dividends on equity shares

Final dividend of 15.2p per ordinary share

paid on

7 February 2020 - 2,439 2,439

-------------------------------------------- -------------- ------------- --------------

- 2,439 2,439

----------------------------------------------------------- ------------- --------------

8. Cash and cash equivalents

Six months Six months Year to

to 31 March to 31 March 30 September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------- ------------- ------------- --------------

Cash at bank and in hand 7,752 12,369 14,038

-------------------------- ------------- ------------- --------------

For the purpose of the consolidated cashflow statement, cash and

cash equivalents comprise the following:

Six months Six months Year

to 31 March to 31 March to 30

September

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------- -------------- -------------- ------------

Cash at bank and in hand 7,752 9,839 11,503

Short term deposits - 2,530 2,535

7,752 12,369 14,038

-------------------------- -------------- -------------- ------------

Cash at bank earns interest at floating rates based on daily

bank deposit rates. Short term deposits are made for variable

lengths, being overnight, three months or one year (with break

conditions), depending on the immediate cash requirements of the

Group, and earn interest at variable rates.

At 31 March 2021 the Group had available a net GBP1.0m (cash

less overdrawn accounts) overdraft facility from Barclays Bank plc,

which will fall for review in July 2021.

The fair value of cash and cash equivalents is GBP7.8m (2020:

GBP12.4m).

9. Capital and reserves

On 1 February 2021 the Company announced a proposed return of up

to GBP10.0m of capital by way of a Tender Offer which was accepted

by shareholders on 25 February 2021. As a result, 4,624,889 shares

were purchased and subsequently cancelled by the Company at a price

of 145p per share, returning GBP6.7m of the Company's cash.

10. Availability of the interim report

A copy of the interim report and interim results presentation is

available on the Company's corporate website, www.zytronicplc.com.

Copies can be requested from the Company's registered office:

Whiteley Road, Blaydon-on-Tyne, Tyne and Wear NE21 5NJ.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUPAAUPGPUU

(END) Dow Jones Newswires

May 11, 2021 02:00 ET (06:00 GMT)

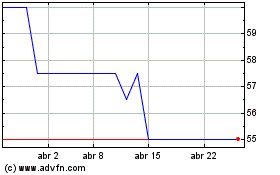

Zytronic (LSE:ZYT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Zytronic (LSE:ZYT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024