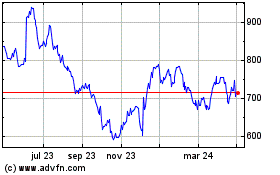

TIDMDSCV

RNS Number : 9463T

discoverIE Group plc

30 November 2021

30 NOVEMBER 2021

discoverIE Group plc

Interim results for the six months ended 30 September 2021

Record growth and order book, targets upgraded

discoverIE Group plc (LSE: DSCV, "discoverIE" or "the Group"), a

leading international designer and manufacturer of customised

electronics to industry , today announces its interim results for

the six months ended 30 September 2021 ("H1 2021/22" or "the

period").

H1 2021/22 H1 2020/21 Growth H1 2019/20 Growth

Continuing Operations(1) % %

Revenue GBP174.3m GBP143.8m +21% GBP149.4m +17%

Underlying operating

profit(2) GBP18.0m GBP13.6m +32% GBP14.2m +27%

Underlying operating

margin(2) 10.3% 9.5% +0.8ppts 9.5% +0.8ppts

Underlying profit

before tax(2) GBP16.1m GBP11.7m +38% GBP12.0m +34%

Underlying EPS(2) 13.0p 9.5p +37% 11.0p +18%

Reported profit

before tax GBP6.4m GBP5.6m +14% GBP6.8m (6%)

Total Operations

Reported fully diluted

EPS 6.6p 5.8p +14% 9.1p (27%)

Interim dividend

per share 3.35p 3.15p +6% 2.97p +13%

Highlights

-- Record growth in orders and sales driving strong financial performance

o Organic(3) orders: +64% (v H1 2020/21) and +34% (v pre-Covid

period H1 2019/20)

o Organic sales: +15% (v H1 2020/21) and +8% (v H1 2019/20)

o Underlying operating profit from continuing operations:

+32%

o Underlying EPS from continuing operations: +37%

-- Further progress made towards key targets; strategic targets now upgraded

o Underlying operating margin increased to 10.3% (with target

increased to 13.5%)

o Good progress towards carbon emissions target reduction of 50%

by 2025

o Sales beyond Europe increased to 38% of total sales (with

target increased to 45%)

o Sales into target markets(4) of 77% (H1 2020/21: 68%)

o Excellent free cash conversion(5) of 95% of PAT, well ahead of

85% target

-- Three international acquisitions completed for GBP85m

o Beacon, Antenova and CPI acquired; integrations progressing

well

o Well supported equity placing in Sept 2021 raising a net

GBP53m

-- Group well positioned for further growth

o Announced sale of Acal BFi business for GBP50m concludes exit

from distribution business

o Record order book of GBP198m (organic: +71% v Sept 2020; +54%

v Sept 2019)

o Further acquisition opportunities developing with considerable

funding headroom

o Proforma gearing(6) post Acal BFi sale of 0.9x, well below our

target of 1.5x to 2.0x

Nick Jefferies, Group Chie f Executive, commented:

"These strong results demonstrate the strength of the discoverIE

business model, with record growth in orders, order book and

underlying earnings per share, which increased by 37% and follows a

resilient performance last year through Covid. Revenues and

earnings are now well ahead of the pre-Covid period and I would

like to thank all employees around the Group for their tremendous

effort and flexibility over the last 18 months that has led to

these results.

The announced sale of Acal BFi earlier this month concludes the

Group's exit from the business of distribution, with discoverIE now

becoming a solely focused global designer and manufacturer of

customised electronics. We have raised our medium-term strategic

targets accordingly and our continuing focus is on achieving

organic growth with new design wins in sustainable target markets,

together with accretive acquisitions.

The second half has started well with continued order and sales

growth over the same period last year and two years ago, and the

Group is on track to deliver full year underlying earnings for the

continuing operations ahead of the Board's previous expectations

despite ongoing supply chain and foreign exchange headwinds.

With a clear strategy focused on long-term, high quality,

structural growth markets across Europe, North America and Asia, a

diversified customer base, a record order book and a strong

pipeline of acquisition opportunities, the Group is well positioned

to make further progress on its key priorities. "

Analyst and investor presentation

A virtual results briefing for analysts and investors will be

held today at 9.30am (UK time) via a live webinar.

If you would like to join the webinar, please contact Buchanan

at discoverie@buchanan.uk.com .

Enquiries :

discoverIE Group plc

Nick Jefferies Group Chief Executive

Simon Gibbins Group Finance Director

Lili Huang Head of Investor Relations 01483 544 500

Buchanan

Chris Lane, Toto Berger, Jack

Devoy

discoverIE@buchanan.uk.com 020 7466 5000

Notes:

(1) Continuing operations excludes the results of the Acal BFi

and Vertec SA businesses following their post period-end disposal

announcements. These two businesses comprise the discontinued

operations.

(2) 'Underlying Operating Profit', 'Underlying Operating

Margin", 'Underlying Operating Expenses', 'Underlying Profit before

Tax' and 'Underlying EPS' are non-IFRS financial measures used by

the Directors to assess the underlying performance of the Group.

These measures relate to continuing operations and exclude

acquisition-related costs (amortisation of acquired intangible

assets of GBP6.4m and acquisition & disposal expenses of

GBP3.3m) totalling GBP9.7m. Equivalent underlying adjustments

within the H1 2020/21 underlying results totalled GBP6.1m. For

further information, see notes 2 and 5 of the attached summary

financial statements.

(3) Organic growth for the Group compared with last year is

calculated at constant exchange rates ("CER") and is shown

excluding the first 12 months of acquisitions post completion

(Phoenix was acquired in October 2020, Limitor in February 2021,

CPI in May 2021, Antenova in August 2021 and Beacon in September

2021). Organic growth compared with two years ago excludes the

first 24 months of acquisitions so also excludes Sens-Tech acquired

in October 2019. The average sterling rate of exchange strengthened

4% against the Euro compared with the average rate for the first

half last year and strengthened 10% against the US Dollar while

remaining in line on average against the three Nordic

currencies.

(4) Target markets are renewable energy, medical, transportation, industrial & connectivity.

(5) Free cash flow is cash flow before dividends, acquisitions and equity fund raising.

(6) Gearing ratio is defined as net debt divided by underlying

EBITDA (annualised for acquisitions).

(7) Unless stated, growth rates refer to the comparable prior year period.

(8) The information contained within this announcement is deemed

by the Group to constitute inside information as stipulated under

the Market Abuse Regulation, Article 7 of EU Regulation 596/2014.

Upon the publication of this announcement via Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Notes to Editors:

About discoverIE Group plc

discoverIE Group plc is an international group of businesses

that designs and manufactures innovative components for electronic

applications.

The Group provides application-specific components to original

equipment manufacturers ("OEMs") internationally. By designing

components that meet customers' unique requirements, which are then

manufactured and supplied throughout the life of their production,

a high level of repeating revenue is generated with long term

customer relationships.

With a focus on key markets driven by structural growth and

increasing electronic content, namely renewable energy, medical,

transportation and industrial & connectivity, the Group aims to

achieve organic growth that is well ahead of GDP and to supplement

that with targeted complementary acquisitions. The Group has an

ongoing commitment to reducing the impact of its operations on the

environment, while its key markets are aligned with a sustainable

future.

The Group's continuing operations employs c.4,500 people and its

principal operating units are located in Continental Europe, the

UK, China, Sri Lanka, India and North America.

The Group is listed on the Main Market of the London Stock

Exchange and is a member of the FTSE250, classified within the

Electrical Components and Equipment subsector.

Strategic, Operational and Financial Review

Overview

The first half saw strong organic growth compared with both the

Covid-impacted prior year, and the pre-Covid period two years ago,

building on the progress of previous years. Over the last four

years as the D&M strategy has gathered momentum, ongoing Group

organic sales have grown by 9% CAGR while underlying EPS of

continuing operations have grown by 17% CAGR, excluding the Covid

year.

With the announcement in November 2021 of the sale of the Acal

BFi distribution business, discoverIE is now solely focused on the

design and manufacture of customised, innovative electronics. Five

higher margin acquisitions were made over the last year (three

during the period), further progressing us towards our medium-term

goals of becoming a higher margin Group, focused on international

and sustainably-aligned target markets, and delivering strong cash

generation. To reflect this, our key strategic targets have been

upgraded, as detailed in the Key Strategic and Performance

Indicators section below. Meanwhile, our low gearing leaves us with

considerable headroom for further acquisitions.

First half continuing Group sales increased by 21%, being 15%

higher organically than last year and 8% higher than the pre-Covid

period two years ago. Performance in our target markets, which now

account for 77% of Group sales, has been much stronger than other

markets, helping to deliver an underlying operating margin of over

10% for the first time.

Orders grew by 64% organically compared with last year and by

34% compared with two years ago following the build-up of a strong

pipeline of design wins over several years. This resulted in a

record period-end order book of GBP198m, respectively 71% and 54%

higher organically than 12 months and 24 months previously.

The Group is managing widespread supply chain challenges

effectively. While these conditions are expected to continue during

the second half, the period has started well with continuing

organic growth in orders and sales and the Group is on track to

deliver full year underlying earnings for the continuing operations

ahead of the Board's previous expectations. To ensure that the

Group can continue to grow well into the future, production

capacity is being expanded in the US, Germany and India, and

production has begun as scheduled at the Group's new larger

facility in Nogales, Mexico.

Carbon emissions

Last year the Group introduced a target to reduce carbon

emissions by 50% on a like for like basis across the Group by 2025.

With numerous manufacturing locations internationally, the primary

source (73%) of emissions is from purchased electricity (Scope 2

emissions). The remaining emissions are mainly from vehicles, as

well as natural gas and oil consumed on site (Scope 1). Good

progress towards our reductions target was made in calendar year

2020 with a 6% like-for-like reduction in underlying carbon

emissions and we anticipate further progress when measurements are

taken at the end of this calendar year.

Sourcing electricity from clean and lower or zero carbon sources

where possible, or installing renewable power generation on site,

as well as adopting more energy efficient practices, are the key

steps to achieving our emissions target. Of the Group's 30

manufacturing sites, the largest eight are responsible for c.60% of

the Group's carbon emissions. Two of these eight sites have now

switched to renewable energy tariffs, while the Sri Lankan facility

has completed the first phase of solar panel installation and one

in Poland has installed a natural source heat pump. When complete,

these latter two initiatives alone are expected to reduce the

Group's carbon emissions by around 10%. Phase 2 and 3 of the solar

panel project in Sri Lanka are both planned for 2022 and, when

complete, will reduce site carbon emissions by c. 75%.

Additionally, the switch to electric and hybrid vehicles is

underway and EV chargers are being installed at a number of sites

around the Group. Likewise, there is an ongoing reduction in

flights with the Group's businesses encouraged to use flights only

where necessary, continuing with video communication and other

channels where possible.

For newly acquired businesses, we aim to increase renewable

energy to at least 50% of their total energy consumption within the

first five years post acquisition. This target is being integrated

into their business plans. Emission audits with the three

acquisitions this Period are expected to complete by the year

end.

Group Results Summary

Continuing Group sales for the first half increased by 21% to

GBP174.3m (+24% CER), with first half underlying operating profit,

which excludes acquisition & disposal-related costs, increasing

by 32% to GBP18.0m. Underlying profit before tax increased by 38%

to GBP16.1m, with underlying earnings per share for the period

increasing by 37% to 13.0p (H1 2020/21: 9.5p).

After underlying adjustments for acquisition costs, together

with taxation costs and the inclusion of net profits from the

discontinued operation, profit after tax for the period on a

reported basis increased by 17% to GBP6.2m (H1 2020/21: GBP5.3m)

with fully diluted earnings per share increasing by 14% to 6.6p (H1

2020/21: 5.8p).

Strong free cash flow of GBP28.1m over the last 12 months

represented 95% of PAT, well ahead of the 85% target. Net debt at

30 September 2021 was GBP75.6m (30 September 2020: GBP42.1m) with a

gearing ratio of 1.3x, being net debt divided by underlying EBITDA

(annualised for acquisitions). Including our post period-end

announced disposals of Acal BFi and Vertec SA, proforma gearing at

the end of September reduced to 0.9x, well below our target range

of 1.5x to 2.0x, leaving considerable headroom for further

accretive acquisitions.

Alongside the acquisitions of Antenova in August 2021 and Beacon

in September 2021, the balance sheet was strengthened in the period

by way of a well-supported equity placing that raised net proceeds

of GBP53.4m. Together with strong organic cash flows, these provide

the Group with an excellent platform from which to continue to

execute its growth strategy. On behalf of the Board, we would like

to thank shareholders for their support.

Increased Dividend

The Board is pleased to declare an increase in the interim

dividend of 6% to 3.35p per share (H1 2020/21: 3.15p per share).

Since 2010, the annual dividend per share has doubled and the total

dividend payment has increased by nearly 400%.

The Board believes that, as an acquisitive growth company,

maintaining a progressive dividend policy is appropriate along with

a long-term dividend cover of over three times on an underlying

basis. This approach will enable funding of both sustainable

dividend growth and a higher level of investment in acquisitions

from internally generated resources.

The interim dividend is payable on 14 January 2022 to

shareholders registered on 17 December 2021.

Board and Group Executive Committee Strengthened

The Board is pleased to report that to support the continued

development of the business, two additional senior level

appointments have been made.

Rosalind Kainyah MBE will join the Board in January 2022 as a

Non-Executive Director. Rosalind brings many years of senior

management, executive and board experience in international

environments. She has extensive experience in sustainability

matters and currently runs Kina Advisory, a consultancy advising on

environmental, social and governance matters for businesses.

Previously, Rosalind held senior executive roles at Tullow Oil, as

Vice President, External Affairs & Corporate Social

Responsibility and De Beers SA with various roles, latterly as

President of its US business.

Following a period of introduction, Rosalind will chair a new

ESG committee of the Board with responsibility for the ESG

strategy, policies and performance of discoverIE and helping to

drive further progress.

Paul Hill joins the Group Executive Committee (GEC) in December

2021 as Group Commercial Director overseeing a number of the

Group's D&M businesses. Paul brings extensive experience in the

electronics and technology sector having held senior operational

roles in both hardware and software companies. Having started his

career in electronics engineering, Paul has worked in electronic

components, smart card systems and electronic design and

manufacturing businesses. More recently Paul has led private equity

held businesses and joins from Antenova, our recent acquisition,

where he was Chief Executive Officer.

Following a period of introduction, Paul will also have

Groupwide responsibility for evolving our approach to developing

design opportunities.

Sustainability and Social Responsibility

The Group provides innovative electronics that help customers

create new technologies for a sustainable world. Applications which

use our products help to reduce power consumption and increase

efficiency, such as wind turbines for renewable energy, charging

infrastructure for vehicle electrification and wireless and fibre

optic communications. This focus on sustainability forms the core

of our target markets where, through targeted growth initiatives,

we aim to grow our revenues organically. These trends are reported

in our key strategic indicators as target market sales.

Additionally, the Group has reduced focus on market areas that are

inconsistent with a long-term sustainability agenda.

Our target sales markets are well aligned to the UNGC

Sustainable Development Goals with our aim being to achieve 85% of

sales from those target markets by the end of FY 2024/25. By the

end of this period, sales from target markets were 77% of

continuing Group sales, an increase of 9ppts in the last two years.

We also aim to increase the proportion of the Group's operations

covered by ISO14001, the international standard for environmental

management, from 31% in FY 2020/21 to 80% by CY 2025. Please refer

to the Group's Impact Report which is published online and which

illustrates how the Group is helping meet the sustainability

challenges facing the world today.

Also during the period a number of initiatives were undertaken

to improve our sustainability and diversity. As mentioned above a

new Non-Executive Director has been appointed, Rosalind Kainyah

MBE, who will lead a new ESG committee of the Board, to be

established in the coming months which will accelerate our progress

on ESG matters. We are also prioritising diversity in our

businesses with a broader range of inputs and more collaborative

working practices. During the period, in addition to a number of

new appointments, further work has been undertaken to increase

diversity in our operating companies. This is an ongoing and

long-term objective.

A range of other ESG activities have taken place, including:

i) Environmental

- Initiated Group Environmental Policy;

- Work commenced on ISO14001 certification in Sri Lanka and Denmark;

- Completed first of three phases to install solar panels in Sri Lanka;

- Natural source heat pump fitted in Poland;

- Continued phase out of R22 refrigerant in Sri Lanka;

- Installed electric car chargers at sites in Norway and at

Group's UK headquarters by end of 2021;

- Several sites in Finland, the UK and Denmark switched to

renewable tariffs in addition to the two Poland sites;

- Introduced other energy efficient measures such as installing

sun screens to reduce the need for cooling and heat exchangers to

reduce emissions from heating; and

- Exploring options for grid supply of clean energy and site

specific renewable power generation in China.

ii) Social

- Launched Supplier Code of Conduct with Group wide supplier

audits due to commence in December 2021;

- Integrated diversity principles into Group hiring practice,

starting with the search for female leaders and engineers in the

electronics industry;

- Improved health & safety incident reporting;

- Initiated Group policies on Human Rights, Conflict Minerals and Freedom of Association; and

- Initiated and supported the Funder Plus Programme through

Community Foundation for Surrey, a longstanding partner of the

Group.

iii) Governance

- Set up the first externally-facilitated Board evaluation;

- Board Diversity Policy adopted;

- Anti-Bribery and Corruption programme on track - policy

updated, benchmarking and risk assessment completed;

- Completed preliminary scoping exercise for BEIS UK Sox

proposal and created a roadmap for implementation;

- Continued roll-out of enhanced cyber security software throughout the Group;

- Internal controls manual reviewed. Roll-out of updated policy,

including self-assessment surveys.

- Subsidiary risk reporting and Group risk register updated.

Group Strategy

The Group designs and manufactures customised electronics,

operating internationally and focusing on structurally growing

markets which are driven by increasing electronic content and where

there is an essential need for our products. With our target

markets and global customer base, the business is expanding both in

Europe and beyond, with 38% of first half continuing Group sales

being outside Europe, as we build a geographically diverse

electronics group.

Acquisitions have made a significant contribution to the

development of the Group and, over the past 11 years, we have

acquired 19 specialist, high margin design and manufacturing

businesses which have been integrated successfully, augmenting our

growth alongside our important organic focus. We have a

well-developed and disciplined approach to acquisitions and the use

of capital, and we see significant scope for further expansion of

the Group with a number of acquisition opportunities in

development.

Following the announced disposals of the Acal BFi and Vertec SA

businesses, the Group's strategy continues to comprise four

elements:

1. Grow sales well ahead of GDP over the economic cycle by

focussing on the structural growth markets that form our target

markets;

2. Move up the value chain into higher margin products;

3. Acquire businesses with attractive growth prospects and strong operating margins;

4. Further internationalise the business by developing

operations in North America and Asia.

These elements are underpinned by a core objective of generating

strong cash flows from a capital-light business model, and

delivering long-term sustainable returns.

Target Markets

Our four focus target markets of renewable energy, medical,

transportation, and industrial & connectivity account for 77%

of continuing Group sales. These markets are expected to drive the

Group's organic revenue growth well ahead of GDP over the economic

cycle and create acquisition opportunities. With continuing sales

growing organically by 8% over the pre-Covid period two years ago,

target market sales have grown by 13% organically in this time

while non-target markets have declined by 6%.

Growth in these target markets is driven by increasing

electronic content and by global trends such as the accelerating

need for renewable sources of energy, an ageing affluent

population, vehicle electrification and industrial automation.

Key Strategic and Performance Indicators

Since 2014, the Group's progress with its strategic objectives

and its financial performance has been measured through key

strategic indicators ("KSIs") and key performance indicators

("KPIs"). The KSI targets have been raised each time they are

achieved, and in June 2020, upwardly revised targets for FY 2024/25

were set. With the announcement in November 2021 of the planned

sale of Acal BFi, the targets have again been upwardly revised. For

tracking purposes, these KSIs and KPIs remain as reported at the

time rather than adjusted for the recently announced disposals.

Given the one-off impact of Covid last year, we have shown this

period's growth relative to the pre-Covid period two years ago (H1

2019/20) to illustrate the underlying development of the Group.

Key Strategic Indicators - targets now upwardly revised

FY14 FY15 FY16 FY17 FY18 FY19 H1 H1 Prior Revised

20 22(1) FY25 FY25

Targets Targets

-----

1. Increase share

of Group revenue

from D&M (2) 18% 37% 48% 52% 57% 61% 63% 100% >75% 100%

2. Increase underlying

operating margin 3.4% 4.9% 5.7% 5.9% 6.3% 7.0% 7.6% 10.3% 12.5% 13.5%

3. Build sales

beyond Europe(2) 5% 12% 17% 19% 19% 21% 24% 38% 40% 45%

-----

4. Target market

sales (2) 56% 62% 66% 66% 77% 85% 85%

(1) Continuing operations

(2) As a percentage of Group revenue

The Group made further significant progress against its KSIs

during this period. Alongside strong organic growth, the announced

exit from distribution by way of the disposals of Acal BFi and

Vertec South Africa has resulted in a positive step change in the

KSIs, which is explained as follows:

- Following this exit, the Group is now wholly focused on the

design and manufacture of customised electronics.

- First half underlying operating margin exceeded 10% for the

first time benefiting both from the strong organic sales growth

delivered during the period and the planned exit from the lower

margin distribution business. With this exit, the FY2024/25 margin

target has been increased to 13.5%.

- Sales beyond Europe in the first half increased by 10ppts to

38% of Group revenue from 28% last year (24% two years ago) driven

by three factors. Firstly, the planned exit from distribution which

is a UK/European focused business (c.7ppts increase); secondly, the

five acquisitions in the last year (c.2ppts) in particular Beacon,

Phoenix and CPI which are all US based; thirdly, organic growth

during the period was strongest in Asia accounting for 22% of

ongoing Group sales (c.1ppt). On an annualised basis, the recent

acquisitions increase our sales beyond Europe to 40% and

accordingly the target for FY2024/25 has been increased to 45%.

- Target market sales in the first half increased by 9ppts to

77% of Group revenue from 68% last year (66% two years ago) of

which 5ppts reflects the planned exit from the distribution

businesses. A further 4ppts improvement has been delivered through

a combination of organic growth being more weighted to these

long-term structural growth markets and from the five acquisitions

in the last year which are well aligned with these markets.

-

Key Performance Indicators

FY14 FY15 FY16 FY17 FY18 FY19 H1 H1 Target

20 22(1)

1. Sales growth

Well ahead

CER 17% 36% 14% 6% 11% 14% 9% 20% of GDP

Continuing organic 3% 9% 3% (1%) 11% 10% 7% 8%

2. Underlying

EPS growth 20% 31% 10% 13% 16% 22% 11% 18% >10%

3. Dividend

growth 10% 11% 6% 6% 6% 6% 6%(2) 6% Progressive

4. ROCE (3) 15.2% 12.0% 11.6% 13.0% 13.7% 15.4% 15.8% 14.8%(4) >15%

>85% of

underlying

5. Operating operating

profit conversion(3) 100% 104% 100% 136% 85% 93% 101% 124% profit

------ ------ ------ ------

>85% of

6. Free cash underlying

conversion (3) 94% 104% 125% PAT

------ ------

7.Carbon emissions Annual 50% reduction

test(5) v CY19

--------- --------------

(1) Continuing operations. H1 2021/22 shown as growth over the

pre-Covid period H1 2019/20 to illustrate the underlying growth of

the business

(2) 6% increase in the H1 2019/20 interim dividend; a final

dividend was not proposed for FY 2019/20 due to Covid

(3) Defined in note 2 of the attached summary financial

statements; operating cash conversions are calculated based on the

last 12 months

(4) Excludes the acquisitions of Beacon and Antenova which only

completed towards the end of the period

(5) Annual carbon emissions for CY 2020 reduced by 19%

(like-for-like) compared to CY 2019 and by 6% on an underlying

basis (adjusted to normalise the impact of Covid).

The Group made further significant progress against its KPIs

during this period. Given the one-off impact of Covid last year,

this period's growth is shown relative to the pre-Covid period H1

2019/20 thus illustrating the underlying development of the

Group.

The performance of each of our Group KPIs for this period are as

follows:

- Organic sales increased by 8% compared with the pre-Covid

period H1 2019/20 (comprising 15% organic growth this year

offsetting an 8% organic reduction during the Covid period). This

follows average annual organic growth of 9% for the preceding three

years and illustrates the strong through cycle organic growth of

the business.

- Underlying EPS increased by 18% compared with the pre-Covid

period H1 2019/20 (comprising 37% growth this year offsetting a 14%

reduction during the Covid period).

- The dividend is being increased by 6%, continuing our

progressive policy whilst providing for a higher proportion of

investment in acquisitions from internally generated resources.

This progressive policy has seen a doubling of the dividend over

the last 11 years, whilst dividend cover on an underlying basis has

increased.

- ROCE of the continuing operations for the period was 14.8%

compared with 15.8% two years ago, and was 2.5ppts higher than that

for the Covid-impacted last year (H1 2020/21: 12.3%).

The reduction compared to two years ago is as a result of recent

larger acquisitions and the discontinuation of Custom Supply.

- Operating profit conversion into cash has been very strong

again at 124% of underlying operating profit on average over the

last 24 months (comprising 95% in the last 12 months during a

period of strong organic growth with the need for increased working

capital, and 159% in the prior 12 month (Covid) period during which

working capital was released). This is significantly above the 85%

target, reflecting tight management of working capital and

expenditure during this period. Over the last nine years, operating

cash conversion has been consistently strong.

- Free cash conversion has also been very strong at 125% of

underlying profit after tax, on average over the last 24 months

(comprising 95% conversion in the last 12 months and 174%

conversion in the prior 12 month period). Again, this is

significantly above the 85% target. This is an important metric as

we seek to increasingly self-fund acquisitions.

- A new target was introduced last year for the reduction of

carbon emissions from the Group's existing businesses by 50% over

five years. Additionally, for new acquisitions, we are targeting

that within the first five years of ownership, at least 50% of

their energy demand is generated from renewable sources. For

calendar year 2020, carbon emissions reduced by 19% and by 6% on an

underlying basis adjusted for the effects of Covid. During this

period, capital has been invested in projects to reduce carbon

emissions by switching to clean energy, including solar panel

installations in Sri Lanka, and an air source heat pump in Poland,

two of the Group's major manufacturing facilities.

Divisional Results (Continuing Group)

The divisional results and results for the Continuing Group for

the half year ended 30 September 2021 are set out and reviewed

below.

H1 2021/22 H1 2020/21 Organic Organic

revenue order

growth growth

------------------------------

Revenue Underlying Margin Revenue Underlying Margin

GBPm operating GBPm operating

profit profit

(1) (1) Revenue

GBPm GBPm growth

-------- ----------- ------- -------- ----------- -------

D&M(2) 174.3 23.9 13.7% 140.5 17.3 12.3% 24% 15% 64%

Unallocated

costs (5.9) (3.9)

FX 3.3 0.2 (3%)

-------- ----------- ------- -------- ----------- ------- -------- --------- --------

Total 174.3 18.0 10.3% 143.8 13.6 9.5% 21% 15% 64%

-------- ----------- ------- -------- ----------- ------- -------- --------- --------

(1) Underlying operating profit excludes acquisition-related

costs and results of the discontinued operations

(2) The residual ongoing business within Custom Supply has been

transferred to D&M with sales in H1 2020/21 of GBP2.5m,

underlying operating profit of GBP0.3m

Orders and Order Book

Organic orders grew very strongly in the period, increasing by

64% organically to GBP221.2m with a book to bill ratio of 1.27:1.

Compared with the pre-Covid period two years ago, orders have grown

by 34% organically.

During the period, the Group order book for continuing

operations also grew very strongly and finished the period at a

record level of GBP198m, being 108% (CER) higher than a year ago.

Organically the order book increased by 71% in a year and by 54%

compared with 30 September 2019, prior to the start of Covid.

Sequentially, the order book increased by 44% (CER) since the year

end.

Since the second half of last year, customers resumed placing

longer term orders. Over 80% of the order book is for delivery

within twelve months from the time of order.

Divisional Revenue and Operating profit

The strong order performance has led to sales increasing

organically by 15%. Combined with a 9% sales increase from

acquisitions, overall sales increased by 24% CER. Including the

impact of translation, reported divisional revenue increased by 21%

to GBP174.3m (H1 2020/21: GBP143.8m).

Compared to the pre-Covid period two years ago, sales grew by 8%

organically. Growth was widespread across the Group although in

certain businesses was offset by supply chain shortages of raw

materials and external components and a slower post Covid recovery

in some of our UK based businesses.

Underlying operating profit of GBP23.9m was GBP6.6m (+38% CER)

higher than last year (H1 2020/21: GBP17.3m at CER) with an

underlying operating margin of 13.7%, 1.4ppts higher than last year

(H1 2020/21: 12.3% at CER) reflecting the positive effect of

organic growth and higher margin acquisitions. On an organic basis,

operating margin increased by 0.5ppt.

Design Wins

Project design wins are a measurement of new business creation.

By working with customers at an early stage in their project design

cycle, opportunities are identified for our products to be

specified into their designs, which in turn lead to future

recurring revenue streams.

The Group has a strong bank of design wins built up over several

years that creates the basis for the strong through cycle growth

and the growth in orders and sales now being experienced. During

the period, design wins increased by 56% over the prior year and by

10% on the pre-Covid period two years prior. 80% were in the

Group's target markets, led by the renewable energy and industrial

& connectivity sectors.

Additionally, during the period, new project design activity

increased strongly, being broad based across all markets. The total

pipeline of ongoing projects in development is now at a record high

level.

Operations

The D&M division designs, manufactures and supplies highly

differentiated, innovative components for electronic applications.

Over 85% of the products are manufactured in-house, with the

division's principal manufacturing facilities being in China,

Hungary, India, Mexico, the Netherlands, Poland, Slovakia, Sri

Lanka, Thailand, the US and the UK. Geographically, 11% of sales

are in the UK, 51% in Europe, 16% in North America and 22% in Asia.

77% of sales in the period were made into the Group's target

markets.

The Group's production facilities have established "new normal"

ways of operating after the disruption of Covid. Some sites are

still feeling the effects of higher absence rates but overall, the

Group's production has returned to output growth capable of

satisfying the strong sales growth rates. To meet future growth,

capacity is being expanded in the US, Germany and India, and

production has begun as scheduled at the Group's new larger

facility in Nogales, Mexico.

Acquisitions

The businesses we acquire are typically led by entrepreneurs who

wish to remain following acquisition. We encourage this as it helps

retain a decentralised, entrepreneurial, dynamic culture. The

market is highly fragmented with many opportunities to acquire and

consolidate.

We acquire businesses that are successful and profitable with

good growth prospects and where we invest for growth and

operational performance development. According to the

circumstances, we add value in some of or all of the following

areas:

- Internationalising sales channels and expanding the customer

base, including via cross-selling initiatives and focussing sales

development onto target market areas;

- Developing and expanding the product range;

- Investing in management capability ('scaling up') and succession planning;

- Implementing ESG initiatives;

- Capital investment in manufacturing and infrastructure;

- Improving manufacturing efficiency;

- Enabling growth with larger customers;

- Infrastructure efficiencies, such as warehousing and freight;

- Finance & administrative support, such as treasury,

banking, legal, pension, tax, insurance, risk & control;

and

- Expanding the business through further acquisitions.

During the period, the Group completed three acquisitions:-

1) In May 2021, Control Products Inc ("CPI"), a New Jersey,

US-based designer and manufacturer of custom, rugged sensors and

switches, for $11.4m (GBP8.1m) on a debt free, cash free basis.

2) In August 2021, Antenova, a UK-based designer and

manufacturer of antennas and radio frequency (RF) modules for

industrial connectivity applications, for GBP18.2m on a debt free,

cash free basis.

3) In September 2021, Beacon EmbeddedWorks ("Beacon"), a

US-based designer, manufacturer and supplier of custom

System-on-Module (SOM) embedded computing boards and related

software, principally supplying the medical and industrial markets

in the US. Beacon was acquired for $80.5m (GBP58.8m) on a debt

free, cash free basis.

All three have retained their distinct brand identities and

high-quality management. Their complementary product ranges and

wider access to customers will create cross-selling opportunities

in our target markets which are expected to drive further

growth.

The Group has completed 19 acquisitions since 2011, contributing

to growth in continuing Group revenues from GBP15m in FY 2012/13 to

GBP303m in FY 2020/21. The Group's operating model is well

established and has facilitated the smooth integration of acquired

businesses. Through a combination of investment in efficiency and

leveraging of the broader Group's commercial infrastructure, the

businesses acquired since 2011 and owned for at least two years

delivered an average return on investment of 16% by FY 2020/21 over

the life of those acquisitions, ahead of our target of 15%.

Group Financial Results

Revenue and Orders

Continuing Group sales of GBP174.3m were 15% higher organically

than last year (H1 2020/21: GBP143.8m), and with acquired

businesses (Phoenix and Limitor acquired last year, and CPI,

Antenova and Beacon added this year) adding 9%, continuing sales

increased by 24% CER. A stronger Sterling during the period,

particularly compared with the US Dollar and Euro, reduced sales by

3% on translation for a net growth in reported continuing Group

sales of 21%. Compared with two years ago, sales increased by 20%

CER with 8% organic growth and 12% through acquisitions (the five

acquisitions above together with Sens-Tech which was acquired in

the last two years).

H1 H1 2021/22 H1 2019/20

Continuing Revenue % %

(GBPm) 2021/22 H1 2020/21

Reported 174.3 143.8 21% 174.3 149.4 17%

FX translation

impact (3.3) (4.6)

----------- ---- ----------- ----------- ----

Underlying (CER) 174.3 140.5 24% 174.3 144.8 20%

Acquisitions:

last 12mths (12.9)

Acquisitions:

last 24mths (18.1)

Organic 161.4 140.5 15% 156.2 144.8 8%

Sales were driven by very strong order rates. Continuing orders

increased by 75% CER to GBP221.2m, and by 64% organically compared

with the Covid-impacted prior period and importantly, by 49% CER

and 34% organically compared with the pre-Covid period 2 years

ago.

The book to bill ratio for the period was 1.27:1 building on the

improvement seen in the second half last year (book to bill:

1.16:1) as the Group recovered from the sharp impact of Covid in

the first half last year (book to bill: 0.90:1). Two years ago the

comparable book to bill ratio was 1.02:1.

Continuing Group Gross Margin and Gross Profit

The continuing Group's gross margin increased 1.1ppts in the

first half to 38.6% (H1 2020/21: 37.5%). Organically, gross margin

decreased by 0.1ppts, with higher gross margin acquisitions adding

1.2ppts.

Gross profit for the period was GBP67.2m, 25% higher than last

year (H1 2020/21: GBP53.9m), being a combination of the 21%

increase in continuing reported sales with 4% from the improvements

in the continuing Group gross margin.

The Group continues with its policy of currency hedging

transactional exposures from the point of order through to payment,

typically hedging around six months of the order book.

Underlying Operating Costs

At the outset of Covid last year, the Group took prudent actions

to preserve cash and reduce expenditure including deferral of

discretionary spend, deferral of pay rises, a hiring freeze, and a

three month 20% salary reduction for the Board and Group Executive

Committee, the cumulative effect of which was to reduce Group

underlying operating costs by 4% organically and by 7% sequentially

(H2 2019/20 to H1 2020/21).

GBPm H1 2021/22 H1 2020/21 %

Organic operating costs

(pre LTIP/HO) 42.8 39.8 8%

Incremental LTIP related

charges 1.6

Central team investment 0.7

----------- ----------- ----

Operating costs (inc

LTIP/HO) 45.1 39.8 13%

Acquisition operating

costs 4.1

----------- ----------- ----

Underlying operating

costs (CER) 49.2 39.8 24%

FX translation 0.5

Underlying adjustments

(see below) 9.7 6.1

Reported operating costs 58.9 46.4 27%

GBPm H1 2021/22 H1 2020/21

Selling and distribution

costs 18.0 15.3

Administrative expenses 40.9 31.1

----------- -----------

Reported operating costs 58.9 46.4

----------- -----------

This period we have invested carefully in operating expenditure

to ensure capacity to deliver strong sales growth, this year and in

future, with costs increasing by 5% organically compared with the

pre-Covid period, H1 2019/20, and 8% relative to last year. This

excludes upscaling of central capabilities and incremental LTIP

related charges.

We have invested in additional central resource to support our

growth plans, including M&A, risk & internal audit, and

ESG. Further investment is anticipated in the next 12 months in

particular additional Board and Group Executive Committee members

as referred to above and additional IT resources to support D&M

system upgrades.

With a share price which, by 30 September 2021, had risen 60%

since the start of the year and 150% since the start of last year,

the accrued cost of national insurance contributions ("NIC") on

LTIPs, the increased rate of NIC from April 2022 and the EPS growth

impact on share based payment accruals, has added an additional

cost of GBP1.6m relative to last year.

Continuing Group Operating Profit and Margin

Continuing Group underlying operating profit for the period was

GBP18.0m, a 32% increase on last year (H1 2020/21: GBP13.6m),

delivering an underlying operating margin of 10.3%, 0.8ppts higher

than last year (H1 2020/21: 9.5%).

Reported Group continuing operating profit for the period (after

accounting for the underlying adjustments discussed below) was

GBP8.3m, GBP0.8m (+11%) higher than last year.

Continuing operations H1 2021/22 H1 2020/21

GBPm

Operating Finance Profit Operating Finance Profit

profit Cost before profit cost before

tax tax

---------- ---------- -------- --------

Underlying 18.0 (1.9) 16.1 13.6 (1.9) 11.7

Underlying adjustments

Acquisition expenses (3.3) - (3.3) (0.6) - (0.6)

Amortisation of acquired

intangibles (6.4) - (6.4) (5.3) - (5.3)

IAS 19 pension cost (0.2) - (0.2)

Reported 8.3 (1.9) 6.4 7.5 (1.9) 5.6

Underlying Adjustments

Underlying adjustments for the period comprise acquisition

expenses of GBP3.3m (H1 2020/21: GBP0.6m), and the amortisation of

acquired intangibles of GBP6.4m (H1 2020/21: GBP5.3m). From this

period, the IAS 19 pension cost of GBP0.3m has been taken as a

continuing cost of the business.

Acquisition expenses of GBP3.3m are the costs associated with

the acquisitions during the period of CPI, Antenova and Beacon

(GBP1.6m), accrued contingent consideration costs of GBP1.3m

(mainly relating to the acquisitions of Cursor and Limitor) and the

integration of Hobart into Noratel (GBP0.4m). The GBP1.1m increase

in the amortisation charge since last year to GBP6.4m relates to

the amortisation of intangibles relating to the five acquisitions

since the first half last year. The annualised amortisation charge

for next year is approximately GBP16.5m.

Financing Costs

Net finance costs for the period were GBP1.9m (H1 2020/21:

GBP1.9m) and include a GBP0.4m charge for leased assets under IFRS

16 (H1 2020/21: GBP0.3m). Finance costs related to our banking

facilities of GBP1.5m (H1 2020/21: GBP1.6m) reflect marginally

lower average net debt during the period.

Underlying Tax Rate

The underlying effective tax rate for continuing operations in

the first half was 25%, in line with last year's rate.

The overall effective tax rate for continuing operations was 53%

(H1 2020/21: 34%). This was higher than the underlying effective

tax rate due to there being tax relief on only a small amount of

acquisition-related expenses and a lower rate of tax relief on the

amortisation of acquired intangibles (both within underlying

adjustments above). The effective tax rate ("ETR") on intangibles

was further impacted this period by the enactment of the increase

in the UK corporate tax rate from 1 April 2023, resulting in a

one-off increase in the deferred tax liability (a non-cash

item).

GBPm H1 2021/22 H1 2020/21

PBT ETR PBT ETR

------- ------- ----

Continuing operations 16.1 25% 11.7 25%

Acquisition expenses (3.3) 4% (0.6) 0%

Amortisation of acquired

intangibles (6.4) 7% (5.3) 19%

IAS 19 pension cost (0.2) 19%

Total reported 6.4 53% 5.6 34%

Continuing Group Profit Before Tax and EPS

Underlying profit before tax for the period of GBP16.1m was

GBP4.4m higher (+38%) than last year (H1 2020/21: GBP11.7m), with

underlying EPS for the period increasing by 37% to 13.0p (H1

2020/21: 9.5p). The increase in underlying EPS was slightly lower

than that for underlying profit before tax due to the issuance of

new equity in September 2021 increasing fully diluted shares by 1%

to 93.3m shares (H1: 2020/21: 92.2m shares). The annualised fully

diluted shares for the full year is expected to be c. 96m

shares.

After the underlying adjustments above, reported profit before

tax on continuing operations was GBP6.4m, an increase of GBP0.8m

(+14%) compared with last year (H1 2020/21: GBP5.6m). With the

reported effective tax rate for the period of 53% being higher than

last year's rate of 34% (for the reasons mentioned above), the

resulting reported fully diluted earnings per share on continuing

operations was 3.2p, 0.8p lower than last year (H1 2020/21:

4.0p).

Continuing operations H1 2021/22 H1 2020/21

GBPm

PBT EPS PBT EPS

------ ------ -----

Underlying 16.1 13.0p 11.7 9.5p

Underlying adjustments

Acquisition expenses (3.3) (0.6)

Amortisation of acquired

intangibles (6.4) (5.3)

IAS 19 pension cost (0.2)

Reported 6.4 3.2p 5.6 4.0p

Discontinued Operations

Since the end of the period, the Group has announced the

disposals of the Acal BFi and Vertec SA distribution businesses

which have been treated for accounting purposes together as a

discontinued operation. In accordance with IFRS 5, net profits of

the discontinued operation have been shown separately to the

results of the continuing operations.

GBPm H1 2021/22 H1 2020/21

PAT EPS PAT EPS

----- ----- ------

Continuing operations 3.0 3.2p 3.7 4.0p

Discontinued operations 3.2 3.4p 1.6 1.8p

Total operations 6.2 6.6p 5.3 5.8p

In accordance with IFRS 5, net assets of the discontinued

operation of GBP55.8m as at 30 September 2021 (including cash in

the operation of GBP26.2m) have been categorised on the Group

balance sheet as assets held for sale comprising assets of GBP91.2m

and liabilities of GBP35.4m.

Working Capital

D&M divisional working capital at 30 September 2021 was

GBP60.5m, equivalent to 16.9% of sales, an efficiency improvement

of 0.8ppts since last year (30 September 2020: GBP48.4m of working

capital at 17.7% of sales). Absolute working capital has increased

to support the strong organic growth in sales, and also by

incorporating the working capital of five acquisitions since the

first half last year. Working capital KPIs have remained robust

with debtors days of 50, creditor days of 71 and stock turns of

3.3.

Cash Flow

Net debt at 30 September 2021 was GBP75.6m compared with

GBP47.2m at 31 March 2021 and GBP42.1m at 30 September 2020.

Excluding dividends, acquisitions and equity raised, free cash flow

over the last 12 months was GBP28.1m, at 95% of underlying profit

after tax (including disposals), demonstrating continuing strong

cash generation by the Group.

H1 Last 12

H1 Months

2021/22 2020/21

Opening net debt (47.2) (61.3) (42.1)

Free cash flow (see

table below) 10.6 20.1 28.1

Acquisition-related

costs (86.7) (0.2) (108.3)

Equity issuance 53.4 - 53.5

Dividends (6.2) - (9.0)

Foreign exchange impact 0.5 (0.7) 2.2

Net debt at 30 Sept (75.6) (42.1) (75.6)

Net acquisition-related costs of GBP86.7m in the period

comprised GBP58.8m for the acquisition of Beacon in September 2021,

GBP18.2m for Antenova in August 2021 and GBP8.1m for CPI in May

2021 (all on debt free, cash free bases). Additionally there were

GBP1.6m of expenses associated with acquisitions and disposals

during the period. Together with the acquisitions of Phoenix and

Limitor during the six month period ended 31 March 2021, a total of

GBP108.3m has been spent on acquisitions during the last 12

months.

A 6% placing of shares in September 2021 raised net equity

proceeds of GBP53.4m, while the final dividend for the last

financial year of GBP6.2m was paid in July 2021, being a 6%

increase on the final dividend for the year ended 31 March 2019; no

final dividend was declared for the year ended 31 March 2020 as

management sought to preserve cash at the outset of Covid.

Operating cash flow and free cash flow (see definitions in note

2 to the interim financial statements) for the period, compared

with the first half of last year, and for the last 12 months, are

shown below:

H1 H1 Last 12

GBPm 2021/22 2020/21 Months

Underlying profit

before tax 16.1 11.7 32.3

Discontinued profit

before tax 4.6 2.1 6.1

--------- --------- --------

Total profit before

tax 20.7 13.8 38.4

Net finance costs 2.0 2.0 3.7

Non-cash items 7.8 6.9 14.1

--------- --------- --------

Total EBITDA 30.5 22.7 56.2

IFRS 16 (3.5) (3.4) (6.8)

--------- --------- --------

EBITDA (pre IFRS16) 27.0 19.3 49.4

Working capital (8.1) 7.9 (4.4)

Capital expenditure (2.8) (1.5) (4.9)

Operating cash flow 16.1 25.7 40.1

Finance costs (1.6) (1.7) (3.0)

Taxation (3.0) (3.0) (7.2)

Legacy pensions (0.9) (0.9) (1.8)

Free cash flow 10.6 20.1 28.1

Total EBITDA of GBP30.5m was 34% higher than the Covid-impacted

last year (H1 2020/21: GBP22.7m) and 26% higher than the pre-Covid

period two years ago (H1 2019/20: GBP24.2m) reflecting strong

organic sales growth combined with contributions from the five

acquisitions made since the first half last year.

During the period, the Group invested GBP8.1m in working capital

to support the organic sales growth contrasting with last year's

GBP7.9m inflow resulting from the reduction in sales following the

onset of the Covid. In total, a net GBP4.4m has been invested in

working capital in the last 12 months.

Capital expenditure of GBP2.8m was invested during the period

including capacity expansions in Mexico and on ESG initiatives

including solar panels in Sri Lanka, the largest Group facility.

While ahead of last year (GBP1.5m), when expenditure was reduced to

maintenance spend only, this was still below our spend of two years

ago (H1 2019/20: GBP3.2m). Capital expenditure levels are expected

to increase in the second half to around GBP8.0m for the full year

as we continue to invest in additional capacity and roll out of our

ESG initiatives.

GBP16.1m of operating cash was generated in the first half;

together with GBP24.0m generated in the second half of last year, a

total of GBP40.1m of operating cash was generated over the last 12

months. While this was below last year's GBP55.8m, this was due to

working capital inflows last year of GBP18.0m resulting from the

reduction in sales due to Covid. Excluding working capital,

operating cash in the last 12 months was up 18% on last year. It

was also 19% higher than for the pre-Covid 12-month period two

years ago (12 month operating cash to 30 Sept 2019: GBP33.8m).

GBP40.1m of operating cash flow represents 95% of underlying

operating profit during the last 12 months (including disposals),

above our 85% target. Over the last eight years, the Group has

consistently achieved high levels of cash conversion, averaging in

excess of 100%.

Finance cash costs of GBP1.6m were marginally below last year

while corporate income tax payments of GBP3.0m were in line with

last year. Further payment of taxes in the second half of c.GBP4m

are expected.

Free cash flow (being cash flow before dividends, acquisitions

and equity) for the last 12 months was GBP28.1m. which was 29%

higher than last year excluding working capital. Compared with the

pre-Covid period two years ago, free cash flow was up 16% (12 month

free cash flow to 30 Sept 2019: GBP24.2m). Our free cash conversion

over the last 12 months was 95% of underlying profit after tax

(including disposals), again well ahead of our 85% target.

Banking Facilities

The Group has a GBP180m syndicated banking facility which

extends to June 2024, together with a GBP60m accordion increasing

the total facility to GBP240m if required. The syndicated facility

is available both for acquisitions and for working capital

purposes.

With net debt at 30 September 2021 of GBP75.6m, the Group's

gearing ratio at the end of the period (being net debt divided by

underlying EBITDA as annualised for acquisitions) was 1.3x.

Including the announced disposals of the Acal BFi and Vertec South

Africa distribution businesses, pro-forma gearing at 30 September

2021 reduced to 0.9x, with our target gearing range being between

1.5x and 2.0x, leaving plenty of funding capacity for future

acquisitions.

Balance Sheet

Net assets of GBP269.3m at 30 September 2021 were GBP60.5m

higher than at the end of the last financial year (31 March 2021:

GBP208.8m). The increase primarily relates to the net issuance of

equity of GBP53.5m, nearly all being the placing in September 2021,

with net profit after tax for the period of GBP6.2m being offset by

last year's final dividend of GBP6.2m paid this period. The

movement in net assets is summarised below:

H1

GBPm 2021/22

Net assets at 31 March

2021 208.8

Net profit after tax 6.2

Dividend paid (6.2)

Net equity issuance 53.5

Currency net assets -

translation impact 2.7

Gain on defined benefit

scheme 0.3

Share based payments

(inc tax) 4.0

Net assets at 30 September

2021 269.3

Defined Benefit Pension Scheme

The Group's IAS 19 pension liability, associated with its legacy

defined benefit pension scheme, reduced during the last 12 months

by GBP1.2m from a liability of GBP1.1m at 30 September 2020 to an

asset of GBP0.1m at 30 September 2021, the key driver being the

annual payment made during the year of GBP1.8m.

An annual payment of GBP1.9m is currently payable, growing by 3%

each year until September 2022 in accordance with the plan agreed

with the pension trustees as part of the last agreed triennial

valuation dated 31 March 2018. The next triennial valuation as at

31 March 2021 is currently being assessed.

Risks and Uncertainties

The principal risks faced by the Group are set out on pages 47

to 52 of the Group's Annual Report for year ended 31 March 2021, a

copy of which is available on the Group's website:

www.discoverieplc.com. These risks comprise: the economic

environment, particularly linked to the impact of Covid; the impact

arising from the UK's decision to leave the European Union; the

performance of acquired companies; climate-related risks; loss of

major customers or suppliers; technological change; major business

disruption; cyber security; loss of key personnel; inventory

obsolescence; product liability; liquidity and debt covenants;

exposure to adverse foreign currency movements; obligations in

respect of a legacy defined benefit pension scheme; and

non-compliance with legal and regulatory requirements.

The Board has continued to review the Group's existing and

emerging risks and the mitigating actions and processes in place in

the first half of the financial year, taking specific consideration

of the impact of Covid. Following this review the Board believes

there has been no material change to the relative importance or

quantum of the Group's principal risks in the first half of the

current financial year. The risk assessment and review are an

ongoing process, and the Board will continue to monitor risks and

the mitigating actions in place.

The Group's risk management processes cover identification,

impact assessment, likely occurrence and mitigation actions where

practicable. Some level of risk, however, will always be present.

The Group is well positioned to manage such risks and

uncertainties, if they arise, given its strong balance sheet,

committed banking facility of GBP180m and the adaptability we have

as an organisation.

Summary and Outlook

These strong results demonstrate the strength of the discoverIE

business model, with record growth in orders, order book and

underlying earnings per share, which increased by 37% and follows a

resilient performance last year through Covid. Revenues and

earnings are now well ahead of the pre-Covid period and I would

like to thank all employees around the Group for their tremendous

effort and flexibility over the last 18 months that has led to

these results.

The announced sale of Acal BFi earlier this month concludes the

Group's exit from the business of distribution, with discoverIE now

becoming a solely focused global designer and manufacturer of

customised electronics. We have raised our medium-term strategic

targets accordingly and our continuing focus is on achieving

organic growth with new design wins in sustainable target markets,

together with accretive acquisitions.

The second half has started well with continued order and sales

growth over the same period last year and two years ago, and the

Group is on track to deliver full year underlying earnings for the

continuing operations ahead of the Board's previous expectations

despite ongoing supply chain and foreign exchange headwinds.

With a clear strategy focused on long-term, high quality,

structural growth markets across Europe, North America and Asia, a

diversified customer base, a record order book and a strong

pipeline of acquisition opportunities, the Group is well positioned

to make further progress on its key priorities.

Nick Jefferies

Group Chief Executive

Simon Gibbins

Group Finance Director

30 November 2021

Condensed consolidated income statement

(unaudited)

for the six months ended 30 September

2021

Six months Six months

ended ended Year

30 Sept 30 Sept ended

2021 2020* 31 Mar 2021*

Notes GBPm GBPm GBPm

Continuing operations

Revenue 4 174.3 143.8 302.8

Cost of sales (107.1) (89.9) (187.7)

-------------------------------------------- -------- ------------ ----------- --------------

Gross profit 67.2 53.9 115.1

Selling and distribution costs (18.0) (15.3) (32.3)

Administrative expenses (including

underlying adjustments) (40.9) (31.1) (65.7)

Operating profit 4 8.3 7.5 17.1

Finance income 0.2 0.1 0.3

Finance costs (2.1) (2.0) (3.9)

Profit before tax 6.4 5.6 13.5

Tax expense 6 (3.4) (1.9) (4.0)

Profit for the period from continuing

operations 3.0 3.7 9.5

-------------------------------------------- -------- ------------ ----------- --------------

Discontinued operations

Profit for the period from discontinued

operations 3.2 1.6 2.5

Profit for the period 6.2 5.3 12.0

-------------------------------------------- -------- ------------ ----------- --------------

Earnings per share

Basic, profit from continuing

operations 8 3.3p 4.2p 10.7p

Diluted, profit from continuing

operations 8 3.2p 4.0p 10.3p

Basic, profit for the year 8 6.9p 6.0p 13.5p

Diluted, profit for the year 8 6.6p 5.8p 13.0p

-------------------------------------------- -------- ----------- --------------

Supplementary income statement

information

Six months Six months Year

ended ended ended

30 Sept 30 Sept 31 Mar 2021*

Underlying Performance Measure Notes 2021 2020* GBPm

GBPm GBPm

Operating profit 4 8.3 7.5 17.1

Add: Acquisition and merger expenses 5 3.3 0.6 1.2

Amortisation of acquired intangible

assets 5 6.4 5.3 11.1

IAS 19 pension charge - 0.2 1.4

-------------------------------------------- -------- ------------ ----------- --------------

Underlying operating profit 18.0 13.6 30.8

-------------------------------------------- -------- ------------ ----------- --------------

Profit before tax 6.4 5.6 13.5

Add: Acquisition and merger expenses 5 3.3 0.6 1.2

Amortisation of acquired intangible

assets 5 6.4 5.3 11.1

Total IAS 19 pension charge 5 - 0.2 1.4

Underlying profit before tax 16.1 11.7 27.2

-------- ------------ -----------

Underlying earnings per share 8 13.0p 9.5p 22.4p

* Re-presented for discontinued operations (note 10)

Condensed consolidated statement of comprehensive income

(unaudited)

for the six months ended 30 September 2021

Unaudited Unaudited

six months six months Audited

ended ended year

30 Sept 30 Sept ended

2021 2020 31 Mar 2021

GBPm GBPm GBPm

--------------------------------------------- ------------ ------------ -------------

Profit for the period 6.2 5.3 12.0

--------------------------------------------- ------------ ------------ -------------

Other comprehensive income/(loss):

Items that will not be subsequently

reclassified to profit or loss:

Actuarial gain/(loss) on defined benefit

pension scheme 0.4 (3.6) (3.4)

Deferred tax (charge)/credit relating

to defined benefit pension scheme (0.1) 0.7 0.6

--------------------------------------------- ------------ ------------ -------------

0.3 (2.9) (2.8)

--------------------------------------------- ------------ ------------ -------------

Items that may be subsequently reclassified

to profit or loss:

Exchange differences on translation

of foreign subsidiaries 2.7 3.3 (0.5)

2.7 3.3 (0.5)

--------------------------------------------- ------------ ------------ -------------

Other comprehensive income/(loss)

for the period, net of tax 3.0 0.4 (3.3)

--------------------------------------------- ------------ ------------ -------------

Total comprehensive income for the

period, net of tax 9.2 5.7 8.7

--------------------------------------------- ------------ ------------ -------------

Condensed consolidated statement of financial position

(unaudited)

at 30 September 2021

Unaudited Unaudited Audited

at 30 Sept at 30 Sept at 31 March

Notes 2021 2020 2021

GBPm GBPm GBPm

--------------------------------------- -------- ------------ ------------ -------------

Non-current assets

Property, plant and equipment 22.8 24.6 23.5

Intangible assets - goodwill 172.7 119.7 127.9

Intangible assets - other 97.0 59.8 63.3

Right of use assets 22.5 20.6 22.4

Pension surplus 13 0.1 - -

Deferred tax assets 11.0 7.5 7.9

--------------------------------------- -------- ------------ ------------ -------------

326.1 232.2 245.0

--------------------------------------- -------- ------------ ------------ -------------

Current assets

Inventories 70.1 69.3 67.7

Trade and other receivables 63.9 80.4 84.9

Current tax assets 1.8 2.1 1.8

Cash and cash equivalents 12 19.9 30.3 29.2

--------------------------------------- -------- ------------ ------------ -------------

155.7 182.1 183.6

--------------------------------------- -------- ------------ ------------ -------------

Assets in a disposal group classified

as held for sale 10 91.2 - -

Total assets 573.0 414.3 428.6

Current liabilities

Trade and other payables (88.1) (85.2) (94.8)

Other financial liabilities (2.1) (3.6) (0.8)

Lease liabilities (4.6) (5.2) (4.8)

Current tax liabilities (8.0) (6.5) (5.6)

Provisions (2.0) (1.1) (1.8)

--------------------------------------- -------- ------------ ------------ -------------

(104.8) (101.6) (107.8)

--------------------------------------- -------- ------------ ------------ -------------

Non-current liabilities

Trade and other payables (1.4) (3.7) (0.8)

Other financial liabilities (119.6) (68.8) (75.6)

Lease liabilities (17.0) (14.8) (16.7)

Pension liability 13 - (1.1) (1.0)

Provisions (4.5) (4.7) (5.4)

Deferred tax liabilities (21.0) (12.6) (12.5)

(163.5) (105.7) (112.0)

--------------------------------------- -------- ------------ ------------ -------------

Liabilities in a disposal group

classified as held for sale 10 (35.4) - -

Total liabilities (303.7) (207.3) (219.8)

--------------------------------------- -------- ------------ ------------ -------------

Net assets 269.3 207.0 208.8

--------------------------------------- -------- ------------ ------------ -------------

Equity

Share capital 4.7 4.4 4.4

Share premium account 192.0 138.8 138.8

Merger reserve 13.7 22.7 19.9

Currency translation reserve - 1.1 (2.7)

Retained earnings 58.9 40.0 48.4

Total equity 269.3 207.0 208.8

--------------------------------------- -------- ------------ ------------ -------------

Condensed consolidated statement of changes in equity

(unaudited)

for the six months ended 30 September 2021

Attributable to equity holders of the Company

----------------------- -------------------------------------------------------------------------

Currency

Share Share Merger translation Retained Total

capital premium reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm

-----------------------

At 1 April 2021 4.4 138.8 19.9 (2.7) 48.4 208.8

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Profit for the period - - - - 6.2 6.2

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Other comprehensive

income - - - 2.7 0.3 3.0

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Total comprehensive

income - - - 2.7 6.5 9.2

Shares issued 0.3 53.2 - - - 53.5

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Share-based payments

including tax - - - - 4.0 4.0

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Transfer to retained

earnings - - (6.2) - 6.2 -

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Dividends - - - - (6.2) (6.2)

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

At 30 September 2021

- unaudited 4.7 192.0 13.7 - 58.9 269.3

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

At 1 April 2020 4.4 138.8 22.7 (2.2) 36.8 200.5

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Profit for the period - - - - 5.3 5.3

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Other comprehensive

income - - - 3.3 (2.9) 0.4

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Total comprehensive

income - - - 3.3 2.4 5.7

Share-based payments

including tax - - - - 0.8 0.8

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

At 30 September 2020

- unaudited 4.4 138.8 22.7 1.1 40.0 207.0

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

At 1 April 2020 4.4 138.8 22.7 (2.2) 36.8 200.5

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Profit for the period - - - - 12.0 12.0

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Other comprehensive

loss - - - (0.5) (2.8) (3.3)

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Total comprehensive

income - - - (0.5) 9.2 8.7

Share-based payments

including tax - - - - 2.4 2.4

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Transfer to retained

earnings - - (2.8) - 2.8 -

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

Dividends - - - - (2.8) (2.8)

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

At 31 March 2021 -

audited 4.4 138.8 19.9 (2.7) 48.4 208.8

----------------------- ---------- ---------- ---------- ------------- ----------- ---------

As at 30 September 2021, the Company's issued share capital

consisted of 94,806,109 ordinary shares of 5p each (31 March 2021:

89,455,915 ordinary shares of 5p each).

Condensed consolidated statement of cash flows (unaudited)

for the six months ended 30 September 2021

Unaudited Unaudited

six months six months Audited

ended ended year

30 Sept 30 Sept ended

2021 2020 31 Mar 2021

Notes GBPm GBPm GBPm

--------------------------------------------- ------ ------------ ------------ -------------

Net cash inflow from operating activities 11 13.9 24.7 46.6

Investing activities

Acquisitions of businesses (net of

cash/(debt) acquired) (83.9) - (20.8)

Purchase of property, plant and equipment (2.6) (1.3) (3.2)

Purchase of intangible assets - software (0.2) (0.2) (0.7)

Proceeds from disposal of property,

plant and equipment - - 0.3

Interest received 0.2 0.1 0.3

Net cash used in investing activities (86.5) (1.4) (24.1)

--------------------------------------------- ------ ------------ ------------ -------------

Financing activities

Net proceeds from the issue of shares 53.4 - 0.1

Proceeds from borrowings 100.0 - 9.3

Repayment of borrowings (56.5) (26.6) (27.8)

Principal element of lease payments (3.1) (3.1) (6.1)

Interest paid on lease liabilities (0.4) (0.3) (0.6)

Dividends paid (6.2) - (2.8)

Net cash generated/(absorbed) from

financing activities 87.2 (30.0) (27.9)

--------------------------------------------- ------ ------------ ------------ -------------

Net increase/(decrease) in cash and

cash equivalents 14.6 (6.7) (5.4)

Cash and cash equivalents at beginning

of period 28.2 34.8 34.8

Net foreign exchange differences 1.0 0.4 (1.2)

--------------------------------------------- ------ ------------ ------------ -------------

Cash and cash equivalents at end

of period 43.8 28.5 28.2

--------------------------------------------- ------ ------------ ------------ -------------

Reconciliation to cash and cash equivalents

in the condensed consolidated statement

of financial position

Cash and cash equivalents shown above 43.8 28.5 28.2

Less cash within assets held for

sale 10 (26.2) - -

Add bank overdrafts 2.3 1.8 1.0

Cash and cash equivalents in the

condensed consolidated statement

of financial position 19.9 30.3 29.2

--------------------------------------------- ------ ------------ ------------ -------------

Further information on the condensed consolidated statement of

cash flows is provided in notes 11 and 12.