TIDMTBLD

RNS Number : 7865L

tinyBuild, Inc.

15 September 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, TO OR FOR THE ACCOUNT OR BENEFIT OF US PERSONS, AS

DEFINED IN REGULATION S PROMULGATED UNDER THE US SECURITIES ACT OF

1933, AS AMED (THE "US SECURITIES ACT"), OR IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

15 September 2021

tinyBuild, Inc

("tinyBuild" or the "Company")

Half year results

tinyBuild (AIM:TBLD), a leading video games publisher and

developer with global operations, is pleased to announce its

unaudited results for the 6 months ended 30 June 2021.

Financial highlights:

-- Revenue of $18.6m (H1 2020: $18.5m), in line with

expectations and reflecting a second-half weighted release

schedule.

-- Adj EBITDA(1) growth of 18% to $7.9m (H1 2020: $6.7m), with

margins increasing to 42% (H1 2020: 36%), as contribution to

revenues from own-IP increased to 78% of group revenue (67% in H1

20), supporting long-term margin expansion.

-- Adj. Operating Profit(2) increased 94% to $5.1m (H1 2020:

$2.6m), reflecting lower share-based payments

-- Adj. Cash Flow from Operations(2) was $3.8m, lower than the

previous year (H1 2020: $6.9m) due to timing differences in

payments to developers and tax payments

-- Net cash increased to $61.6m (Dec 2020: $26.3m), including

$50m gross proceeds following the successful listing on AIM

(1) Excludes expenses related to the IPO, share based

compensation expenses; includes amortisation of Development

costs

(2) Excludes expenses related to the IPO

Operational highlights:

-- Three new games published including first-party titles Cartel

Tycoon (early access), Mayhem in a Single Valley and Hello Engineer

(early access), growing tinyBuild's portfolio to over 40 games, in

addition to platform launches (Secret Neighbor on PS4 and iOS).

-- Strong back catalogue sales representing 91% of total

revenues, demonstrating the Company's ability to extend games' life

cycles, while adding new titles.

-- Three development studio acquihires We're Five Games (Totally

Reliable Delivery Service), Hungry Couch (Black Skylands) and

DogHelm (Streets of Rogue).

-- Successful admission to AIM, raising GBP36.2m ($50m) of gross

proceeds, to accelerate organic growth and support our M&A

strategy.

-- Henrique Olifiers was appointed as Non-Executive Chairman,

with Nick Van Dyk and Neil Catto appointed as Non-Executive

Directors.

Post-Period End

-- Acquihire of BadPixel, the studio behind successful shooter

Deadside, currently in early access, for a total consideration of

up to $17.1m (see separate announcement).

-- Acquihire of Animal (Rawmen) announced in August 2021, for a

total consideration of up to $10.2m.

-- Released Black Skylands (early access), plus release dates

announced for Potion Crafts (early access), Despot's Game (early

access) and Happy's Humber Burger Farm.

-- Secured a new credit facility of $25m (expiry September 2022) with Bank of America.

Outlook

-- The pipeline for coming years now stands at 29 titles,

including near launch games such as Potion Craft, Despot's Game and

Happy's Humble Burger Farm.

-- While tinyBuild reviews the impact of the pandemic, and the

fluid macroeconomic situation, early indicators of traction across

the pipeline, including KPIs for Hello Neighbor 2, are very

encouraging.

-- The Board remains confident the Company is on track to

deliver results at least in line with expectations, plus accretive

acquisitions.

Alex Nichiporchik, Chief Executive Officer of tinyBuild,

commented:

"We are really excited about tinyBuild's progress this year,

with major titles in our pipeline showing strong KPIs ahead of

launch. This includes new titles such as Tinykin and the widely

anticipated Hello Neighbor 2.

"Our successful listing on AIM earlier this year and the

additional expected $25m facility announced today, provide a

platform from which we can deliver our organic and M&A growth

ambitions. Our back catalogue has performed strongly, and we remain

focused on finding new games at different stages of development. We

are evaluating a number of M&A targets to help accelerate

growth.

"Our goal is to expand our position as a leading global

developer and publisher, focusing on IP ownership while creating

long-term scalable franchises across multiple media formats. To

date, 2021 has seen significant progress towards that ambition, and

we look to the future with confidence."

Enquiries :

tinyBuild, Inc investorrelations@tinybuild.com

Alex Nichiporchik - Chief Executive Officer

Luke Burtis - Chief Operating Officer

Antonio Jose Assenza - Chief Financial Officer

Giasone (Jaz) Salati - Head of M&A and IR

Zeus Capital (Nominated Adviser and Joint

Broker)

Nick Cowles, Richard Kauffer (Corporate Finance)

Benjamin Robertson (Equity Capital Markets) +44 (0)20 3829 5000

Berenberg (Joint Broker)

Ben Wright, Mark Whitmore, Alix Mecklenburg-Solodkoff,

Milo Bonser +44 (0)20 3207 7800

SEC Newgate (Financial PR) tinybuild@secnewgate.co.uk

Robin Tozer, Bob Huxford, Megan Kovach +44 (0)7540 106366

About tinyBuild:

Founded in 2013, tinyBuild (AIM: TBLD) is a leading premium

AA-rated and indie video games publisher and developer. tinyBuild

strategically secures access to IP and partners with developers to

establish a stable platform on which to build multi-game and

multimedia franchises. tinyBuild has a strong portfolio of over 40

titles, and its upcoming pipeline includes over 20 new titles

currently in development.

Headquartered in Seattle, Washington, USA, the Company has key

operations worldwide, with employees, contractors or partners in

multiple locations across five continents. tinyBuild's geographic

diversity enables it to source high-potential IP, cost-effective

development resources and a loyal customer base through innovative

grassroots marketing.

tinyBuild was admitted to AIM, a market operated by the London

Stock Exchange, in March 2021.

For further information, visit: www.tinybuildinvestors.com .

OPERATIONAL REVIEW

2021 has seen the progressive lifting of Covid restrictions

across a number of countries. In contrast with general expectations

that video games sales would be negatively impacted by the lifting

of restrictions, the Board is pleased to confirm that catalogue

titles are performing strongly, alongside new game launches. Sales

are progressing at least in line with expectations for the

financial year 2021.

tinyBuild continues to benefit from platform competition and is

also well-positioned to work with subscription services. Revenues

from deals with distribution partners were above management

expectations and gave the Company greater visibility of future

revenue growth, while helping de-risk the development process for

new games.

As anticipated, the release schedule for 2021 is weighted

towards the second half of the year (e.g. Potion Craft and Despot's

Game). As a result, back catalogue contribution to total revenue in

the first six months of the year increased to 91%. The share of

revenues from own-IP also increased to 78% in H1 2021.

Current portfolio and pipeline

Since the beginning of the year, tinyBuild published four new

games (including Black Skylands in July) and added new platforms

for two games already in the portfolio:

-- Cartel Tycoon (early access) - a survival business sim

inspired by the eighties narco trade. Expand and conquer, fight off

rival cartels and evade the authorities

-- Mayhem in Single Valley (PC only) - a puzzle-loaded action

adventure where you have to prevent the end of the world while

keeping everyone from finding out it was all your fault

-- Hello Engineer (early access on Stadia) - a multiplayer

machinery-building construction game set in the sandbox world of a

mysterious amusement park, but beware of the Neighbor

-- Black Skylands (early access) - a skypunk Open World

action-adventure. Build your skyship and explore the open world,

fight factions of pirates and monsters, and claim territories.

-- Totally Reliable Delivery Service (Steam) - a ragdoll physics

simulation about terrible package delivery couriers

-- Secret Neighbor (PS4, iOS and Switch) - a Multiplayer Social

Suspense Game where a group of intruders try to rescue their friend

from the Neighbor's creepy basement

We have recently announced, or we are close to announcing a

release date for:

-- Potion Craft (early access on Steam) - an alchemist simulator

that was the number one trending game in the February Steam Game

Festival

-- Despot's Game (early access on Steam) - a rogue-like game

with turbocharged battles and a top 10 trending game in the

February Steam Game Festival

-- Happy's Humble Burger Farm (Steam and consoles) - a first

person adventure horror cooking game, a sequel to the award-winning

burger simulation

-- Trash Sailors (Steam and consoles) - a hand-drawn sailing

simulator with co-op up to 4 players. Create the trashiest sailing

team in history, fight with monsters and trash

-- Undungeon - an Action/RPG game driven by intense real-time

combat and an immensely rich science fiction story.

Finally, we announced three new titles:

-- Tinykin - an innovative 3D puzzle platformer where astronaut

Milo uses hundreds of tinykin and their unique powers to go back to

his home planet - and back to normal size.

-- SpiderHeck - a physics-based brawler that's easy to pick up

but difficult to master. Duel to the death or choose to team up and

hold back swarms of savage enemies.

-- BookWalker - a thief with an ability to dive into books is

forced to use his powers to track and steal the likes of Thor's

Hammer and the Excalibur to save his brother.

tinyBuild had 23 games in the pipeline at the end of 2020. So

far, in 2021, the Company has signed an additional ten new games,

increasing the total number of new games under development to 29,

after accounting for the four new titles already launched in 2021.

Five of these new games will be developed in Eastern Europe and

Russia, four in the United States and one in New Zealand.

Acquisitions

Since the beginning of the year, we have made five acquisitions.

We acquihired two studios in January and February 2021: We're Five

Games, the Minneapolis developer of Totally Reliable Delivery

Service and the Russia based developer of Black Skylands year,

Hungry Couch.

In June, we acquihired DogHelm, the studio behind Streets of

Rogue, the highest-rated title in tinyBuild's portfolio according

to Steam users. In August, we announced the acquihire of Animal,

following a two-year partnership to develop a new game, Rawmen.

Today, we are pleased to announce the acquihire of Bad Pixel,

the development studio behind the very popular open world game

Deadside. Bad Pixel is based in Russia with five developers

currently.

People

As part of its effort to secure talent at a competitive cost,

the Company continued to hire staff (both employees and independent

contractors) in strategic geographies.

tinyBuild aims to offer employees the best working conditions in

the industry. For example, the Company has implemented clear

policies against crunching, the industry practice by which

developers overwork to meet specific targets. In June, tinyBuild

also gifted one extra week of holiday to all direct employees in a

gesture of appreciation for everybody's hard work.

As a result, tinyBuild enjoys one of the lowest levels of staff

turnover, low single-digit, compared to an estimated 15.5% across

the industry ( Wired ).

Position and strategy

tinyBuild is well-positioned with a strong pipeline of new

titles and a proven ability to attract, screen and market

high-quality game franchises. Our low-risk M&A strategy

continues to help us increase our IP portfolio, and our multimedia

franchise model allows us to extend the life of our IP, maximising

our return on investment.

Our medium-term strategy is to expand our position as a leading

global video games developer and publisher, focussing on IP

ownership while creating long-term scalable franchises across

multiple media formats. 2021 has seen significant progress towards

that ambition, and I would like to thank all of our shareholders

for their support.

Alex Nichiporchik

Chief Executive Officer

15 September 2021

FINANCIAL REVIEW

On 9 March 2021, tinyBuild raised $50m (GBP36.2m) in gross

proceeds, which is being used to accelerate organic growth and

support the M&A strategy. Adjusted EBITDA for the six months

ended June 2021 was marginally ahead of expectations, and the

Company closed three acquihires in the period.

Revenue

In the six months to June 2021, tinyBuild revenues were $18.6m,

slightly ahead of the previous year (H1 2020: $18.5m), reflecting a

release schedule skewed towards the second half and the success of

Totally Reliable Delivery Service, which was first released on 1

April 2020. Back catalogue performed strongly in the first half,

with new platform launches of Secret Neighbor driving revenues

across the wider Hello Neighbor franchise. Revenue from events,

primarily DevGAMM, fell slightly as a result of the global

pandemic.

Adjusted EBITDA and Operating Profit

Adjusted EBITDA is presented net of amortisation of development

costs, excluding share-based compensation expenses and exceptional

costs (e.g. IPO), giving a clear picture of the business

progression. Adjusted EBITDA grew 18% to $7.9m in H1 of 2021, with

margin expanding to 42% (H1 2020: 36%) as a result of higher share

of revenues from own-IP (78% in H1 2021 vs 67% in H1 2020) and back

catalogue (91% in H1 2021).

Operating profit for H1 2021 was $0.7m (H1 2020: $2.6m).

Excluding the $4.4m one-off IPO costs, Adjusted Operating Profit

increased over 90% to $5.1m due to higher margins and lower charges

relating to share-based compensation ($2.2m in H1 2021 vs $3.6m in

H1 2020).

Interest income and taxation

Interest income was immaterial in H12021, and taxation charges

were $1.0m, lower than $1.6m in H1 2020 due to timing differences

that will reverse in the second half of the year.

Exceptional Costs Relating to the AIM Listing

In H1 2021, tinyBuild incurred one-off costs ($4.4m) related to

the IPO on the London Stock Exchange's AIM market, including

expenses related to audit and legal fees ($3m).

Financial Position

In H1 of 2021, the net cash position increased from $26.3m, as

of December 2020, to $61.6m, with the majority of the increase

being driven by the AIM float, where tinyBuild raised $50m in gross

proceeds.

Cash Flow

Adjusted cash flows from operating activities decreased from

$6.9m to $3.8m in H1 2021, (-$0.6m including exceptional costs

relating to the IPO) mainly due to timing of payments to developers

and tax, which will reverse in the second half of the year.

Software development costs, mainly consisting of developer

salaries, advances, localisation and porting, increased from $2.4m

to $5.6m, reflecting the increase in investment for upcoming

pipeline releases.

Events after the reporting date

In August 2021, tinyBuild announced the acquihire of Animal, for

a total consideration up to a max of $10.2 million, split

approximately 30%-70% between cash and newly issued tinyBuild

shares, including upfront and deferred payments over the next three

financial years.

In September 2021, we announced the acquihire of Bad Pixel, the

development studio behind the very popular open-world game

Deadside, for a total consideration of up to $17.1m, including

upfront and deferred payments over the next three financial years.

The deal will be marginally accretive in 2021, a year of

investments, with greater potential for return in the following

years (please see separate press release published today).

tinyBuild secured a new credit facility of $25m (expiry

September 2022) on favourable terms with Bank of America. The new

credit facility has been designed to expand tinyBuild's financial

capacity in the event of larger M&A deals while having minimal

impact on P&L and cash flow if not used.

Antonio Jose Assenza

Chief Financial Officer

15 September 2021

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months Year ended

Note ended 30 ended 30 31 December

June 2021 June 2020 2020

Unaudited Audited Audited

--------- ---------- -------------- --------------

$'000 $'000 $'000

--------- ---------- -------------- --------------

Revenue 4 18,626 18,510 37,648

--------- ---------- -------------- --------------

Cost of sales (5,449) (8,635) (15,120)

--------- ---------- -------------- --------------

Gross profit 13,177 9,875 22,528

--------- ---------- -------------- --------------

Administrative expenses:

--------- ---------- -------------- --------------

- General administrative expenses (5,920) (3,690) (8,714)

--------- ---------- -------------- --------------

- Share-based payment expenses (2,159) (3,561) (5,845)

--------- ---------- -------------- --------------

- IPO transaction costs 5 (4,409) - (467)

--------- ---------- -------------- --------------

Total administrative expenses (12,488) (7,251) (15,026)

--------- ---------- -------------- --------------

Other operating income - - 162

--------- ---------- -------------- --------------

Operating profit 689 2,624 7,664

--------- ---------- -------------- --------------

Finance costs (9) (11) (21)

--------- ---------- -------------- --------------

Finance income 4 55 57

--------- ---------- -------------- --------------

Profit before tax 684 2,668 7,700

--------- ---------- -------------- --------------

Income tax expense (981) (1,599) (2,752)

--------- ---------- -------------- --------------

(Loss)/profit and total comprehensive

income for the year (297) 1,069 4,948

--------- ---------- -------------- --------------

Attributable to:

--------- ---------- -------------- --------------

Owners of the parent company (225) 1,063 4,942

--------- ---------- -------------- --------------

Non-controlling interests (72) 6 6

--------- ---------- -------------- --------------

(297) 1,069 4,948

--------- ---------- -------------- --------------

Earnings per share ($) 6 (0.001) 0.006 0.028

--------- ---------- -------------- --------------

Diluted earnings per share ($) 6 (0.001) 0.006 0.027

--------- ---------- -------------- --------------

Adjusted EBITDA 7 7,905 6,705 15,275

--------- ---------- -------------- --------------

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF FINANCIAL POSITION

30 June 2021 31 December

2020

Unaudited Audited

---- -------------------- -------------------

ASSETS Note $'000 $'000

---- -------------------- -------------------

Non-current assets

---- -------------------- -------------------

Intangible assets 8 21,933 15,141

---- -------------------- -------------------

Property, plant and equipment:

---- -------------------- -------------------

- owned assets 87 87

---- -------------------- -------------------

- right-of-use assets 573 673

---- -------------------- -------------------

Trade and other receivables 16 16

---- -------------------- -------------------

Total non-current assets 22,609 15,917

---- -------------------- -------------------

Current assets

---- -------------------- -------------------

Trade and other receivables 7,926 4,999

---- -------------------- -------------------

Cash and cash equivalents 61,642 26,313

---- -------------------- -------------------

Total current assets 69,568 31,312

---- -------------------- -------------------

TOTAL ASSETS 92,177 47,229

---- -------------------- -------------------

EQUITY AND LIABILITIES

Equity

---- -------------------- -------------------

Share capital 10 202 1

---- -------------------- -------------------

Share premium 60,877 18,674

---- -------------------- -------------------

Warrant reserve 1,920 -

---- -------------------- -------------------

Retained earnings 21,853 19,919

---- -------------------- -------------------

Equity attributable to owners of the

parent company 84,852 38,594

---- -------------------- -------------------

Non-controlling interest 90 162

---- -------------------- -------------------

Total equity 84,942 38,756

---- -------------------- -------------------

LIABILITIES

---- -------------------- -------------------

Non-current liabilities

---- -------------------- -------------------

Trade and other payables 50 -

---- -------------------- -------------------

Lease liabilities 356 442

---- -------------------- -------------------

Deferred tax liabilities 1,663 1,663

---- -------------------- -------------------

Total non-current liabilities 2,069 2,105

---- -------------------- -------------------

Current liabilities

---- -------------------- -------------------

Borrowings - 13

---- -------------------- -------------------

Trade and other payables 3,355 3,496

---- -------------------- -------------------

Contract liabilities 1,625 2,675

---- -------------------- -------------------

Lease liabilities 186 184

---- -------------------- -------------------

Total current liabilities 5,166 6,368

---- -------------------- -------------------

Total liabilities 7,235 8,473

---- -------------------- -------------------

TOTAL EQUITY AND LIABILITIES 92,177 47,229

---- -------------------- -------------------

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF CHANGES IN EQUITY

Note Share Share Warrant Retained Total equity Non-controlling Total

capital premium reserve earnings attributable interest equity

to owners

of the parent

$'000 $'000 $'000 $'000 $'000 $'000 $'000

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Balance at 1

January

2020 1 18,674 - 9,132 27,807 156 27,963

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Profit and

total

comprehensive

income for

the period - - - 1,063 1,063 6 1,069

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Transactions

with owners

in their

capacity as

owners:

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Share-based

payments - - - 3,561 3,561 - 3,561

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Total

transactions

with

owners - - - 3,561 3,561 - 3,561

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Balance at 30

June 2020 1 18,674 - 13,756 32,431 162 32,593

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Share Share Warrant Retained Total equity Non-controlling Total

capital premium reserve earnings attributable interest equity

to owners

of the parent

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

$'000 $'000 $'000 $'000 $'000 $'000 $'000

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Balance at 1

January

2021 1 18,674 - 19,919 38,594 162 38,756

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Loss and total

comprehensive

expense for

the year - - - (225) (225) (72) (297)

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Transactions

with owners

in their

capacity as

owners:

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Share split 10 178 (178) - - - - -

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Issue of

shares, net

of

transaction

costs 10 22 44,147 - - 44,169 - 44,169

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Issue of

shares on

exercise

of options 10 1 154 - - 155 - 155

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Issue of

warrants 10 - (1,920) 1,920 - - - -

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Share-based

payments - - - 2,159 2,159 - 2,159

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Total

transactions

with

owners 201 42,203 1,920 2,159 46,483 - 46,483

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

Balance at 30

June 2021 202 60,877 1,920 21,853 84,852 90 84,942

---- ------------------- ------------------ --------------------- -------------------- ---------------------- -------------------- ------------------

TINYBUILD INC.

CONSOLIDATED CONDENSED STATEMENT OF CASH FLOWS

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Unaudited Audited Audited

---- ---------- ------------- ------------

Note $'000 $'000 $'000

---- ---------- ------------- ------------

Cash flows from operating activities

---- ---------- ------------- ------------

Cash generated from operations 11 (566) 6,883 16,470

---- ---------- ------------- ------------

Net cash generated by operating activities (566) 6,883 16,470

---- ---------- ------------- ------------

Cash flows from investing activities

---- ---------- ------------- ------------

Software development (5,636) (2,443) (6,549)

---- ---------- ------------- ------------

Purchase of intellectual property (2,089) (180) (570)

---- ---------- ------------- ------------

Purchase of property, plant and equipment - (5) (24)

---- ---------- ------------- ------------

Net cash used in investing activities (7,725) (2,628) (7,143)

---- ---------- ------------- ------------

Cash flows from financing activities

---- ---------- ------------- ------------

Proceeds from borrowings - 175 175

---- ---------- ------------- ------------

Repayment of borrowings (13) - -

---- ---------- ------------- ------------

Proceeds from issuance of ordinary shares, 43,570 - -

net of issuance costs

---- ---------- ------------- ------------

Proceeds on exercise of share options 154 - -

---- ---------- ------------- ------------

Payment of principal portion of lease

liabilities (91) (107) (198)

---- ---------- ------------- ------------

Net cash generated by/(used in) financing

activities 43,620 68 (23)

---- ---------- ------------- ------------

Cash and cash equivalents

---- ---------- ------------- ------------

Net increase in the year 35,329 4,323 9,304

---- ---------- ------------- ------------

At beginning of period 26,313 17,009 17,009

---- ---------- ------------- ------------

At end of period 61,642 21,332 26,313

---- ---------- ------------- ------------

Non-cash investing activities

The Group purchased the intellectual property rights to four

video games, for consideration which included non-cash

consideration of $599,000 (see note 8).

During the period, the Group granted 1,511,448 warrants to

subscribe for ordinary shares (see note 10) These warrants had a

fair value at grant date of $1,919,540.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2021

1 GENERAL INFORMATION

TinyBuild Inc. ("the Company") is a public company limited by

shares, and is registered, domiciled and incorporated in Delaware,

USA. The address of the registered office is 127 Bellevue Way SE,

Suite 200, Bellevue, WA 98004, United States. On 9 March 2021, the

Company's shares were listed on the Alternative Investment Market

of the London Stock Exchange ("AIM").

The Group ("the Group") consists of TinyBuild Inc. and all of

its subsidiaries. The Group's principal activity is that of an

indie video game publisher and developer.

The board of Directors approved this interim financial

information on 15 September 2021.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

These condensed, consolidated financial statements for the

interim half-year reporting period ended 30 June 2021 have been

prepared in accordance with IAS 34 'Interim Financial Reporting'.

These interim financial statements do not constitute full financial

statements and do not include all the notes of the type normally

included in annual financial statements. Accordingly, these

financial statements are to be read in conjunction with the annual

report for the year ended 31 December 2020.

The annual financial statements of the Group are prepared in

accordance with International Financial Reporting Standards

("IFRS") as issued by the International Accounting Standards Board

("IASB"). The Annual Report and Financial Statements for 2020 have

been issued and are available on the Group's investor relations'

website:

https://www.tinybuildinvestors.com/documents-and-presentations.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated

financial statements as in its 31 December 2020 annual financial

statements, except for those that relate to new standards and

interpretations effective for the first time for periods beginning

on (or after) 1 January 2021 and will be adopted in the 2021

financial statements. There are deemed to be no new and amended

standards and/or interpretations that will apply for the first time

in the next annual financial statements that are expected to have a

material impact on the Group.

Tax charged within the 6 months ended 30 June 2021 has been

calculated by applying the effective rate of tax which is expected

to apply to the Group for the year ending 31 December 2021 as

required by IAS 34 'Interim Financial Reporting'.

The financial statements have been prepared on the historical

cost basis except for, where disclosed in the accounting policies,

certain financial instruments that are measured at fair value. The

financial statements are prepared in US Dollars, which is the

functional currency and presentational currency of the Company and

all entities within the Group. Monetary amounts in these financial

statements are rounded to the nearest thousand US Dollars

(US$'000).

3 SEGMENTAL REPORTING

IFRS 8 Operating Segments requires that operating segments be

identified on the basis of internal reporting and decision-making.

The Group identifies operating segments based on internal

management reporting that is regularly reported to and reviewed by

the Board of directors, which is identified as the chief operating

decision maker. Management information is reported as one operating

segment, being revenue from self-published franchises and other

revenue streams such as royalties, licensing, development and

events.

Whilst the chief operating decision maker considers there to be

only one segment, the Company's portfolio of games is split between

those based on IP owned by the Group and IP owned by a third party

and hence to aid the readers understanding of our results, the

split of revenue from these two categories is shown below.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

3 SEGMENTAL REPORTING (CONTINUED)

Game and merchandise royalties 6 months ended 6 months ended Year ended

30 June 2021 30 June 2020 31 December

2020

Unaudited Audited Audited

-------------- -------------- ------------

$'000 $'000 $'000

-------------- -------------- ------------

Owned IP 14,100 12,242 24,683

-------------- -------------- ------------

Third-party IP 4,050 4,874 9,239

-------------- -------------- ------------

_ _

-------------- -------------- ------------

18,150 17,116 33,922

-------------- -------------- ------------

Five customers were responsible for approximately 80% of the

Group's revenues (30 June 2020: four - 73%, 31 December 2020: five

- 81%).

The Group has one right-of-use asset located overseas with a

carrying value of $39,881 (30 June 2020: $58,287, 31 December 2020:

$49,084). All other non-current assets are located in the US.

4 REVENUE 6 months 6 months Year ended

ended 30 ended 30 31 December

June 2021 June 2020 2020

Unaudited Audited Audited

An analysis of the Group's revenue $'000 $'000 $'000

is as follows:

Revenue analysed by class of business

Game and merchandise royalties 18,150 17,116 33,922

Development services 224 980 2,917

Events 252 414 809

18,626 18,510 37,648

5 IPO TRANSACTION COSTS 6 months ended 6 months ended Year ended

30 June 2021 30 June 2020 31 December

2020

Unaudited Audited Audited

-------------- -------------- ------------

$'000 $'000 $'000

-------------- -------------- ------------

IPO related costs 4,409 - 467

-------------- -------------- ------------

IPO transaction costs in the 6 months ended 30 June 2021 relate

to significant one-off costs, which have not been deducted from

equity, associated with the Group's admission onto AIM in March

2021. The costs comprise advisors' fees, stock exchange listing

fees and other IPO costs. Costs totalling $8,593,000 incurred in

association with the IPO which met IAS 32 definition of transaction

costs (being incremental and directly related to the issuance of

new equity instruments and which would have been avoided had the

instruments not been issued) have been deducted from share

premium.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

6 EARNINGS PER SHARE

The Group reports basic and diluted earnings per common share. Basic

earnings per share is calculated by dividing the profit attributable

to common shareholders of the Company by the weighted average number

of common shares outstanding during the period.

Diluted earnings per share is determined by adjusting the profit attributable

to common shareholders by the weighted average number of common shares

outstanding, taking into account the effects of all potential dilutive

common shares, including options.

6 months 6 months ended Year ended

ended 30 30 June 2020 31 December

June 2021 2020

---------------------- -------------------- --------------------

Unaudited Audited Audited

---------------------- -------------------- --------------------

$'000 $'000 $'000

---------------------- -------------------- --------------------

Total comprehensive (loss)/income attributable

to the owners of the company (225) 1,063 4,942

---------------------- -------------------- --------------------

Weighted average number of shares 192,047,223 179,602,538 179,602,538

---------------------- -------------------- --------------------

Basic earnings per share ($) (0.001) 0.006 0.028

---------------------- -------------------- --------------------

6 months 6 months ended Year ended

ended 30 30 June 2020 31 December

June 2021 2020

Unaudited Audited Audited

--------------- -------------- ------------

$'000 $'000 $'000

--------------- -------------- ------------

Total comprehensive income attributable

to the owners of the company (225) 1,063 4,942

--------------- -------------- ------------

Weighted average number of shares 192,047,223 179,602,538 179,602,538

--------------- -------------- ------------

Dilutive effect of share options - 2,393,223 2,739,413

--------------- -------------- ------------

Weighted average number of diluted shares 192,047,223 181,995,761 182,341,950

--------------- -------------- ------------

Diluted earnings per share ($) (0.001) 0.006 0.027

--------------- -------------- ------------

Pursuant to IAS 33, options whose exercise price is higher than

the value of the Company's security were not taken into account in

determining the effect of dilutive instruments. The calculation of

diluted earnings per share does not assume conversion, exercise, or

other issue of potential ordinary shares that would have an

antidilutive effect on earnings per share.

The earnings per share disclosed for the 6 months ended 30 June

2020 and year ended 31 December 2020 have been adjusted for the

stock split occurring in 2021 (see note 10).

7 ADJUSTED EBITDA

The Directors of the Group have presented the performance

measure adjusted EBITDA as they monitor this performance measure at

a consolidated level and they believe this measure is relevant to

an understanding of the Group's financial performance. Adjusted

EBITDA is calculated by adjusting profit from continuing operations

to exclude the impact of taxation, net finance costs, share-based

payment expenses, depreciation, amortisation of purchased

intellectual property and IPO transaction costs. Adjusted EBITDA is

not a defined performance measure in IFRS. The Group's definition

of adjusted EBITDA may not be comparable with similarly titled

performance measures and disclosures by other entities.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

7 ADJUSTED EBITDA (CONTINUED) 6 months 6 months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Audited Audited

------------------- ------------- ------------

$'000 $'000 $'000

------------------- ------------- ------------

(Loss)/profit for the period (297) 1,069 4,948

------------------- ------------- ------------

Income tax expense 981 1,599 2,752

------------------- ------------- ------------

Finance costs 9 11 21

------------------- ------------- ------------

Finance income (4) (55) (57)

------------------- ------------- ------------

Share-based payment expenses 2,159 3,561 5,845

------------------- ------------- ------------

Amortisation of purchased intellectual

property 547 402 1,222

------------------- ------------- ------------

Depreciation of property, plant and equipment 101 118 239

------------------- ------------- ------------

IPO transaction costs 4,409 - 467

------------------- ------------- ------------

Other operating income - - (162)

------------------- ------------- ------------

Adjusted EBITDA 7,905 6,705 15,275

------------------- ------------- ------------

8 INTANGIBLE ASSETS Purchased Software development Total

intellectual costs

property

$'000 $'000 $'000

------------------ -------------------- -----------------

Cost:

------------------ -------------------- -----------------

As at 1 January 2020 5,600 10,578 16,178

------------------ -------------------- -----------------

Additions - internally generated - 6,549 6,549

------------------ -------------------- -----------------

Additions - separately acquired 570 - 570

------------------ -------------------- -----------------

As at 31 December 2020 6,170 17,127 23,297

------------------ -------------------- -----------------

Additions - internally generated - 5,636 5,636

------------------ -------------------- -----------------

Additions - separately acquired 2,688 - 2,688

------------------ -------------------- -----------------

Transfers 645 (645) -

------------------ -------------------- -----------------

As at 30 June 2021 9,503 22,118 31,621

------------------ -------------------- -----------------

Amortisation and impairment:

------------------ -------------------- -----------------

As at 1 January 2020 267 2,568 2,835

------------------ -------------------- -----------------

Amortisation charge for the year 819 4,502 5,321

------------------ -------------------- -----------------

As at 31 December 2020 1,086 7,070 8,156

------------------ -------------------- -----------------

Amortisation charge for the period 547 985 1,532

------------------ -------------------- -----------------

As at 30 June 2021 1,633 8,055 9,688

------------------ -------------------- -----------------

Carrying amount:

------------------ -------------------- -----------------

As at 30 June 2021 7,870 14,063 21,933

------------------ -------------------- -----------------

As at 31 December 2020 5,084 10,057 15,141

------------------ -------------------- -----------------

During the period, the Group purchased the intellectual property

rights to four video games for total consideration of $3,333,000,

including non-cash consideration of $599,000 and transfers from

software development costs of $645,000. Amortisation of purchased

intellectual property is recognised within general administrative

expense in the Statement of Comprehensive Income. Amortisation of

software development costs is recognised within cost of sales in

the Statement of Comprehensive Income.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

9 SHARE-BASED PAYMENTS

The Group operates two share-based plans, the Equity Incentive

Plan and a Stock Restriction Agreement, which are detailed as

follows:

The Stock Restriction Agreement is a plan that provides for

grants of Restricted Stock Awards (RSA) for the founders of the

company. The awarded shares are made in the Company's ordinary

share capital. The fair value of the RSAs is estimated by using the

Black-Scholes valuation model on the date of grant, based on

certain assumptions, and is charged on a straight-line basis over

the required service period, normally two to three years. The fair

value of the 2017 grant is $8.98 per share and the 2019 grant is

$40.21 per share. The RSAs vest in instalments every three months

over the service period. Each instalment has been treated as a

separate share option grant because each instalment has a different

vesting period. This plan is equity-settled. The plan was fully

settled upon admission to trading. A reconciliation of RSAs is as

follows:

31 December

30 June 2020

2021

Opening RSA outstanding 191,220 367,730

RSA granted - -

RSA vested (191,220) (176,510)

Closing RSA outstanding - 191,220

Weighted average remaining contractual

life in years - 1.08

The company has an Equity Incentive Plan that provides for the

issuance of non-qualified stock options to officers and other

employees that have a contracted term of 10 years and generally

vest over four years. The stock options are granted on shares

issued by the company. A reconciliation of share option movements

is shown below:

Number Weighted Number Weighted Weighted

of options average of options average average

outstanding exercise exercisable exercise remaining

price ($) price ($) contractual

life (years)

At 31 December 2020 21,100 42.41 11,815 13.33 8.08

Adjust for stock split

(see note 10) 2,718,246 0.33

Granted during the period 692,756 1.59

Exercised during the

period (489,836) 0.07

At 30 June 2021 2,942,266 0.58 1,845,436 0.17 7.99

During the period covered by the financial statements, no

options expired or were forfeited. Options granted during the year

were valued using the Black-Scholes option-pricing model. The fair

value per option granted during the period covered by the financial

statements and the assumptions used in the calculation are as

follows:

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

9 SHARE-BASED PAYMENTS (CONTINUED)

Grant date

3 25 November

February 2020 15 October 17 April

2021 2020 2020

Share price at grant date $1.59 $1.59 $1.06 $0.33

Exercise price $1.59 $1.59 $1.06 $0.33

Option life 6.25 6.25 6.25 6.25

Expected volatility 60.00% 60.00% 60.00% 60.00%

Expected dividends 0.00% 0.00% 0.00% 0.00%

Discount rate 0.25% 0.25% 0.25% 0.25%

Weighted average fair value per

option $0.66 $0.66 $0.44 $0.14

Expected volatility is estimated based on the historic

volatility (based on the expected term) and the historical

volatility of comparable public peers over the same period. The

2020 grants have been adjusted to reflect the impact of the stock

split (see note 10).

10 SHARE CAPITAL 31 December

30 June 2021 2020

Unaudited Audited

------------ -----------

Number Number

------------ -----------

Class of share

------------ -----------

Ordinary shares of $0.001 each 201,744,118 1,059,052

------------ -----------

Series Seed preferred shares of $0.001

each - 125,755

------------ -----------

Series A preferred shares of $0.001

each - 198,560

------------ -----------

31 December

30 June 2021 2020

------------ -----------

Unaudited Audited

------------ -----------

$ $

------------ -----------

Class of share

------------ -----------

Ordinary shares of $0.001 each 201,744 1,059

------------ -----------

Series Seed preferred shares of $0.001

each - 126

------------ -----------

Series A preferred shares of $0.001

each - 199

------------ -----------

201,744 1,384

------------------------------------------------- ------------ -----------

On 26 February 2021, 324,315 preferred shares were converted

into 324,315 ordinary shares. The Company then completed a stock

split pursuant to which 1,383,367 ordinary shares of $0.001 each

were split into 179,597,639 shares of $0.001 each.

On 9 March 2021, the Company's shares were listed on the

Alternative Investment Market of the London Stock Exchange ("AIM").

A total of 21,438,985 new ordinary shares were issued in the

placing at the placing price of 169 pence per share. Share premium,

net of transaction costs, totalling $44,147,000 has been recognised

on the transaction.

During the period, 692,756 share options were issued to

employees and contractors at an exercise price of $1.59 per

share.

During the period, 489,836 share options were exercised at an

exercise price of $0.07 per share. Share premium totalling $34,000

has been recognised on the transaction.

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIODED 30 JUNE 2021

10 SHARE CAPITAL (CONTINUED)

During the period, 51,454 shares were issued to the

Non-Executive Chairman at the placing price of 169 pence per share.

Share premium totalling $120,000 has been recognised on the

transaction.

During the period, 166,204 shares were issued as partial

consideration for the acquisition of intellectual property (see

note 8).

On 3 March 2021, the Company granted Zeus Capital 1,511,448

warrants to subscribe for ordinary shares. Each warrant confers the

right, exercisable only if the share price exceeds 253 pence per

share, to subscribe in cash for one ordinary share at the placing

price of 169 pence per share. The warrants are only exercisable

during the period from 9 September 2022 to 9 March 2031. The fair

value of this warrant instrument has been calculated using a

lattice model, giving a total fair value of $1,919,540. This amount

has been recognised within the warrant reserve with a corresponding

decrease in the share premium account.

11 CASH GENERATED FROM OPERATIONS 6 months Year ended

ended 6 months ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Audited Audited

-------------------- -------------- ------------

$'000 $'000 $'000

-------------------- -------------- ------------

(Loss)/profit for the year (297) 1,069 4,948

-------------------- -------------- ------------

Adjustments for:

-------------------- -------------- ------------

Share-based payments 2,159 3,561 5,845

-------------------- -------------- ------------

Amortisation of intangible assets 1,532 2,580 5,321

-------------------- -------------- ------------

Depreciation of tangible fixed assets 101 118 239

-------------------- -------------- ------------

Foreign exchange (gains)/losses (2) - 5

-------------------- -------------- ------------

Finance costs 9 11 21

-------------------- -------------- ------------

Movements in working capital:

-------------------- -------------- ------------

(Increase)/decrease in receivables (2,927) (1,251) (1,299)

-------------------- -------------- ------------

Increase/(decrease) in payables (1,141) (55) 511

-------------------- -------------- ------------

Increase/(decrease) in deferred tax

liability - 850 879

-------------------- -------------- ------------

Cash (used in)/generated from operations (566) 6,883 16,470

-------------------- -------------- ------------

12 RELATED PARTY TRANSACTIONS

An analysis of key management personnel remuneration is set out

below:

Key management personnel remuneration 6 months Year ended

ended 6 months ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Audited Audited

------------- --------------- ------------

$'000 $'000 $'000

------------- --------------- ------------

Aggregate emoluments 758 410 1,552

------------- --------------- ------------

Equity-settled share-based payments 2,001 5,789 5,801

------------- --------------- ------------

2,759 6,199 7,353

------------- --------------- ------------

TINYBUILD INC.

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

(CONTINUED)

FOR THE SIX MONTH PERIOD ENDED 30 JUNE 2021

12 RELATED PARTY TRANSACTIONS (CONTINUED)

Transactions with other related parties

The wife of the Company's CEO is a member and manager of DevGAMM

LLC and pursuant to an agreement tied to her continued service to

DevGAMM LLC, her membership interest in the company increased from

40% to 51% during the six month period ended 30 June 2021. The

results of DevGamm LLC are included in the consolidation on the

basis of control.

There were no other related party transactions during the period

which require disclosure.

13 SUBSEQUENT EVENTS

In August tinyBuild announced the acquihire of Animal, for a

total consideration up to a max of $10.2 million, split

approximately 30%-70% between cash and newly issued tinyBuild

shares, including upfront and deferred payments over the next three

financial years.

In September we announced the acquihire of Bad Pixel, the

development studio behind the very popular open world game

Deadside, for a total consideration of up to $17.1m, including

upfront and deferred payments over the next three financial

years.

tinyBuild secured a new credit facility of $25m (expiry

September 2022) on favorable terms with Bank of America. The new

credit facility has been designed to expand tinyBuild's financial

capacity in the event of larger M&A deals, while having minimal

impact on P&L and cash flow if not used.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKQBDBBKBKCD

(END) Dow Jones Newswires

September 15, 2021 02:00 ET (06:00 GMT)

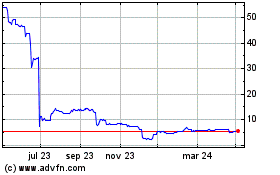

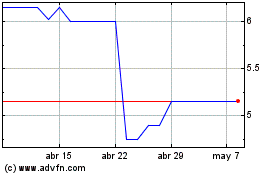

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tinybuild (LSE:TBLD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024