General Mills to Buy Pet-Food Maker Blue Buffalo For About $8 Billion -- 2nd Update

23 Febrero 2018 - 8:07AM

Noticias Dow Jones

By Cara Lombardo

General Mills Inc., best known for Cheerios breakfast cereal and

Yoplait yogurt, is paying $8 billion to get back into pet food.

The Minneapolis-based food giant, which has only sold human food

for many years, said Friday it plans to buy Blue Buffalo Pet

Products Inc. as it looks for a piece of the fast-growing natural

pet food market.

Under terms of the agreement, General Mills would pay $40 a

share for Blue Buffalo, a 17.2% premium over its Thursday closing

price of $34.12.

Shares in Blue Buffalo jumped 17% premarket Friday, while

General Mills shares dropped 4%.

Blue Buffalo makes natural cat and dog food and treats under the

"Blue" label, and in its last fiscal year had $1.3 billion in net

sales.

The Blue Buffalo purchase marks the first major deal Jeff

Harmening has struck since taking over as General Mills's chief

executive in June. Mr. Harmening had gained acclaim in previous

roles for spearheading the company's shift toward natural

foods.

Mr. Harmening said in prepared remarks that consumers are

looking for more natural products for their pets, as they are for

themselves. Natural pet food is the fastest-growing piece of the

$30 billion U.S. pet-food market, General Mills said, and accounts

for about 10% of sales volume but about 20% of the revenue.

The deal also comes as General Mills's peers have already

established pet divisions. Earlier this year, Mars Inc. said it

would pay $7.7 billion to buy veterinary and dog day-care company

VCA Inc. J.M. Smucker Co. paid more than $3 billion in 2015 to buy

Milk-Bone owner Big Heart and Nestlé bought the maker of Purina pet

food for more than $10 billion in 2001.

General Mills's offer for Blue Buffalo was "not unexpected,"

Susquehanna analyst Pablo Zuanic said in a research note, and it is

possible other companies could make counteroffers.

With the addition of Blue Buffalo, General Mills would establish

a new pet business segment. It expects to maintain Blue Buffalo's

current Wilton, Conn., headquarters, and Blue Buffalo CEO Billy

Bishop will keep his position.

General Mills produced pet food as far back as the 1930s, when

it sold dog food through feed stores, and in the 1950s it marketed

food for dogs, cats and birds.

General Mills expects the deal to close by the end of its fiscal

year, which is May 27, subject to regulatory approval and other

closing conditions.

The deal has been approved by the boards of General Mills and

Blue Buffalo, and Invus LP and the Bishop family, which together

own more than 50% of Blue Buffalo shares. It doesn't require

additional sign-off from other Blue Buffalo shareholders, General

Mills said.

Blue Buffalo, which has about 1,700 employees, went public in

2015.

Write to Cara Lombardo at cara.lombardo@wsj.com

(END) Dow Jones Newswires

February 23, 2018 08:52 ET (13:52 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

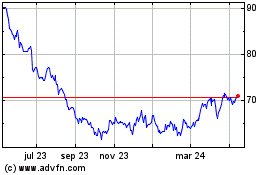

General Mills (NYSE:GIS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

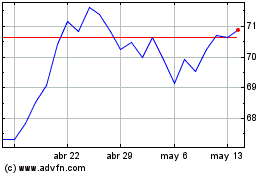

General Mills (NYSE:GIS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024