Canadian Dollar Advances As U.S. Drops Contentious Auto-content Demand

20 Marzo 2018 - 9:08PM

RTTF2

The Canadian dollar advanced against its major counterparts in

the Asian session on Wednesday, following news that the Trump

administration had abandoned contentious demand about auto-content,

clearing key roadblock in NAFTA renegotiation.

The Trump administration has dropped a contentious demand that

all vehicles made in Canada and Mexico for export to the United

States contain at least 50 percent US content, according to a

report by Canada's Globe and Mail.

Earlier, the U.S. had proposed content requirement of at least

50 percent and to raise existing requirement for North American

content in autos from 62.5 percent to 85 percent.

Meanwhile, Asian shares advanced ahead of the Federal Reserve's

monetary policy decision later in the day.

The Fed is widely expected to hike interest rates for the first

time this year by 25 basis points when it concludes its two-day

policy meeting at 2:00 pm ET.

Investors are also likely to keep an eye on the accompanying

statement for clues about the outlook for future rate hikes.

New Fed Chairman Jerome Powell's first press conference as head

of the central bank is also likely to attract considerable

attention.

The loonie climbed to 6-day highs of 1.3011 against the

greenback and 81.83 against the yen and held steady thereafter. The

loonie ended Tuesday's trading at 1.3071 against the greenback and

81.49 against the yen.

The loonie advanced to an 8-day high of 1.5945 against the euro

and near a 2-week high of 1.0015 against the aussie and held steady

thereafter. The loonie finished Tuesday's trading at 1.6001 against

the euro and 1.0042 against the yen.

Looking ahead, U.K. claimant count rate for February, ILO

jobless rate for the three months to January and public sector

finance data for February are due in the European session.

In the New York session, U.S. current account data for the

fourth quarter and existing home sales for February are scheduled

for release.

At 2:00 pm ET, the Fed announces decision on interest rate.

Economists widely expect the Fed to raise benchmark rate by 25

basis points to 1.75 percent from the current 1.50 percent.

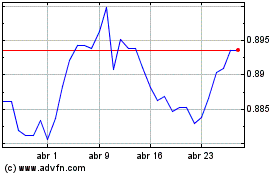

AUD vs CAD (FX:AUDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

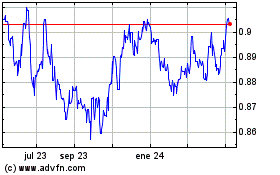

AUD vs CAD (FX:AUDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024