Pound Drops Amid Risk Aversion

23 Marzo 2018 - 2:06AM

RTTF2

The pound declined against its major opponents in the European

session on Friday amid risk aversion, as Trump administration's

announcement to impose tariffs against Chinese imports of about $50

billion and Beijing's action to impose tariffs on U.S. imports

worth $3 billion triggered worries over a global trade war.

GLobal markets were spooked by Trump's annoucement of tariffs of

about $50 billion on imports from China over intellectual-property

violations.

In response, Beijing rolled out tariffs targeting up to $3

billion of U.S. imports, including pork, fresh fruit and wine.

China said that the plan is aimed to "balance losses to Chinese

interests caused by the U.S. tariffs on steel and aluminum

products."

Esclating tensions between the world's two largest economies

intensified fears of a global trade war.

The currency has been trading in a negative territory against

its major rivals in the Asian session, with the exception of the

greenback.

The pound eased back to 147.72 against the yen, from an early

high of 148.56. This may be compared to a 4-day low of 147.67 hit

early in the Asian session. The pound is seen finding support

around the 144.00 level.

Data from the Ministry of Internal Affairs and Communications

showed that Japan's consumer prices rose 1.5 percent on year in

February.

That was in line with expectations and up from 1.4 percent in

January.

Reversing from an early high of 1.4127 versus the dollar, the

pound fell to 1.4085. The next possible support for the pound is

seen around the 1.39 level.

The pound dropped to a 2-day low of 0.8754 against the euro,

reversing from an early high of 0.8721. On the downside, 0.90 is

seen as the next support level for the pound.

On the flip side, the pound held steady against the franc, after

easing from an early high of 1.3394. This may be compared to a

3-day low of 1.3333 set at 2:45 am ET. The pair closed Thursday's

trading at 1.3378.

Looking ahead, Atlanta Fed President Raphael Bostic speaks about

the economic outlook at the Knoxville Economics Forum at 8:10 am

ET.

At 8:30 am ET, the Bank of England member Gertjan Vlieghe speaks

at the Birmingham Chamber of Commerce.

In the New York session, Canada CPI for February and retail

sales for January, as well as U.S. durable goods orders and new

home sales for February are scheduled for release.

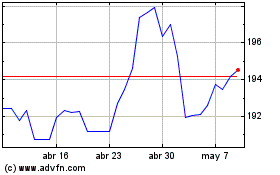

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024