Macron Pushes to Privatize State Assets in Big Philosophical Shift

13 Junio 2018 - 10:19AM

Noticias Dow Jones

By William Horobin

PARIS -- President Emmanuel Macron's pro-business overhaul of

France shifted up a gear Wednesday as the government announced

plans to privatize state assets and pour funds into risky

technology investments, a break with tradition in a country where

the state has wielded power in the boardrooms of large

companies.

The French government said it would change the laws that prevent

the state from selling shares in the airport operator Aéroports de

Paris SA, national lottery operator La Française des Jeux and

energy company Engie SA. Officials say the legal changes will pave

the way for France to start selling stakes next year to pay down

national debt and bolster a state-controlled innovation fund.

"It is vital to redefine the state's role in our economy. Do we

want a state that is content with getting dividends, or a strategic

state that prepares the future?" economy and finance minister Bruno

Le Maire said in a radio interview Wednesday.

The privatizations are Mr. Macron's latest move to shake up the

economy after rewiring labor laws, slashing corporate and wealth

taxes, and overhauling the state's railway operator. The

40-year-old president is betting that his rapid pro-business

overhauls will spur risk-taking, growth and job creation.

But his attempts to upend France's economic policies are meeting

with growing opposition. Rail unions have entered their third month

of on-off strikes in protest against his plans to end the monopoly

of railway operator SNCF and change working conditions. A video

released by his office of Mr. Macron complaining about the huge

sums of money France spends on welfare sparked further ire.

"Government policy can be summed up as bad business for the

country and good business for shareholders," Eric Coquerel, a

lawmaker from the leftist France Unbowed party said in a message on

Twitter. "These privatizations are shameful and contrary to the

interests of the nation."

Mr. Macron is also under pressure to quickly show results after

economic growth slowed sharply at the start of the year.

Unemployment hovers around 9% and France's public debt totaled 97%

of economic output at the end of last year.

The regulatory changes required for privatizations are part of a

broad economic bill to be presented by Mr. Le Maire next week that

will contain provisions to loosen regulation on small businesses

and increase profit-sharing with employees. The bill will also

include measures to incentivize French citizens to buy shares in

companies, a move government spokesman Benjamin Griveaux said would

engender a "People's Capitalism."

Current laws prevent the state from selling any of La Française

des Jeux, reducing its shareholding in ADP Groupe below 50%, or

reducing its voting rights in Engie below one third. The state

currently owns 50.6% of Groupe ADP and 24.1% of Engie's

capital.

The government will use some of the proceeds from selling stakes

to pay down debt, and earmark the rest for a EUR10 billion ($12

billion) fund Mr. Macron is building for innovation. Dividends and

interest from the fund -- which Mr. Macron hopes to eventually pool

with other European countries -- will be invested.

Mr. Le Maire said the state has around EUR15 billion locked up

in Engie and Aeroports de Paris.

"It's a lot of immobilized money," Mr. Le Maire said in an

interview with French daily Les Echos.

Write to William Horobin at William.Horobin@wsj.com

(END) Dow Jones Newswires

June 13, 2018 11:04 ET (15:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

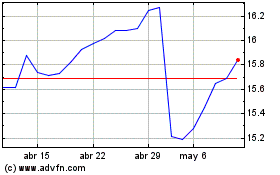

Engie (EU:ENGI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

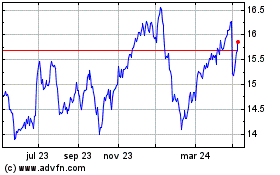

Engie (EU:ENGI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024