Euro Slips As Draghi Says ECB To Be Patient On Timing Of First Rate Hike

19 Junio 2018 - 1:38AM

RTTF2

The euro drifted lower against its major counterparts in the

European session on Tuesday, after the European Central Bank

President Mario Draghi remarked that the bank would adopt a patient

approach in determining the timing of the first-rate rise given

increased uncertainty surrounding the bloc's growth outlook.

Speaking at the central bank forum in Sintra, Portugal, Draghi

said that ECB would remain patient in determining the timing of the

first rate rise and take a gradual approach in adjusting policy

thereafter.

He said that monetary policy in the euro area will remain

patient, persistent and prudent.

The key ECB interest rates would remain at their present levels

at least through the summer of 2019, and in any case for as long as

necessary to ensure that the evolution of inflation remains aligned

with the bank's current expectations of a sustained adjustment

path, he reiterated.

Draghi observed that the economy continues on a growth path and

inflation is gradually returning towards objective. But uncertainty

permeates the economic outlook.

Draghi added that the bank stands ready to adjust all

instruments as appropriate to ensure that inflation continues to

move towards the target.

Caution prevailed as a trade dispute between China and the U.S.

intensified and oil turned volatile ahead of a critical meeting of

crude-producing nations that will determine whether it's time to

ramp up production.

Traders eyed looming trade wars after U.S. President Donald

Trump threatened new tariffs on $200 billion of Chinese goods and

Beijing vowed to "immediately" retaliate.

Data from the European Central Bank showed that the euro area

current account surplus declined to a 10-month low in April.

The current account surplus fell to EUR 28.4 billion in April

from EUR 32.8 billion in March. This was the lowest surplus since

June 2017.

Separate data showed that Eurozone construction output increased

in April, after falling in the previous three months.

Construction output advanced 1.8 percent month-over-month in

April, reversing a revised 0.2 percent drop in March.

The currency showed mixed trading against its major counterparts

in the Asian session. While it fell against the yen and the franc,

it held steady against the pound. Against the greenback, it

rose.

The euro eased to 0.8758 against the pound, from a 5-day high of

0.8781 seen at 7:30 pm ET. Next key support for the euro is likely

seen around the 0.86 level.

The single currency slipped to near a 3-week low of 1.1542

against the greenback, following a 5-day high of 1.1645 touched at

11:15 pm ET. The euro is seen finding support around the 1.13

region.

Extending early fall, the euro shed 1.4 percent to near a 3-week

low of 126.65 against the Japanese yen. This may be compared to a

5-day high of 128.51 hit at 6:15 pm ET. The next likely support for

the euro is seen around the 125.00 level.

Pulling away from a high of 1.1571 hit at 6:00 pm ET, the euro

weakened to near a 3-week low of 1.1492 against the Swiss franc. On

the downside, 1.13 is possibly seen as the next support level for

the euro.

Report from the State Secretariat for Economic Affairs showed

that Swiss economy is forecast to expand as previously estimated

this year as strong global economy and favorable exchange rate

developments boost demand for domestic products.

The gross domestic product will grow 2.4 percent this year, in

line with the estimate published in March. Likewise, the projection

for 2019 was retained at 2 percent.

The 19-nation currency edged down to 1.5268 against the loonie,

reversing from a 1-1/2-month high of 1.5383 hit at 11:15 pm ET. The

euro is poised to challenge support around the 1.51 level.

The euro retreated to 1.6703 against the kiwi and 1.5639 against

the aussie, coming off from its early 5-day high of 1.6830 and near

a 5-week high of 1.5752, respectively. Continuation of the euro's

downtrend may see it challenging support around 1.65 against the

kiwi and 1.55 against the aussie.

Looking ahead, U.S. housing starts and building permits for May

are scheduled for release in the New York session.

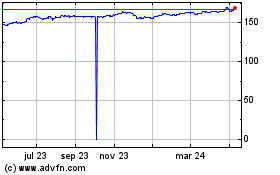

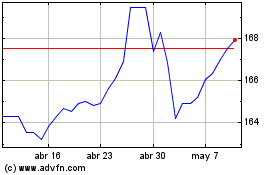

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024