China's Manufacturing Sector Growth Slows Marginally In June

01 Julio 2018 - 9:52PM

RTTF2

China's manufacturing sector continued to expand in June but the

pace of growth slowed from May, survey data from IHS Markit showed

Monday.

The factory Purchasing Managers' Index fell marginally to 51.0

in June from 51.1 in May. The score was forecast to remain

unchanged at 51.1.

The health of the sector has strengthened in each of the past 13

months, with the latest improvement broadly in line with the

historical trend, Markit noted.

The latest PMI readings suggest that the economy lost some

momentum last month, Julian Evans-Pritchard, an economist at

Capital Economics, said. With credit growth still cooling and US

tariffs imminent, further weakness ahead is expected.

Survey data signaled a further increase in Chinese manufacturing

production, with the rate of growth edging up to a four-month high.

Nonetheless, the pace of expansion remained moderate overall.

Supporting the latest upturn in production was a sustained rise

in new business. As was the case for output, the rate of growth was

moderate and similar to those seen in the prior two months.

There was further reduction in workforce numbers in June. Lower

headcounts were due to retirements, company downsizing policies and

insufficient workloads.

On the price front, data showed that the rate of input price

inflation picked up to the sharpest in five months. As a result,

manufacturers raised their prices charged, and at the steepest rate

since last September.

Finally, goods producers in China remained optimistic that

production levels would rise over the next year. However, the level

of positive sentiment was the lowest registered for six months,

amid concerns of rising costs and stricter environmental

policies.

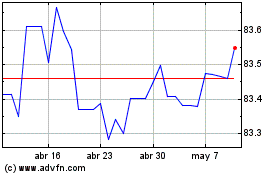

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Mar 2024 a Abr 2024

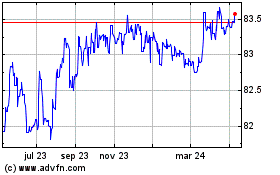

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Abr 2023 a Abr 2024