Euro Higher After Eurozone Inflation Hits 5-1/2-year High

31 Julio 2018 - 1:35AM

RTTF2

The euro was higher against its most major counterparts in the

European session on Tuesday, following a data showing an

acceleration in the euro area inflation in July to its highest

since December 2012.

Preliminary data from Eurostat showed that the harmonized index

of consumer prices rose 2.1 percent year-on-year in July, after

climbing 2 percent in June. Economists had expected the rate to

remain unchanged.

Core inflation, excluding energy, food, alcohol and tobacco,

accelerated to 1.1 percent in July from 0.9 percent in June.

Economists had expected an increase to 1 percent.

The core figure was 1.1 percent in May.

Meanwhile, separate data showed that the euro area economy grew

at a slower pace in the second quarter.

Gross domestic product grew 0.3 percent from the first quarter,

when the economy expanded 0.4 percent. A similar slower growth was

last seen in the second quarter of 2016.

European shares were mixed as investors digested the latest

batch of earnings and mixed economic reports.

The Federal Reserve's monetary policy announcement is due on

Wednesday, with traders likely to keep a close eye on the

accompanying statement for clues about the outlook for rates.

The Bank of England is widely expected to increase rates by a

quarter point when it concludes its policy meeting on Thursday.

The currency traded mixed against its major counterparts in the

Asian session. While it held steady against the greenback and the

pound, it fell against the franc. Against the yen, it rose.

The single currency hovered at a 5-day high of 1.1731 against

the greenback, compared to 1.1705 hit late New York Monday. If the

euro rises further, 1.19 is likely seen as its next resistance

level.

The 19-nation currency appreciated to 130.85 against the

Japanese yen, its strongest since July 20. The euro is seen finding

resistance around the 132.00 mark.

The Bank of Japan retained its massive monetary stimulus and

announced its plan to bring flexibility in bond operations.

The bank said it intends to maintain the current extremely low

levels of short and long-term interest rates for an extended period

of time.

Having fallen to near a 4-week low of 1.1561 against the Swiss

franc at 9:15 pm ET, the euro reversed direction and climbed to

1.1589. On the upside, 1.18 is possibly seen as the next resistance

level for the euro.

The euro appreciated to a weekly high of 1.7209 against the

kiwi, from a low of 1.7137 hit at 8:30 pm ET. The next possible

resistance for the euro is seen around the 1.73 level.

The euro bounced off to 1.5806 against the aussie, from a low of

1.5758 seen at 1:45 am ET. The euro is poised to locate resistance

around the 1.60 level.

Data from the Australian Bureau of Statistics showed that

Australia's building approvals increased at a faster-than-expected

pace in June, after falling in the previous two months.

The seasonally-adjusted estimate for total dwellings approvals

rose notably by 6.4 percent month-over-month in June, reversing a

2.5 percent fall in May.

Meanwhile, the euro held steady against the loonie, after rising

to a 5-day high of 1.5326 at 10:15 pm ET. At Monday's close, the

pair was worth 1.5258.

The euro eased back to 0.8910 against the pound, from an 8-day

high of 0.8928 touched at 2:45 am ET. The next likely support for

the euro is seen around the 0.88 level.

Survey from GfK showed that the U.K. consumer confidence

weakened further in July, with an index score of -10.

That missed forecasts for a reading of -9, which would have been

unchanged from the June reading.

Looking ahead, Canada GDP data for May and industrial product

price index for June, U.S. personal income and spending data for

the same month, S&P/Case-Shiller home price index for May and

consumer confidence for July are scheduled for release in the New

York session.

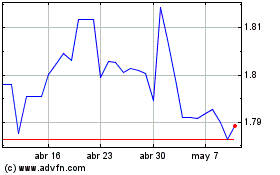

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024