Australian Dollar Slides On Trade Fears

06 Septiembre 2018 - 10:31PM

RTTF2

The Australian dollar weakened against its major counterparts in

the Asian session on Friday, as investors continued to worry over a

possible escalation in the US-China trade war later in the day.

China has already warned of retaliation if the U.S. goes ahead

with the fresh round of tariffs. The threat of auto tariffs is also

back on the agenda as media reports suggest that Japan may be the

next target of U.S. President Donald Trump's trade war.

Trump reportedly told a columnist for The Wall Street Journal

that he was "still bothered by the terms of U.S. trade with

Japan."

Meanwhile, the U.S. Labor Department is scheduled to release its

more closely watched monthly jobs report today, which includes both

public and private sector jobs.

U.S. employment is likely to increase by about 191,000 jobs in

August after an increase of 157,000 jobs in July. The unemployment

rate is expected to dip to 3.8 percent from 3.9 percent.

The latest survey from the Australian Industry Group revealed

that the construction sector in Australia continued to expand in

August, albeit at a slower pace, with a Performance of Construction

Index score of 51.8. That's down from 52.0 in July, although it

remains above the boom-or-bust line of 50 that separates expansion

from contraction.

The aussie slipped to 4-day lows of 1.0872 against the kiwi and

0.9380 against the loonie, from its early highs of 1.0929 and

0.9471, respectively. If the aussie falls further, 1.07 and 0.92

are likely seen as its next support levels against the kiwi and the

loonie, respectively.

The aussie weakened to 0.7137 against the greenback, its weakest

since February 2016. This may be compared to a high of 0.7201 hit

at 6:30 pm ET. The aussie is poised to find support around the 0.70

level.

The aussie fell to near a 2-year low of 78.96 against the yen

and more than a 3-year low of 1.6285 against the euro, reversing

from its early highs of 79.72 and 1.6128, respectively. On the

downside, 77.00 and 1.64 are possibly seen as the next support

levels for the aussie against the yen and the euro,

respectively.

Looking ahead, Eurozone GDP data for the second quarter is due

in the European session.

In the New York session, U.S. and Canadian jobs data and Canada

Ivey PMI, all for August, are scheduled for release.

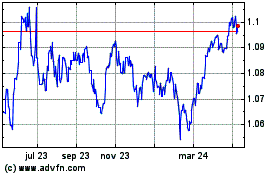

AUD vs NZD (FX:AUDNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

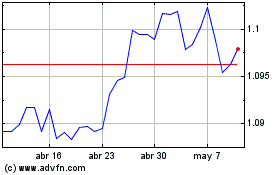

AUD vs NZD (FX:AUDNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024