Euro Falls Amid Risk Aversion On Trade Worries

11 Septiembre 2018 - 5:02AM

RTTF2

The euro slipped against its major counterparts in the European

session on Tuesday amid risk aversion, as investors awaited fresh

developments in U.S.-China trade tensions for direction.

Fears over a trade war escalated following news that China has

asked the World Trade Organization to authorize the imposition of

trade sanctions on the U.S.

Survey data from the Centre for European Economic Research

showed that German economic sentiment improved more-than-expected

in September.

The economic sentiment indicator climbed to -10.6 from -13.7 in

August. Economist had expected a modest improvement in the index to

-13.5.

Data from Eurostat showed that Eurozone employment increased at

a steady pace in the second quarter.

Employment increased 0.4 percent sequentially in the second

quarter, the same rate as seen in the first quarter. The annual

growth also remained unchanged, at 1.5 percent.

The euro rose against its major opponents in the Asian session,

with the exception of the pound.

The euro retreated to 1.1565 against the greenback, from a 4-day

high of 1.1644 hit at 3:15 am ET. If the euro falls further, 1.13

is likely seen as its next support level.

Having advanced to a 5-day high of 129.83 against the yen at

3:15 am ET, the single currency reversed direction and eased to

128.77. The euro is poised to find support around the 126.00

level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's tertiary industry activity recovered in July.

The tertiary industry activity index edged up 0.1 percent on

month in July, in line with expectations, after declining by

revised 0.6 percent in June.

The single currency dropped to 1.1264 against the franc, after

rising to near a 2-week high of 1.1344 at 2:45 am ET. On the

downside, 1.08 is possibly seen as the next support level for the

euro.

The euro hit near a 6-week low of 0.8876 against the pound,

reversing from a high of 0.8938 touched at 4:45 am ET. The euro is

seen finding support around the 0.87 mark.

Data from the Office for National Statistics showed that the UK

unemployment rate remained unchanged at the lowest since 1975.

The unemployment rate came in at 4 percent in three months to

July, according to labor force survey. This was the lowest rate

since February 1975.

The euro pared gains to 1.5223 against the loonie, from a 4-day

high of 1.5294 hit at 3:15 am ET. Next key support for the euro is

seen around the 1.51 region.

On the flip side, the euro extended gains to 1.7813 against the

kiwi, marking a 3-year high. Further uptrend may take the euro to a

resistance around the 1.80 level.

Data from Statistics New Zealand showed that New Zealand credit

card spending climbed a seasonally adjusted 1.1 percent on month in

August, following the 0.5 percent gain in July.

Retail credit card spending climbed 1.0 percent on month,

accelerating from 0.7 percent in the previous month.

The euro held steady against the aussie, after having advanced

to a 3-year high of 1.6347 at 3:45 am ET. At yesterday's close, the

pair was worth 1.6293.

Data from the National Australia Bank showed that Australia's

business confidence weakened in August, while business conditions

improved from last month.

The business confidence index fell to +4, the lowest since

August 2016, from +7 in July. Meanwhile, the business conditions

index rose around 2 points to 15 in August.

Looking ahead, U.S. wholesale inventories for July will be out

in the New York session.

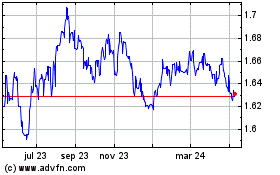

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

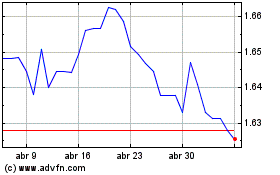

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024