Canadian Dollar Advances Amid Risk Appetite

18 Septiembre 2018 - 2:03AM

RTTF2

The Canadian dollar climbed against its most major rivals in the

European session on Tuesday, as European shares advanced after U.S.

President Donald Trump imposed 10 percent tariffs on an additional

$200 billion worth of Chinese imports, far below the 25 percent the

White House had said it was considering.

The tariffs will be set at 10 percent until the year-end, but

would increase to 25 percent from January 1. It will come into

effect from next week.

China said that the United States has not been "sincere" and it

has no choice but to retaliate. The statement, however, gave no

timeline or details of the proposed action.

The Ministry had previously stated that it would slap levies on

$60 billion worth of U.S. goods.

Oil prices rose after Saudi Arabia remarked that it is satisfied

with Brent prices going above $80 a barrel.

Crude for October delivery rose $0.88 to $69.80 per barrel.

The currency dropped against its major counterparts in the Asian

session, with the exception of the greenback.

The loonie hit a 4-day high of 86.20 against the yen, from a

6-day low of 85.48 hit at 8:00 pm ET. The loonie is seen finding

resistance around the 88.5 level.

The loonie bounced off to 1.3013 against the greenback, from a

6-day low of 1.3065 touched at 7:30 pm ET. On the upside, 1.28 is

possibly seen as the next resistance level for the loonie.

Having dropped to a weekly low of 1.5261 against the euro at

2:15 am ET, the loonie reversed direction and edged up to 1.5199.

The next possible resistance for the loonie is seen around the 1.51

level.

On the flip side, the loonie held steady against the aussie,

after having dropped to near a 2-week low of 0.9404 at 2:00 am ET.

The pair finished Monday's trading at 0.9356.

Data from the Australian Bureau of Statistics showed that

Australia's house prices fell 0.7 percent on quarter in the second

quarter of 2018 - in line with expectations and unchanged from the

three months prior.

On a yearly basis, house prices dipped 0.6 percent versus

expectations for a loss of 0.7 percent after rising 2.0 percent in

Q1.

Looking ahead, Canada manufacturing sales for July and U.S. NAHB

housing market index for September are scheduled for release in the

New York session.

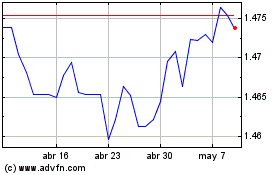

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

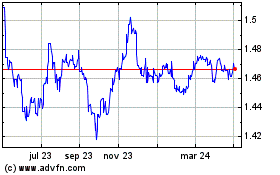

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024