Unilever Details Plan to Consolidate Shares Under Dutch Listing

01 Octubre 2018 - 5:55AM

Noticias Dow Jones

By Adam Clark

Unilever PLC (ULVR.LN) on Monday laid out further details of its

plan to consolidate its dual structure and base itself solely in

the Netherlands.

The consumer-goods company said it will cancel the Dutch

preference shares it acquired earlier this year, and shut down its

depository receipt structure.

Unilever also said that in reference to a proposed 250-day

"time-out period" which companies could use to delay shareholder

calls for strategy changes, it would not invoke the measure now or

in the future.

The Dutch government has proposed the measure and said it could

be used in the face of hostile takeover bids. Unilever rejected a

$143 billion bid from Kraft Heinz Co. (KHC) in 2017.

Unilever said that under the new structure, a 3% stake will be

sufficient to call a shareholder meeting, and a 1% stake will be

enough to table a resolution at meetings.

Unilever's consolidation plan has been publicly opposed by some

U.K. shareholders, after the company said it was unlikely to be

able to maintain its listing on the FTSE 100 index.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

October 01, 2018 06:40 ET (10:40 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

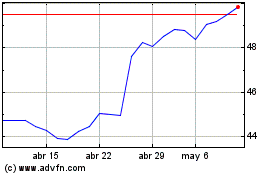

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

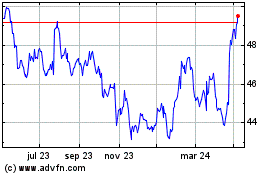

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024