By Mike Cherney

SYDNEY-- Unilever PLC wants its Australian instant-soup brand to

be a top-seller in the lucrative Chinese market. But instead of

launching an advertising campaign in Beijing, it is offering free

samples to Chinese residents here, hoping they'll buy and ship the

product to family, friends and other consumers back home.

The Chinese buyers in Australia are called "daigou," a term

(pronounced "die-go") that is derived from a Mandarin phrase that

means "buying on behalf of." That role has evolved from students or

tourists who sent home the occasional package to people who do it

as a part-time or full-time job, reaping often hefty profit

margins.

Now, companies like Unilever are increasingly marketing their

products directly to daigou, a low-cost channel into the Chinese

market that doesn't require warehouses or distribution networks in

China itself. But even well-known Western brands, many of which are

still absent from China, aren't guaranteed success, and must

convince daigou and their Chinese customers that their products are

high quality and authentic.

"The daigou buyers here have become more like a wholesaler,"

said Julia Illera, a consultant at market-research firm Euromonitor

International in Sydney. They can "make or destroy a brand" in

China, she said.

Daigou sales are difficult to measure because the items can be

bought routinely from grocery stores and pharmacies. But such sales

could exceed 1 billion Australian dollars (about US$720 million)

annually, according to an estimate from Keong Chan, executive

chairman of AuMake International Ltd., which operates stores in

Australia that cater specifically to Chinese tourists and

daigou.

Marketing to daigou could be more effective at first than a

conventional advertising campaign in China. Chinese consumers are

willing to pay more for products they know are shipped directly

from overseas because of concerns over locally made products as a

result of scandals like the 2008 tainted-milk incident. And they

rely on daigou for information on which products are popular

abroad.

After the milk scandal, Australian supermarkets restricted the

amount of infant formula that individual customers could buy

because the demand became so intense. Other popular daigou items

include dietary supplements, cosmetics, Ugg boots and jackets.

The stakes are high. The stakes are high. After an oversupply of

products from infant-formula producer Bellamy's Australia Ltd. in

China forced Chinese e-commerce sites to lower prices, daigou in

Australia struggled to make a profit on Bellamy's products, and

many switched to other brands. That dented the company's margins,

and in December 2016 Bellamy's shares crumbled by nearly 50%, and

the chief executive eventually resigned.

"Bellamy's inadvertently went too broad on distribution, which

led to crowding out of the daigou channel," a Bellamy's spokesman

said, adding that the surrogate buyers are now "back as core to the

business."

Daigou operate all over the globe, but Australia is a focus

given the influx of Chinese tourists and students in recent years.

The country received more than 1.3 million Chinese visitors last

year, up 12% on the previous year, according to Australia's tourism

agency. And about 510,000 mainland-China natives live in Australia,

according to the 2016 census, up 60% from 2011.

Earlier this year, Mr. Chan's company, AuMake, opened a store in

Sydney that it calls a "daigou hub," where an assortment of

products can be bought and shipped out to China from within the

store. It also includes a cafe and a room where Australian

companies, such as cosmetics company Jurlique, offer training

sessions and free samples.

"I find now that we're able to present in Mandarin, that they're

a lot more engaged," said Rachael Lupton, regional business manager

at Jurlique, whose Mandarin-speaking colleague gave a presentation

at AuMake's store about a new product line.

Two audience members were using smartphones to film video likely

intended for online viewing by customers back in China. At one

point, the daigou lined up to take photos of themselves with the

Jurlique employees. Among them was Winnie Qian, 23, a student who

shops mainly for her parents and grandparents back in China but

wants to expand her daigou business.

"I have to make my customers trust me," she said. The photo,

which she planned to post on the popular Chinese messaging app

WeChat, shows that "we're buying the real Jurlique, and we really

understand the product," she said. "We just want to show the

customer that we're here."

Currently, some personal shipments under a particular value

aren't taxed by Chinese authorities, said Matt McDougall, whose

Sydney-based company, DaigouSales, operates an online store for

daigou. A new Chinese e-commerce law, however, goes into effect

next year. Mr. McDougall doesn't expect it will significantly

impact daigou shipments at this point, though the taxes could

rise.

Unilever declined to discuss its daigou strategy. But on a

recent afternoon, about 10 buyers gathered in an office building

north of Sydney to sample Unilever's Australian products, including

the Continental instant-soup brand and Bushells tea. One daigou

said the soup might appeal to younger people who work in offices,

but that older people in China would prefer to make their own soup

from scratch.

Only about 10% of brands are ultimately successful in using

daigou as a step toward more conventional distribution in China,

said Mr. McDougall, whose company organized the sampling session.

New Zealand-made infant-formula brands--including a2, owned by a2

Milk Co., and Aptamil, owned by Danone SA--have been a big hit with

Chinese consumers, while others have failed to sustain traction, he

said.

An item must "look and feel like a premium product," Mr.

McDougall said. "It's all about brand perception. It's all really

word-of-mouth and testimonials."

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

October 03, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

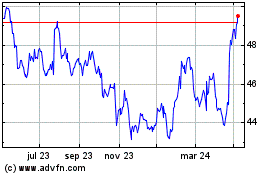

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

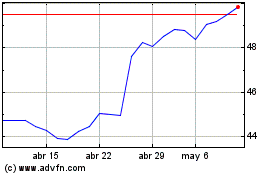

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024