Unilever Drops Plan to Consolidate in Netherlands Amid Shareholder Revolt -- 3rd Update

05 Octubre 2018 - 3:00AM

Noticias Dow Jones

By Adam Clark

LONDON -- Unilever PLC on Friday abandoned its plan to

consolidate its British and Dutch operating companies after facing

mounting opposition from some of its largest investors.

Under the plan, the maker of Hellmann's mayonnaise and Ben &

Jerry's ice cream would have ended its dual-listed structure and

ditched its London headquarters in favor of Rotterdam.

The reversal represents a surprise capitulation for departing

Chief Executive Paul Polman, who made the consolidation effort his

swan song at Unilever. After fending off an unsolicited bid from

American rival Kraft Heinz Co., Mr. Polman and the board embarked

on a strategic review that concluded a single structure would make

it more nimble.

However, in recent weeks a parade of big, institutional

investors publicly said they would oppose the plan at a shareholder

vote later this month, raising questions as to whether Unilever

could muster enough support.

On Friday, Unilever said it would withdraw the proposal after

recognizing it hadn't received support from a significant group of

shareholders.

The company had said that being a single entity would make it

easier to do deals and act quickly. But the move would have cost

the company its place in the U.K.'s FTSE 100, forcing some funds

that have specific mandates to sell.

Critics had argued that the plan's benefits weren't clear, that

there was uncertainty about Dutch dividend taxes and that the move

could have set a bad precedent as the U.K. readies to depart the

European Union.

Major investors, including Aviva, M&G, Legal & General,

Schroders, Lindsell Train, Columbia Threadneedle and Royal London

Asset Management -- who together own around 10% of Unilever -- all

said they planned to vote "no."

The proposal also angered some private shareholders, who stood

to have an outsize role in the vote because of a rule requiring a

"yes" vote from more than 50% of those voting no matter how big

their stake is. That would have given an owner or just one share

the same voice as a major investor.

Unilever had made a big push to win over shareholders in recent

weeks as public opposition mounted.

The company's chairman wrote an op-ed for a major British

newspaper, its finance chief appeared on a high-profile BBC radio

show and the company took out full-page adverts in the mainstream

press.

On Friday, the company said it still thought that simplifying

its structure would be best in the long term and that it would now

consider next steps and engage with shareholders. It also said it

would proceed with its plan to cancel its Dutch preference

shares.

Unilever has long operated as two separate listed entities --

Unilever PLC in the U.K. and Unilever NV in the Netherlands -- with

a group-wide set of managers and directors.

In March, it said it would unify the dual structure that dates

back to the 1929 merger of Lever Bros., an English soap maker, and

Margarine Unie, a Dutch margarine producer.

Unilever picked the Netherlands over the U.K. for its base

because it said the Dutch entity was bigger and that those shares

traded with greater liquidity. It said the move wasn't related to

Brexit.

--Saabira Chaudhuri contributed to this article.

(END) Dow Jones Newswires

October 05, 2018 03:45 ET (07:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

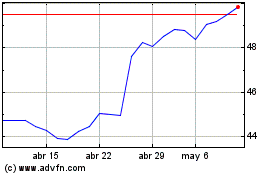

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

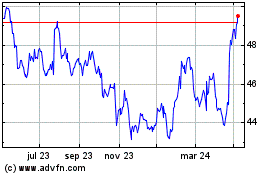

Unilever (EU:UNA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024