Mining ETF Shares Drop Following China Fears

05 Octubre 2018 - 9:57AM

Noticias Dow Jones

Shares in exchange-traded funds PICK and COPX dropped by 1.5%

and 2.3% respectively on Friday morning as wobbles in China meant

negative sentiment knocked the stocks of some of their top

holdings.

--ETF iShares MSCI Global Metals & Mining Producers (PICK)

counts Anglo American PLC (AAL.LN), Glencore PLC (GLEN.LN) and BHP

Billiton PLC (BLT.LN) among its top holdings, while ETF Global X

Copper Miners (COPX) includes companies like Chile's Antofagasta

PLC (ANTO.LN).

--In particular, London-listed shares of Anglo American and BHP

were down 4.1% and 3.5% at 1,671.60 pence and 1,641.80 pence

respectively, while Antofagasta was down 4.7% at 833.40 pence.

--Analysts at Liberum and UBS say that general concerns around

China--including weak housing data and lower-than-expected

purchasing managers' index--are likely to blame for fall in the

large miners' share price, rather than anything stock specific.

--According to issuer BlackRock, PICK has net assets of $403.7

million. COPX, issued by Mirae Asset Global Investments, has net

assets of $79.1 million.

Write to Oliver Griffin at oliver.griffin@dowjones.com;

@OliGGriffin

(END) Dow Jones Newswires

October 05, 2018 10:42 ET (14:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

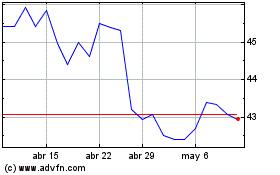

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

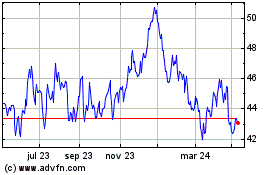

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024