Euro Falls On Rising Italian Bond Yields Amid Budget Worries

08 Octubre 2018 - 1:37AM

RTTF2

The euro fell against its major counterparts in early European

deals on Monday amid rising Italian bond yields, as the European

Commission warned that Italy's budget plan were a "source of

serious concern," sparking fears of a showdown between Italy and

the EC.

Last week, the EC has told Italy that it is concerned about its

budget deficit plans for the next three years as it deviates from

what had been meant in July.

"We call on the Italian authorities to ensure that the budget

will be in compliance with the common fiscal rules and look forward

to seeing the details of the measures," according to a letter sent

by the EC to Italian Economy Minister Tria on Friday.

The benchmark yield on 10-year Italian bonds rose 3.6 percent,

its highest level since early 2014.

Investors also fretted about rising interest rates in the U.S.,

following the release of strong U.S. jobs data for September and

hawkish comments from Federal Reserve chairman Jerome Powell last

week.

News that Chinese authorities has slashed the banks' reserve

ratio requirement to spur lending failed to cheer investor

mood.

In economic releases, figures from Destatis showed that German

industrial output slid 0.3 percent in August from the previous

month, confounding expectations for an increase of 0.5 percent.

Production had decreased 1.3 percent in July.

On a yearly basis, industrial production logged a fall of 0.1

percent, in contrast to the expected growth of 0.1 percent and the

1.5 percent increase seen in July.

Survey data from think tank Sentix showed that Eurozone investor

confidence weakened in October largely due to uncertainties about

the fiscal policy stance in Italy and the automobile industry in

Germany.

The investor sentiment index fell more-than-expected to 11.4

from 12.0 in September. The expected reading was 11.8.

The currency has been trading in a negative territory against

its major counterparts in the Asian session.

The euro fell to 129.93 against the yen, lowest since September

13. If the euro falls further, 128.00 is possibly seen as its next

support level.

The single currency dropped to 4-day lows of 1.1471 against the

greenback and 1.1382 versus the franc, from its early highs of

1.1530 and 1.1441, respectively. On the downside, 1.12 may be seen

as the next support level for the euro against both the greenback

and the franc.

The common currency weakened to 1.6251 against the aussie and

1.7790 against the kiwi, reversing from an early high of 1.6348 and

a 3-year high of 1.7929, respectively. The euro is seen finding

support around 1.60 against the aussie and 1.77 against the

kiwi.

The European currency eased back to 0.8783 against the pound,

from a high of 0.8801 touched at 4:15 am ET. This may be compared

to a 3-1/2-month low of 0.8775 seen at the commencement of today's

trading. The euro is poised to target support around the 0.86

level.

The euro retreated to 1.4916 against the loonie, after having

advanced to a weekly high of 1.4943 at 2:45 am ET. The next

possible support for the euro is seen around the 1.47 level.

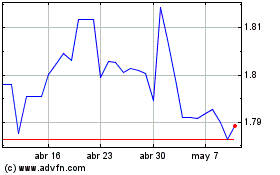

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024