Italy's Eni to Take Control of BP's Libya Assets Despite Insecurity

08 Octubre 2018 - 3:40PM

Noticias Dow Jones

By Benoit Faucon

Eni SpA has agreed to acquire a controlling stake in BP PLC's

assets in Libya and plans to resume oil exploration there, the

Italian energy giant said Monday.

The company will join a handful of others betting on prospects

in the war-torn nation. Some companies are investing in Libya

because "oil prices are high and the political situation is

reasonably stable," said Jason Pack, president of U.S.-based

consultancy Libya Analysis. "That means more oil will come

out."

Insecurity had forced BP to suspend searches for oil and gas as

part of three $900-million projects four years ago.

The country descended into chaos following a 2011 civil war that

toppled dictator Moammar Gadhafi. Last month gunmen carried out a

deadly attack on the offices of Libya's state-run company National

Oil Corp., an incident for which the radical Islamic State later

claimed responsibility.

But in recent months, NOC has also negotiated a return to

operations in fields and ports formerly blocked by militias,

boosting its output by up to roughly 1 million barrels a day. That

has led to renewed appetite for its oil concessions.

Eni said it has signed a letter of intent to acquire a 42.5%

stake in the assets held by the U.K.'s BP PLC, the companies said

in a press release. The share purchase will give the Italian major

operatorship of the projects, where it intends to restart

exploration next year, they said, without providing details on the

terms of the deal.

"This agreement is a clear signal and recognition by the market

of the opportunities Libya has to offer and will only serve to

strengthen our production outlook," NOC Chairman Mustafa Sanalla

said. "This initiative will hopefully drive further inward

investment and facilitate higher production levels."

Last week, NOC said Russia's state-controlled Tatneft had agreed

to return to Libya seven years after suspending operations. The

Libyan company also has held discussions with Gazprom, Russia's

largest government-owned company, to reactivate a giant gas project

in Libya.

The asset transfers reflected oil companies' unequal situations,

said Mr. Pack, who frequently advises firms operating in Libya.

Those in Southern and Eastern Europe are backed by their

governments and have less stringent safety and security

constraints, unlike their peers in the U.K. and the U.S., he

said.

In March, Total SA bought a 16.33% stake of an East Libyan

concession from Marathon Oil Corp. for $450 million, though the

French company remains embroiled in a dispute with NOC over the

purchase.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

October 08, 2018 16:25 ET (20:25 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

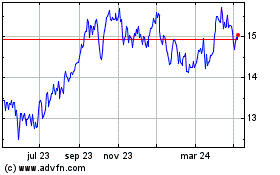

Eni (BIT:ENI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

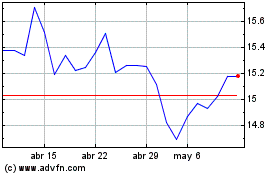

Eni (BIT:ENI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024