Indian Rupee Drops To Historic Low Against U.S. Dollar

09 Octubre 2018 - 3:09AM

RTTF2

The Indian rupee drifted lower against the U.S. dollar in the

evening session on Tuesday, touching an all-time low, as emerging

markets fell after the downgrade of global growth forecast by the

International Monetary Fund, citing trade disruptions.

The Washington-based lender slashed the global growth forecast

to 3.7 percent for this year and next, from the 3.9 percent

predicted in April.

Further undermining the currency was a surge in oil prices,

which raised concerns over widening current account deficit in

India.

Persistent dollar strength also weighed on the currency, as U.S.

Treasury yields remained higher on hopes of further rate hikes in

the U.S.

Indian markets also declined, with the benchmark BSE Sensex

falling 198.84 points or 0.58 percent to 34,275.54, while the

broader Nifty index was down 53.35 points or 0.52 percent at

10,294.70.

The rupee breached the key 74 mark, falling 2.9 percent to a

record low of 74.53 against the U.S. dollar. The rupee had ended

Monday's trading at 72.45 against the greenback.

So far this year, the currency has fallen around 13.7 percent

against the U.S. dollar.

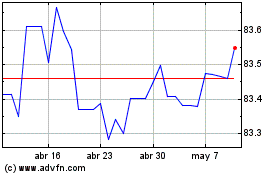

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Mar 2024 a Abr 2024

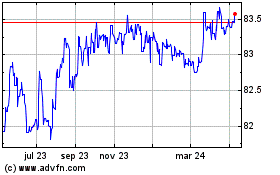

US Dollar vs INR (FX:USDINR)

Gráfica de Divisa

De Abr 2023 a Abr 2024