Australian, NZ Dollars Retreat On Growth Worries

10 Octubre 2018 - 3:23AM

RTTF2

The Australian and NZ dollars eased from their early highs

against the major counterparts in the European session on

Wednesday, as investors fretted about slowing Chinese growth and

watched developments around Brexit and Italy's budget.

Traders largely shrugged off comments from US President Donald

Trump, who cautioned that the central bank was moving too quickly

with the rate hikes.

Trump also repeated a threat to impose tariffs on $267 billion

worth of additional Chinese imports if Beijing retaliates for the

recent levies and other measures.

Meanwhile, Italian bond yields pulled back from four-year high

hit on Tuesday after the country's finance minister tried to stem

growing concerns over Italy's budget plans, saying the government

will do all it can to restore market confidence.

Survey data from Westpac showed that Australia's consumer

confidence rebounded in October.

The Westpac Melbourne Institute Index of Consumer Sentiment rose

1 percent to 101.5 in October.

Data from Statistics New Zealand showed that New Zealand's

credit card spending advanced a seasonally adjusted 1.3 percent on

month in September, accelerating from the 1.1 percent gain in

August.

Retail credit card spending gained 1.1 percent on month -

exceeding expectations for an increase of 0.6 percent and up from

1.0 percent in the previous month.

The aussie retreated to 0.7089 against the greenback and 0.9187

against the loonie, from its early weekly highs of 0.7131 and

0.9222, respectively. The next possible support for the aussie is

seen around 0.69 against the greenback and 0.90 against the

loonie.

The Australian currency eased to 80.25 against the yen and

1.6209 against the euro, coming off from its early 5-day high of

80.60 and a 6-day high of 1.6147, respectively. If the aussie falls

further, it may find support around 78.00 against the yen and 1.64

against the euro.

The kiwi reversed from its early 6-day highs of 0.6497 against

the greenback and 1.7719 against the euro, pulling back to 0.6454

and 1.7798, respectively. The kiwi is seen finding support 0.63

versus the greenback and 1.80 against the euro.

Having advanced to a 5-day high of 73.48 against the yen at

10:15 pm ET, the kiwi reversed direction and eased back to 73.08.

The kiwi is poised to target support around the 72.00 area.

The kiwi fell to 1.0990 against the aussie, after rising to

1.0957 at 7:00 pm ET. On the downside, 1.11 is possibly seen as the

next support level for the kiwi.

Looking ahead, Canada building permits for August, U.S. producer

price index for September and wholesale inventories for August are

set for release in the New York session.

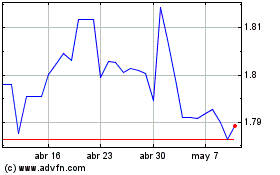

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024