Canadian Dollar Slides On Oil Price Decline

18 Octubre 2018 - 5:02AM

RTTF2

The Canadian dollar drifted lower against its key counterparts

in the European session on Thursday, as oil prices slipped on

demand worries following an overnight data showing a large build in

U.S. crude inventories last week.

Crude for November delivery fell $1.01 to $68.74 per barrel.

Data from the U.S. Energy Information Administration showed that

U.S. crude oil inventories rose by 6.5 million barrels last

week.

That marked the fourth straight weekly build and was almost

triple what analysts had forecast. In the previous week ending Oct.

5 also, there was a large build of 6.0 million barrels.

Gasoline stocks fell by 2.0 million barrels last week, compared

to expectations for a draw of 1.07 million barrels, while

distillate inventories dropped by 0.8 million barrels, compared to

forecasts for a decrease of 1.3 million.

Further undermining the currency was a higher dollar, which was

well-bid after the hawkish Fed minutes that supported expectations

of a faster pace of interest rate hikes in the U.S.

The minutes from the Fed's September meeting showed broad

consensus for further interest rate hikes on the back of robust

economic growth and strong labor market conditions.

The currency has been trading in a negative territory against

its major opponents in the Asian session.

The loonie declined to a 5-week low of 0.9321 against the

aussie, after rising to 0.9251 at 5:00 pm ET. The next possible

support for the loonie is seen around the 0.95 level.

Data from the Australian Bureau of Statistics showed that the

unemployment rate in Australia came in at a seasonally adjusted 5.0

percent in September.

That was beneath expectations for 5.3 percent, which would have

been unchanged.

The loonie reversed from an early high of 1.4969 against the

euro, declining to a 2-day low of 1.5027. If the loonie slides

further, 1.52 is likely seen as its next support level.

Data from Destatis showed that Germany's wholesale prices rose

at a slower pace in September.

Wholesale price inflation slowed to 3.5 percent from 3.8 percent

in August.

The loonie fell back to 1.3053 against the greenback, not far

from a weekly low of 1.3056 hit at 2:45 am ET. This may be compared

to a high of 1.3015 seen at 5:00 pm ET. The loonie is seen finding

support around the 1.32 level.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits showed a modest decrease in the week

ended October 13th.

The report said initial jobless claims slipped to 210,000, a

decrease of 5,000 from the previous week's revised level of

215,000.

The Canadian currency dropped back to 86.17 against the yen,

from a high of 86.55 touched at 5:00 pm ET. This is short of few

pips from a 2-day low of 86.14 hit at 2:15 am ET. On the downside,

85.00 is possibly seen as the next support for the loonie.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade surplus of 139.6 billion yen in September.

That exceeded expectations for a deficit of 45.1 billion yen

following the 444.6 billion yen shortfall in August.

Looking ahead, U.S. leading index for September is due

shortly.

At 12:15 pm ET, Federal Reserve Governor Randal Quarles speaks

about the economic outlook at the Economic Club of New York

luncheon.

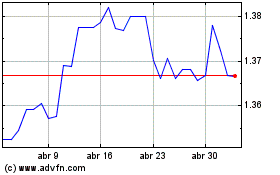

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024