Essar Steel's Committee Of Creditors Approves Arcelormittal's Acquisition Of Essar Steel

26 Octubre 2018 - 2:19AM

Noticias Dow Jones

TIDMMT

Essar Steel's Committee of Creditors approves ArcelorMittal's

acquisition of Essar Steel

26 October 2018 -- ArcelorMittal ('the Company') announces Essar Steel

India Limited's ('ESIL') Committee of Creditors ('CoC') has voted to

approve the Company's acquisition of ESIL. ESIL's Resolution

Professional, on behalf of the CoC, has issued the Company with a Letter

of Intent ('LOI') stating that the Company has been identified as the

'Successful Applicant'.

Further to ArcelorMittal being named the H1 Resolution Applicant (the

preferred bidder) on 19 October 2018, ESIL's CoC has now approved the

Company's Resolution Plan for ESIL, with the LOI identifying it as the

'Successful Resolution Plan'. The Resolution Plan includes an upfront

payment of 42,000 crore rupees (*c. $5.7 billion) towards ESIL's

resolution debt, with a further 8,000 crore rupees (*c. $1.1 billion) of

capital injection into ESIL to support operational improvement, increase

production levels and deliver enhanced levels of profitability.

ESIL is an integrated flat steel producer, and the largest steel company

in western India. Its current level of annualised crude steel production

is c. 6.5 million tonnes. ESIL also has iron ore pellet facilities in

the east of India, with current annual capacity of 14 million tonnes per

annum. ArcelorMittal's Resolution Plan details:

-- The Company's intention to increase ESIL's finished steel shipments to

8.5 million tonnes over the medium-term. This will be achieved by

initially completing ongoing capital expenditure projects and infusing

expertise and best practice to deliver efficiency gains, and then through

the commissioning of additional assets, while simultaneously improving

product quality and grades to realise better margins;

-- A long-term aspiration to increase finished steel shipments to between 12

and 15 million tonnes through the addition of new iron and steelmaking

assets, in order that ESIL can play an active role and fully benefit from

the anticipated growth in the Indian steel industry.

In-line with ESIL's corporate insolvency process, the Company's

Resolution Plan must now be formally accepted by India's National

Company Law Tribunal ('NCLT') before completion, which is expected

before the end of 2018.

After completion, ArcelorMittal will jointly own and operate ESIL in

partnership with Nippon Steel & Sumitomo Metal Corporation ('NSSMC'),

Japan's largest steel producer and the third largest steel producer in

the world, in-line with the joint venture formation agreement signed

with NSSMC on 2 March 2018. ArcelorMittal and NSSMC expect to finance

the joint venture through a combination of partnership equity

(one-third) and debt (two-thirds), and ArcelorMittal anticipates that

its investment in the joint venture will be equity accounted.

*at 73.2 Indian rupees / $1

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a

presence in 60 countries and an industrial footprint in 18 countries.

Guided by a philosophy to produce safe, sustainable steel, we are the

leading supplier of quality steel in the major global steel markets

including automotive, construction, household appliances and packaging,

with world-class research and development and outstanding distribution

networks.

Through our core values of sustainability, quality and leadership, we

operate responsibly with respect to the health, safety and wellbeing of

our employees, contractors and the communities in which we operate.

For us, steel is the fabric of life, as it is at the heart of the modern

world from railways to cars and washing machines. We are actively

researching and producing steel-based technologies and solutions that

make many of the products and components people use in their everyday

lives more energy efficient.

We are one of the world's five largest producers of iron ore and

metallurgical coal. With a geographically diversified portfolio of iron

ore and coal assets, we are strategically positioned to serve our

network of steel plants and the external global market. While our steel

operations are important customers, our supply to the external market is

increasing as we grow.

In 2017, ArcelorMittal had revenues of $68.7 billion and crude steel

production of 93.1 million metric tonnes, while own iron ore production

reached 57.4 million metric tonnes.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock

exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS).

For more information about ArcelorMittal please visit:

http://corporate.arcelormittal.com/

Contact information ArcelorMittal

Investor Relations

Europe +44 20 7543 1156

Americas +1 312 899 3985

Retail +44 20 7543 1156

SRI +44 207543 1156

Bonds/Credit +33 171 921 026

Contact information ArcelorMittal

Corporate Communications

E-mail: mailto:press@arcelormittal.com press@arcelormittal.com

--------------------------------------------------------

Phone: +442076297988

ArcelorMittal Corporate

Communications

Paul Weigh +44 20 3214 2419

India - Brunswick

Khozem Merchant / Azhar +91 9167883290

Khan

(END) Dow Jones Newswires

October 26, 2018 03:04 ET (07:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

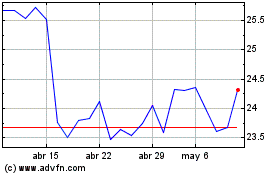

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

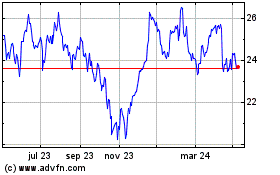

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024