Pioneer of Walkman targets premium market dominated by Bose and

Beats

By Takashi Mochizuki

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 29, 2018).

TOKYO -- When Ichiro Takagi took over Sony Corp.'s audio

business seven years ago, he found the staff took pride in being

the global No. 1 in headphones, in terms of units sold. But he was

appalled at how many were $10 headphones sold for minimal profit at

grocery stores.

"What's the point of that? Where's our brand image?" Mr. Takagi

recalls telling employees.

Fast forward to this fall and the international electronics show

in Berlin, where Mr. Takagi was showing off the latest version of

his flagship product, a $350 pair of noise-canceling wireless

headphones.

The premium-price headphone market has been largely dominated by

Bose, the industry pioneer popular with frequent fliers, and Beats,

the fashion-savvy brand acquired by Apple Inc. for $3 billion in

2014. All share the challenge of wooing listeners who already get

free earbuds with their smartphones.

Sony said in May it has 11% of the headphone market in terms of

revenue, the third-largest slice. It didn't name the top two

companies.

The audio business -- where Sony has been a player since the

1950s -- is a prime example of how it got back to profitability in

recent years, even in a traditional hardware business that once

looked like a lost cause. For the year that ended in March, sales

for the audio unit rose for the first time in 20 years after having

fallen some 80% from the peak.

More important for Chief Executive Kenichiro Yoshida, the

home-electronics division, including audio and televisions (another

former money loser), posted operating profit of nearly $800 million

for the year, helping Sony achieve record overall profit. Mr.

Yoshida is hoping roughly to match that record in the current

fiscal year: Quarterly earnings coming Tuesday will give a progress

report.

The rise of Spotify Technology SA and other music services has

been good for headphone makers, increasing the time consumers spend

listening on the go. Streaming companies such as Spotify and

France-based Deezer offer high-resolution services that have

expanded the market for higher-quality headphones costing hundreds

or even thousands of dollars.

Recent product releases by Sony include a $280 pair of

earphones; an $8,500 portable music player targeted at audiophiles

goes on sale in December, with a gold-plated volume controller and

a battery system designed to reduce noise.

In the first generation of portable MP3 music players, "the

quality of the music sources was poor," Sony audio executive

Yoshinori Matsumoto said. "We couldn't push high-end listening

devices because they would highlight the coarseness." Now, better

technology has "made high-quality music more accessible both to

customers and creators," he said.

Audio has paralleled Sony's highs and lows through its 72-year

history. The Walkman in 1979 set off a revolution in portable

electronic devices, with Sony in the lead. But in the 2000s, Sony

let Apple and the iPod seize the dominant position.

By 2011, the Tokyo company was nearly giving up on its old

hardware products. "The attitude of management at that time was

like, 'If you're so-so, that's fine,' " Mr. Takagi, the audio-unit

chief, said.

That changed under then Chief Executive Kazuo Hirai, who took

over in 2012, and Mr. Yoshida, who was chief financial officer

under Mr. Hirai and became CEO this year. They pushed the audio

team to drop cheap products and focus on a few high-end models.

Mr. Takagi says the new management scrapped an organizational

chart that had separate groups of engineers focusing on

subcategories like car audio. "I told them to look around the whole

industry to come up with products that consumers are willing to pay

extra for," he said.

Sony says the $350 headphones can detect the owner's facial

shape, hairstyle and presence of glasses, as well as pressure

changes in an airplane, all to optimize the noise-canceling

feature.

"Our latest model is distinctly the best in terms of

noise-canceling technology," says Mr. Takagi, who is in the habit

of visiting electronics stores to eavesdrop on what customers are

saying to salespeople. "It's obvious if you ask your ears."

Another Sony rival, especially for younger customers, is Beats.

Mr. Matsumoto says the competition has led Sony to stress fashion

as well as sound quality. "In China, headphones have become part of

the outfit for young people, and they have to have a style that

people want to wear all the time, even when they are not

listening," he said.

With the changes in Sony's audio strategy, more young engineers

are raising their hands to join the department. "Sony was becoming

exciting when I was looking for a job," says Mayo Tsuji, a

24-year-old Walkman planner who joined Sony two years ago.

Mr. Takagi said there is more innovation to come, such as

headsets that stream music from the internet on their own without

having to be hooked up to a smartphone.

"Audio will remain a profitable business so long as we keep

listening to music," Mr. Takagi said. "If we remain as a strong and

respected player in the industry, than the whole company will be

too because audio is the origin of Sony."

Write to Takashi Mochizuki at takashi.mochizuki@wsj.com

(END) Dow Jones Newswires

October 29, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

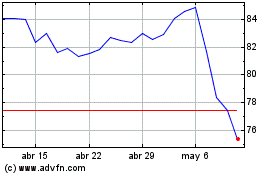

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

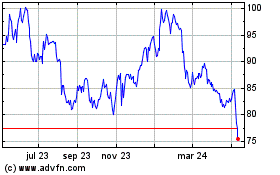

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024