BHP Billiton Plans US$10.4 Billion Capital Return

31 Octubre 2018 - 4:11PM

Noticias Dow Jones

By David Winning

SYDNEY--BHP Billiton Ltd. (BHP.AU), the world's biggest mining

company by market value, said it would return US$10.4 billion to

shareholders via a stock buyback and special dividend after

completing the sale of its U.S. onshore oil and natural gas

assets.

BHP, which has faced pressure from activist investor Elliott

Management Corp. to improve returns, said the move would bring the

total cash handed back to shareholders over the past two years to

US$21 billion.

The Melbourne-based company said it planned to buy back shares

worth US$5.2 billion and pay a special dividend to shareholders

totaling US$5.2 billion. It said the capital-management program

would begin immediately.

On Wednesday, BHP completed the sale of the bulk of its U.S. oil

and gas unit to BP PLC (BP), ending a costly saga that left the

company roughly US$20 billion worse off.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

October 31, 2018 17:56 ET (21:56 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

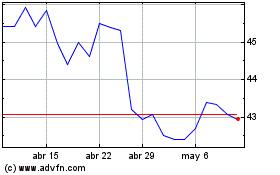

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

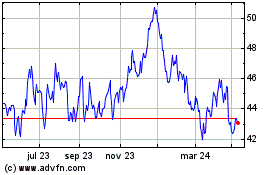

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024