TIDMMT

Luxembourg, November 1, 2018 - ArcelorMittal (referred to as

"ArcelorMittal" or the "Company") (MT (New York, Amsterdam, Paris,

Luxembourg), MTS (Madrid)), the world's leading integrated steel and

mining company, today announced results(1) for the three-month and

nine-month periods ended September 30, 2018.

Highlights:

-- Health and safety: LTIF rate of 0.62x in 3Q 2018 as compared to 0.71x in

2Q 2018 and 0.67x in 3Q 2017

-- Operating income in 3Q 2018 decreased to $1.6 billion (which includes

$0.5 billion impairment primarily related to the Ilva remedy assets sale)

as compared to $2.4 billion in 2Q 2018, 26.9% higher YoY

-- EBITDA of $2.7 billion in 3Q 2018, 11.2% lower as compared to $3.1

billion in 2Q 2018, primarily reflecting lower steel shipments (-5.5%)

and the negative impact from hyperinflation accounting in Argentina ($0.1

billion); 3Q 2018 EBITDA up 41.8% YoY

-- Net income of $0.9 billion in 3Q 2018 as compared to $1.9 billion in 2Q

2018 and $1.2 billion in 3Q 2017

-- Crude steel production of 23.3Mt in 3Q 2018, up 0.5% vs. 2Q 2018 and down

1.4% vs. 3Q 2017

-- Steel shipments of 20.5Mt in 3Q 2018, down 5.5% vs. 2Q 2018 and down 5.4%

vs. 3Q 2017

-- 3Q 2018 iron ore shipments of 14.2Mt (-5.6% YoY), of which 8.5Mt shipped

at market prices (-6.1% YoY)

-- Gross debt of $13.0 billion as of September 30, 2018. Net debt as of

September 30, 2018 stable at $10.5 billion as compared to June 30, 2018

despite further working capital investment of $1.7 billion; net debt is

$1.5 billion lower when compared to net debt as of September 30, 2017

Financial highlights (on the basis of IFRS(1) ):

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 18,522 19,998 17,639 57,706 50,969

Operating income 1,567 2,361 1,234 5,497 4,200

Net income attributable

to equity holders of the

parent 899 1,865 1,205 3,956 3,529

Basic earnings per share

(US$)(2) 0.89 1.84 1.18 3.89 3.46

Operating income/ tonne

(US$/t) 76 109 57 86 65

EBITDA 2,729 3,073 1,924 8,314 6,267

EBITDA/ tonne (US$/t) 133 141 89 131 98

Steel-only EBITDA/ tonne

(US$/t) 119 127 73 116 80

Crude steel production

(Mt) 23.3 23.2 23.6 69.8 70.4

Steel shipments (Mt) 20.5 21.8 21.7 63.6 64.2

Own iron ore production

(Mt) 14.5 14.5 14.2 43.5 42.9

Iron ore shipped at market

price (Mt) 8.5 10.0 9.1 27.7 27.2

--------------------------- ------ ------ ------ ------ ------

Commenting, Mr. Lakshmi N. Mittal, ArcelorMittal Chairman and CEO, said:

"As anticipated market conditions in the third quarter remained

favourable, resulting in significantly improved EBITDA for the first

nine months compared with 2017. We continue to see robust real demand

and healthy utilization rates across all steel segments.

"We continue to make good progress with the implementation of our Action

2020 plan, which will improve the performance of our existing business

and targets further growth in higher added value products. We are also

expanding our business through the execution of a targeted and

disciplined strategy to create long-term value. Within 6 months of

taking ownership of Votorantim we have captured a significant amount of

synergies, and have strengthened our long steel business in Brazil. We

are confident we will be similarly successful in integrating and

delivering rapid improvement at Ilva, Europe's single largest integrated

steel-making facility, which completed today. And in India, we have

recently been named the successful bidder for Essar Steel which provides

a unique opportunity to establish a meaningful production presence in

the world's fastest growing steel-market.

"The progress the industry and our Company has made is significant but

we remain cognizant of the challenges, including continued global

overcapacity, and we remain concerned with the high level of imports in

various markets. We continue to prioritize net debt reduction and a

strong balance sheet to ensure we can prosper in all market conditions."

Sustainable development and safety performance

Health and safety - Own personnel and contractors lost time injury

frequency rate

Health and safety performance, based on own personnel figures and

contractors lost time injury frequency (LTIF) rate was 0.62x in the

third quarter of 2018 ("3Q 2018") as compared to 0.71x for the second

quarter of 2018 ("2Q 2018") and 0.67x for the third quarter of 2017 ("3Q

2017").

Health and safety performance improved to 0.66x in the first nine months

of 2018 ("9M 2018") as compared to 0.74x for the first nine months of

2017 ("9M 2017").

The Company's efforts to improve its Health and Safety record remain

focused on both further reducing the rate of severe injuries and

preventing fatalities.

Own personnel and contractors - Frequency rate

Lost time injury frequency

rate 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Mining 0.63 0.62 1.05 0.59 0.75

NAFTA 0.56 0.64 0.57 0.56 0.69

Brazil 0.39 0.35 0.45 0.39 0.42

Europe 0.76 1.02 0.79 0.88 1.05

ACIS 0.61 0.52 0.42 0.63 0.49

Total Steel 0.62 0.72 0.60 0.68 0.74

Total (Steel and Mining) 0.62 0.71 0.67 0.66 0.74

--------------------------- ----- ----- ----- ----- -----

Key sustainable development highlights for 3Q 2018:

-- Our safety video, titled "We choose the safest way", won a gold medal at

The Cannes Corporate Media & TV Awards in France in September 2018. The

innovative film had been made to mark ArcelorMittal's annual Health and

Safety Day in April this year.

https://corporate.arcelormittal.com/news-and-media/multimedia-gallery/video-gallery#we-choose-the-safest-way

https://corporate.arcelormittal.com/news-and-media/multimedia-gallery/video-gallery#we-choose-the-safest-way

-- ArcelorMittal won two Steelie Awards at the Annual Dinner of the World

Steel Association (worldsteel) on October 16, 2018.

-- ArcelorMittal Brazil, won the Steelie Award in the 'Excellence in

Sustainability' category for its water master plan which reduced

the Company's water intake by more than 6,000,000 m3 /year,

despite a 17% increase in production.

-- The Company also won the Steelie in the 'Excellence in Life Cycle

Assessment' category for its Steligence(R) concept. Steligence(R)

goes beyond relying on steel's excellent recycling credentials and

low embedded carbon content to earn a construction project its

sustainability designation. It offers developers, architects,

engineers and contractors a whole new way of thinking about

construction -- life cycle assessment -- to enable them to build a

truly circular economy.

-- The inaugural ResponsibleSteelTM Forum, held in Berlin on October 15,

2018, attracted over 80 delegates. Leading businesses from steel, mining,

automotive and other sectors met with social, environmental, and policy

organisations to debate key issues relating to the responsible sourcing

and production of steel. As a founding member of ResponsibleSteelTM,

ArcelorMittal is proud to be taking the lead in developing the world's

first multi-stakeholder sustainability certification program for the

global steel sector.

Analysis of results for the nine months ended September 30, 2018 versus

results for the nine months ended September 30, 2017

Total steel shipments for 9M 2018 were 63.6 million metric tonnes

representing a decrease of 1.0% as compared to 9M 2017, primarily due to

lower steel shipments in ACIS (-7.8%) offset in part by improvement in

Brazil (+8.0%), NAFTA (+1.1%) and Europe (+0.4%).

Sales for 9M 2018 increased by 13.2% to $57.7 billion as compared with

$51.0 billion for 9M 2017, primarily due to higher average steel selling

prices (+15.3%) offset in part by lower steel shipments (-1.0%).

Depreciation of $2.1 billion for 9M 2018 was higher as compared with

$2.0 billion in 9M 2017. FY 2018 depreciation is expected to be

approximately $2.9 billion (based on current exchange rates).

Impairment charges for 9M 2018 were $595 million primarily related to

the remedy asset sales for the Ilva acquisition and $86 million related

to the agreed remedy package required for the approval of the Votorantim

acquisition(3) . Impairment charges for 9M 2017 were $46 million in

South Africa.

Exceptional charges for 9M 2018 were $146 million related to a provision

taken in 1Q 2018 in respect of a litigation case that was settled in 3Q

2018(4) . Exceptional charges for 9M 2017 were nil.

Operating income for 9M 2018 was higher at $5.5 billion as compared to

$4.2 billion in 9M 2017 driven by improved operating conditions.

Operating results for 9M 2018 and 9M 2017 were impacted by impairment

and exceptional charges as discussed above.

Income from associates, joint ventures and other investments for 9M 2018

was $425 million as compared to $323 million for 9M 2017. Income from

associates, joint ventures and other investments in 9M 2018 increased

primarily on account of improved performance of a Chinese investee and

higher annual dividend income from Erdemir of $87 million as compared to

$45 million in 9M 2017. 9M 2018 includes $132 million impairment of

ArcelorMittal's investment in Macsteel (South Africa) following the

announced sale of its 50% stake in May 2018. Upon closing of the

transaction, the charge is expected to be offset by currency translation

gains. 9M 2017 includes a gain from disposal of ArcelorMittal USA's 21%

stake in the Empire Iron Mining Partnership(5) ($133 million), offset in

part by a loss on dilution of the Company's stake in China Oriental(6)

and the recycling of cumulative foreign exchange translation losses

incurred in connection with the disposal of the 50% stake in Kalagadi(7)

($187 million).

Net interest expense was lower at $475 million for 9M 2018, as compared

to $635 million for 9M 2017, driven by debt repayment and lower cost of

debt. The Company expects full year 2018 net interest expense of

approximately $0.6 billion reflecting the benefits of liability

management exercises completed in 2017 and 2018.

Foreign exchange and other net financing losses were $1.0 billion for 9M

2018 as compared to gains of $0.2 billion for 9M 2017. Foreign exchange

losses for 9M 2018 were $227 million primarily related to the effect of

the depreciation of the U.S. dollar in 1Q 2018 against the euro on the

Company's euro denominated debt(8) as compared to foreign exchange gains

of $463 million in 9M 2017, primarily related to the effect of the

depreciation of the U.S. dollar against the euro on the Company's euro

denominated deferred tax assets and euro denominated debt. 9M 2018

includes non-cash mark-to-market losses related to mandatory convertible

bond call option totalling $0.1 billion as compared to gains of $0.6

billion in 9M 2017. 9M 2018 includes $0.1 billion premium expense on the

early redemption of bonds as compared to $0.4 billion in 9M 2017.

ArcelorMittal recorded an income tax expense of $362 million for 9M 2018

as compared to $551 million for 9M 2017. The current tax expense of $730

million for 9M 2018 as compared to $449 million for 9M 2017 is primarily

driven by the higher results in a number of countries. The deferred tax

benefit of $368 million in 9M 2018 as compared with a deferred tax

expense of $102 million for 9M 2017 is the result of recording in 9M

2018 a deferred tax asset primarily due to the expectation of higher

future profits mainly in Luxembourg, following the share capital

conversion.

ArcelorMittal's net income for 9M 2018 was $4.0 billion, or $3.89 basic

earnings per share, as compared to a net income in 9M 2017 of $3.5

billion, or $3.46 basic earnings per share.

Analysis of results for 3Q 2018 versus 2Q 2018 and 3Q 2017

Total steel shipments in 3Q 2018 were 5.5% lower at 20.5Mt as compared

with 21.8Mt for 2Q 2018 primarily due to lower steel shipments in Europe

(-7.7%), NAFTA (-5.0%) and ACIS (-2.3%) offset in part by an improvement

in Brazil (+9.4%).

Total steel shipments in 3Q 2018 were 5.4% lower as compared with 21.7Mt

for 3Q 2017 primarily due to 11.2% lower steel shipments in ACIS

(primarily in Ukraine and Kazakhstan), Europe (down -4.0% mainly due to

operational issues in France and slower ramp up following blast furnace

reline in Poland) and NAFTA (-2.5%), offset in part by higher shipments

in Brazil (+5.4%).

Sales in 3Q 2018 were $18.5 billion as compared to $20.0 billion for 2Q

2018 and $17.6 billion for 3Q 2017. Sales in 3Q 2018 were 7.4% lower as

compared to 2Q 2018 primarily due to lower steel shipments (-5.5%),

lower average steel selling prices (-0.7%) and lower market-priced iron

ore shipments (-14.4%). Sales in 3Q 2018 were 5.0% higher as compared to

3Q 2017 primarily due to higher average steel selling prices (+12.8%)

offset by lower steel shipments (-5.4%), lower market-priced iron ore

shipments (-6.1%) and lower seaborne iron ore reference prices (-6.2%).

Depreciation for 3Q 2018 was lower at $653 million as compared to $712

million for 2Q 2018 and $690 million in 3Q 2017 primarily due to the

appreciation of the US dollar against the Euro and the reduction of

depreciation due to the reclassification of Ilva remedies recorded as

assets held for sale beginning May 2018.

Impairment charges for 3Q 2018 were $509 million primarily related to

remedy asset sales for the Ilva acquisition. Impairment charges for 2Q

2018 and 3Q 2017 were nil.

Operating income for 3Q 2018 was $1.6 billion as compared to $2.4

billion in 2Q 2018 and $1.2 billion in 3Q 2017. Operating results for 3Q

2018 were impacted by impairment charges as discussed above.

Income from associates, joint ventures and other investments for 3Q 2018

was $183 million as compared to $30 million for 2Q 2018. 2Q 2018 was

negatively impacted by a $132 million impairment of ArcelorMittal's

investment in Macsteel (South Africa) following the announced sale of

its 50% stake in May 2018. Upon closing of the transaction, the charge

is expected to be offset by currency translation gains. Income from

associates, joint ventures and other investments for 3Q 2017 of $117

million includes the recycling of the cumulative foreign exchange

translation losses in connection with the disposal of the 50% stake in

Kalagadi ($187 million) offset by a gain on disposal of ArcelorMittal

USA's 21% stake in the Empire Iron Mining Partnership ($133 million).

Net interest expense in 3Q 2018 was $152 million as compared to $159

million in 2Q 2018 and $205 million in 3Q 2017. Net interest expense was

lower in 3Q 2018 as compared to 3Q 2017, primarily due to debt

repayments and lower cost of debt.

Foreign exchange and other net financing losses in 3Q 2018 were $475

million as compared to losses of $390 million for 2Q 2018 and gains of

$132 million in 3Q 2017. Foreign exchange gain for 3Q 2018 was $9

million as compared to a loss of $309 million in 2Q 2018 and a gain of

$181 million in 3Q 2017(8) . 3Q 2018 includes non-cash mark-to-market

losses of $114 million related to the mandatory convertible bonds call

option as compared to gains of $91 million in 2Q 2018 and $327 million

in 3Q 2017. 3Q 2018 and 3Q 2017 also include premium expenses on the

early redemption of bonds of $0.1 billion and $0.2 billion,

respectively.

ArcelorMittal recorded an income tax expense of $178 million for 3Q 2018

as compared to an income tax benefit of $19 million for 2Q 2018 and an

income tax expense of $71 million in 3Q 2017. The tax benefit of 2Q 2018

is the result of recording a deferred tax asset primarily due to

expectation of higher future profits mainly in Luxembourg, following the

share capital conversion.

ArcelorMittal recorded a net income for 3Q 2018 of $899 million, or

$0.89 basic earnings per share, as compared to a net income for 2Q 2018

of $1.9 billion, or $1.84 basic earnings per share, and a net income for

3Q 2017 of $1.2 billion, or $1.18 basic earnings per share.

Analysis of segment operations

NAFTA

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 5,367 5,356 4,636 15,475 13,701

Operating income 612 660 256 1,580 1,030

Depreciation (132) (131) (125) (395) (381)

EBITDA 744 791 381 1,975 1,411

Crude steel production

(kt) 5,723 5,946 5,904 17,533 17,882

Steel shipments (kt) 5,512 5,803 5,655 16,874 16,684

Average steel selling

price (US$/t) 896 853 741 843 740

------------------------ ----- ----- ----- ------ ------

NAFTA segment crude steel production decreased by 3.8% to 5.7Mt in 3Q

2018 as compared to 5.9Mt in 2Q 2018.

Steel shipments in 3Q 2018 decreased by 5.0% to 5.5Mt as compared to

5.8Mt in 2Q 2018. Shipments were lower primarily due to weak market

conditions in the US.

Sales in 3Q 2018 were stable at $5.4 billion as compared to 2Q 2018,

primarily due to higher average steel selling prices +5.0% (for flat

products +4.3% and long products +5.2%) offset by lower steel shipment

volumes as discussed above.

Operating income in 3Q 2018 of $612 million was lower as compared to

$660 million in 2Q 2018 and higher as compared to $256 million in 3Q

2017.

EBITDA in 3Q 2018 decreased by 6.0% to $744 million as compared to $791

million in 2Q 2018 primarily due to lower steel shipment volumes offset

in part by a positive price-cost effect. EBITDA in 3Q 2018 increased by

95.2% as compared to $381 million in 3Q 2017 primarily due to a

significant positive price-cost impact.

Brazil

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 2,103 2,191 2,059 6,282 5,503

Operating income 374 369 128 958 431

Depreciation (71) (74) (74) (214) (218)

Impairment -- -- -- (86) --

EBITDA 445 443 202 1,258 649

Crude steel production

(kt) 3,158 3,114 2,797 9,073 8,221

Steel shipments (kt) 3,097 2,831 2,940 8,411 7,788

Average steel selling

price (US$/t) 714 728 651 730 660

------------------------ ----- ----- ----- ----- -----

Brazil segment crude steel production increased by 1.4% to 3.2Mt in 3Q

2018 as compared to 3.1Mt in 2Q 2018.

Steel shipments in 3Q 2018 increased by 9.4% to 3.1Mt as compared to

2.8Mt in 2Q 2018, driven by improved domestic demand and higher export

volumes in both flat and long products. 2Q 2018 steel shipments were

adversely impacted by a nationwide truck strike (0.1Mt).

Sales in 3Q 2018 decreased by 4.0% to $2.1 billion as compared to $2.2

billion in 2Q 2018, due to lower average steel selling prices (-2.0%)

and negative impact from hyperinflation accounting in Argentina, offset

in part by higher steel shipments (+9.4%).

Operating income in 3Q 2018 was slightly higher at $374 million as

compared to $369 million in 2Q 2018 and higher than $128 million in 3Q

2017.

EBITDA in 3Q 2018 was stable at $445 million as compared to $443 million

in 2Q 2018 with the benefit of higher shipment volumes offset by the

impact of hyperinflation accounting in Argentina ($0.1 billion) and

forex headwinds. EBITDA in 3Q 2018 was 120.2% higher as compared to $202

million in 3Q 2017 primarily due to a positive price-cost effect driven

by improved market demand.

Europe

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 9,559 10,527 9,196 30,727 26,598

Operating income 100 853 546 1,533 1,834

Depreciation (262) (292) (302) (872) (865)

Impairment (509) -- -- (509) --

Exceptional charges -- -- -- (146) --

EBITDA 871 1,145 848 3,060 2,699

Crude steel production

(kt) 10,841 11,026 11,248 33,113 33,457

Steel shipments (kt) 9,709 10,516 10,116 30,922 30,790

Average steel selling

price (US$/t) 776 800 723 793 690

------------------------ ------ ------ ------ ------ ------

Europe segment crude steel production decreased by 1.7% to 10.8Mt in 3Q

2018 as compared to 11.0Mt in 2Q 2018 primarily impacted by a power

outage in ArcelorMittal Méditerranée (Fos-sur-Mer, France),

and a slower ramp up following a blast furnace repair in Poland.

Steel shipments in 3Q 2018 decreased by 7.7% to 9.7Mt as compared to

10.5Mt in 2Q 2018, primarily on account of a seasonal slowdown and

operational disruptions mentioned above.

Sales in 3Q 2018 were $9.6 billion, 9.2% lower as compared to $10.5

billion in 2Q 2018, with lower steel shipments, as discussed above, and

3.0% lower average steel selling prices (broadly stable in local euro

currency).

Operating income in 3Q 2018 was lower at $100 million as compared to

$853 million in 2Q 2018 and $546 million in 3Q 2017. Operating income in

3Q 2018 was impacted by a $509 million impairment expense primarily

related to remedy asset sales for Ilva acquisition.

EBITDA in 3Q 2018 decreased by 23.9% to $871 million as compared to

$1,145 million in 2Q 2018 primarily due to lower steel shipment volumes

and foreign exchange translation impact. EBITDA in 3Q 2018 improved by

2.7% as compared to 3Q 2017 primarily due to positive price-cost effect

offset in part by lower steel shipments (-4.0%).

ACIS

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 1,989 2,129 1,941 6,198 5,582

Operating income 371 312 159 973 326

Depreciation (76) (85) (80) (234) (232)

Impairment -- -- -- -- (46)

EBITDA 447 397 239 1,207 604

Crude steel production

(kt) 3,560 3,087 3,669 10,047 10,846

Steel shipments (kt) 2,986 3,057 3,362 9,072 9,840

Average steel selling

price (US$/t) 597 621 515 609 505

------------------------ ----- ----- ----- ------ ------

ACIS segment crude steel production in 3Q 2018 increased by 15.3% to

3.6Mt as compared to 3.1Mt in 2Q 2018 primarily due to recovery in

Ukraine following operational issues impacting 2Q 2018 production.

Steel shipments in 3Q 2018 decreased by 2.3% to 3.0Mt as compared to

3.1Mt in 2Q 2018, primarily due to lower steel shipments in Kazakhstan

and South Africa.

Sales in 3Q 2018 decreased by 6.6% to $2.0 billion as compared to $2.1

billion in 2Q 2018 primarily due to lower average steel selling prices

(down 4.0% primarily impacted by the devaluation of the South African

rand) and lower steel shipments (-2.3%).

Operating income in 3Q 2018 was higher at $371 million as compared to

$312 million in 2Q 2018 and $159 million in 3Q 2017.

EBITDA in 3Q 2018 increased by 12.8% to $447 million as compared to $397

million in 2Q 2018 primarily due to a positive price-cost effect. EBITDA

in 3Q 2018 was significantly higher as compared to $239 million in 3Q

2017, primarily due to a positive price-cost effect offset in part by

lower steel shipments (-11.2%).

Mining

(USDm) unless otherwise

shown 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Sales 1,008 1,065 1,029 3,097 3,074

Operating income 179 198 238 619 832

Depreciation (102) (107) (103) (316) (308)

EBITDA 281 305 341 935 1,140

Own iron ore production

(a) (Mt) 14.5 14.5 14.2 43.5 42.9

Iron ore shipped externally

and internally at market

price (b) (Mt) 8.5 10.0 9.1 27.7 27.2

Iron ore shipment - cost

plus basis (Mt) 5.6 4.6 5.9 14.9 16.4

Own coal production (a)

(Mt) 1.5 1.6 1.5 4.6 4.8

Coal shipped externally

and internally at market

price (b) (Mt) 0.7 0.7 0.6 1.8 2.2

Coal shipment - cost plus

basis (Mt) 0.9 0.9 0.9 2.7 2.7

---------------------------- ----- ----- ----- ----- -----

(a) Own iron ore and coal production not including strategic long-term

contracts.

(b) Iron ore and coal shipments of market-priced based materials include

the Company's own mines and share of production at other mines, and

exclude supplies under strategic long-term contracts.

Own iron ore production in 3Q 2018 was stable at 14.5Mt as compared to

2Q 2018, due to lower volumes in Liberia on account of heavy rains

offset by higher production at Ukraine. Own iron ore production in 3Q

2018 increased by 1.6% as compared to 3Q 2017 primarily due to higher

production in Liberia and Ukraine offset in part by lower production in

Kazakhstan and Mexico. Own iron ore production for 9M 2018 increased by

1.4% primarily due to Liberia (which remains on track to produce

approximately 5Mt in 2018), offset in part by lower production in

AMMC(9) (lower yield from a new mix of ore bodies following pit wall

instability issue which first occurred in 4Q 2017).

Market-priced iron ore shipments in 3Q 2018 decreased by 14.4% to 8.5Mt

as compared to 10.0Mt in 2Q 2018, primarily driven by lower

market-priced iron ore shipments in Ukraine primarily due to logistical

constraints, AMMC (lower available inventory following the pit wall

instability issue that first occurred in 4Q 2017) and Liberia

(additional handling/logistic constraints for the new Gangra product

during the wet season). Due to these revised expectations at Liberia and

AMMC, market-priced iron ore shipments are now expected to grow by

approximately 5% in 2018 as compared to 2017 (down from the previous

guidance of 10% year-on-year growth). Market-priced iron ore shipments

in 3Q 2018 decreased by 6.1% as compared to 3Q 2017 driven by lower

shipments in AMMC, Brazil and Mexico offset in part by higher shipments

in Liberia and Ukraine.

Own coal production in 3Q 2018 decreased by 6.2% to 1.5Mt as compared to

2Q 2018 primarily due to lower Princeton (US) mines production. Own coal

production in 3Q 2018 decreased by 0.7% as compared to 3Q 2017 primarily

due to lower production at Princeton offset in part by higher production

at Kazakhstan.

Market-priced coal shipments in 3Q 2018 were stable at 0.7Mt as compared

to 2Q 2018. Market-priced coal shipments in 3Q 2018 increased by 13.4%

as compared to 3Q 2017 primarily due to increased shipments at

Kazakhstan.

Operating income in 3Q 2018 decreased to $179 million as compared to

$198 million in 2Q 2018 and $238 million in 3Q 2017.

EBITDA in 3Q 2018 decreased by 8.1% to $281 million as compared to $305

million in 2Q 2018, primarily due to the impact of lower market-priced

iron ore shipments. EBITDA in 3Q 2018 was lower as compared to $341

million in 3Q 2017, primarily due to the combined effects of lower

market-priced iron ore shipments and lower seaborne iron ore reference

prices (-6.2%) offset in part by higher market-priced coal shipments

(+13.4%).

Liquidity and Capital Resources

For 3Q 2018, net cash provided by operating activities was $634 million

as compared to $1,232 million in 2Q 2018 and $763 million in 3Q 2017.

The lower net cash provided by operating activities during 3Q 2018

reflects lower earnings and includes working capital investment of

$1,713 million (largely reflecting a seasonal inventory build in Europe

and a replenishment of inventory in Ukraine following production losses

incurring in the first half of 2018), as compared to a working capital

investment of $1,232 million in 2Q 2018. The 9M 2018 working capital

investment of $4.8 billion compared to a working capital investment of

$3.5 billion in 9M 2017 also largely reflects the price effect of

improved market conditions experienced during the first nine months of

the year.

Net cash used in investing activities during 3Q 2018 was $601 million as

compared to $556 million during 2Q 2018 and $563 million in 3Q 2017.

Capital expenditures increased to $781 million in 3Q 2018 as compared to

$616 million in 2Q 2018 and higher as compared to $637 million in 3Q

2017. FY 2018 capital expenditure is expected to be $3.7 billion. Cash

provided by other investing activities in 3Q 2018 of $180 million

primarily includes cash received from Enerfos JV and the second

installment of disposal proceeds from ArcelorMittal USA's 21% stake in

the Empire Iron Mining Partnership ($44 million). Cash provided by other

investing activities in 2Q 2018 of $60 million primarily relates to the

release of restricted cash related to the Mandatory Convertible Bond due

to contractual renegotiation. Investing activities in 3Q 2017 primarily

included the first installment of disposal proceeds from ArcelorMittal

USA's 21% stake in the Empire Iron Mining Partnership ($44 million).

Net cash used by financing activities in 3Q 2018 was $597 million as

compared to net cash provided by financing activities of $352 million

and $514 million in 2Q 2018 and 3Q 2017, respectively. In 3Q 2018, $543

million primarily include payments relating to bond repurchases pursuant

to cash tender offers ($0.6 billion). In 2Q 2018, $474 million

primarily includes the proceeds from a $1 billion short-term loan

facility entered into on May 14, 2018 offset by repayment of a EUR400

million ($491 million) bond at maturity on April 9, 2018. In 3Q 2017,

$587 million primarily included borrowings and commercial paper, offset

in part by a $0.5 billion repayment of drawings under the asset-based

revolving credit facility at ArcelorMittal USA.

During 3Q 2018, the Company paid dividends of $37 million to minority

shareholders in ArcelorMittal Mines Canada. During 2Q 2018, the Company

paid dividends of $101 million to ArcelorMittal shareholders. During 3Q

2017, the Company paid dividends of $80 million primarily to minority

shareholders in ArcelorMittal Mines Canada and in Bekaert (Brazil).

As of September 30, 2018, the Company's cash and cash equivalents

amounted to $2.5 billion as compared to $3.1 billion at June 30, 2018

and $2.8 billion at December 31, 2017.

Gross debt decreased to $13.0 billion as of September 30, 2018, as

compared to $13.6 billion at June 30, 2018 and increased as compared to

$12.9 billion in December 31, 2017.

As of September 30, 2018, net debt remained stable at $10.5 billion as

compared to June 30, 2018 despite the $1.7 billion investment in working

capital. Net debt as of December 31, 2017 was $10.1 billion. Net debt as

of September 30, 2018 was $1.5 billion lower as compared to $12.0

billion as of September 30, 2017.

As of September 30, 2018, the Company had liquidity of $8.0 billion,

consisting of cash and cash equivalents of $2.5 billion and $5.5 billion

of available credit lines(10) . The $5.5 billion credit facility

contains a financial covenant not to exceed 4.25x Net debt / EBITDA (as

defined in the facility). As of September 30, 2018, the average debt

maturity was 3.9 years.

Key recent developments

-- Further to ArcelorMittal being named the H1 Resolution Applicant (the

preferred bidder) on October 19, 2018, Essar Steel India Limited's

('ESIL') Committee of Creditors ('CoC') announced on October 26, 2018,

that it had approved the Company's Resolution Plan for ESIL by issuing

the Company with a Letter of Intent ('LOI') stating that the Company had

been identified as the Successful Applicant. The Resolution Plan includes

an upfront payment of 42,000 crore Indian rupees (c. $5.7 billion)12

towards ESIL's resolution debt, with a further 8,000 crore Indian rupees

(c. $1.1 billion)12 of capital injection into ESIL to finance capex in

support of operational improvement, increased production levels and

deliver enhanced levels of profitability. The Company's Resolution Plan

details are as follows:

-- The Company's intention is to increase ESIL's finished steel

shipments to 8.5 million tonnes over the medium-term. This will be

achieved by initially completing ongoing capital expenditure

projects and infusing expertise and best practice to deliver

efficiency gains, and then through the commissioning of additional

assets, while simultaneously improving product quality and grades

to realise better margins;

-- A long-term aspiration is to increase finished steel shipments to

between 12 and 15 million tonnes through the addition of new iron

and steelmaking assets, in order that ESIL can play an active role

and fully benefit from the anticipated growth in the Indian steel

industry.

ESIL is an integrated flat steel producer, and the largest steel company

in western India. Its current level of annualised crude steel production

is c. 6.5 million tonnes. ESIL also has iron ore pellet facilities in

the east of India, with current annual capacity of 14 million tonnes per

annum.

In-line with ESIL's corporate insolvency process, the Company's

Resolution Plan must now be formally accepted by India's National

Company Law Tribunal ('NCLT') before completion, which is expected

before the end of 2018.

After completion, ArcelorMittal will jointly own and operate ESIL in

partnership with Nippon Steel & Sumitomo Metal Corporation ('NSSMC'),

Japan's largest steel producer and the third largest steel producer in

the world, in-line with the joint venture formation agreement signed

with NSSMC on 2 March 2018. ArcelorMittal and NSSMC expect to finance

the joint venture through a combination of partnership equity

(one-third) and debt (two-thirds), and ArcelorMittal anticipates that

its investment in the joint venture will be equity accounted.

-- On October 17, 2018, the Company announced that it had approved a payment

of 7,469 crore rupees (c. $1 billion, subsequently paid) to the financial

creditors of Uttam Galva and KSS Petron to clear overdue debts in order

that the offer it submitted for ESIL on April 2, 2018 would be eligible

and considered by ESIL's CoC.

-- On October 12, 2018, ArcelorMittal announced that it had received a

binding offer from Liberty House Group for the acquisition of

ArcelorMittal Ostrava (Czech Republic), ArcelorMittal Galati (Romania),

ArcelorMittal Skopje (Macedonia) and ArcelorMittal Piombino (Italy). The

four assets are part of a divestment package the Company agreed with the

European Commission ('EC') during its merger control investigation into

the Company's acquisition of Ilva S.p.A ('Ilva'). Transaction closing is

subject to the completion of the Company's acquisition of Ilva (now

completed), and conditional on EC approval and the conclusion of

consultations with local and European Works Councils. Negotiations are

ongoing with buyers regarding the sale of the other assets -

ArcelorMittal Dudelange in Luxembourg, and several finishing lines in

Liege, Belgium - included in the divestment package.

-- On September 6, 2018, ArcelorMittal announced that it had reached a

provisonal labour agreement (now ratified) with Ilva's trade unions. The

agreement represented an important milestone in AM Investco Italy S.r.l

(AM Investco)'s proposed acquisition of Ilva (now completed). The key

terms of the agreement are as follows:

The labour agreement details a solution for every member of Ilva's

existing workforce.

-- ArcelorMittal has committed to initially hire 10,700 workers based on

their existing contractual terms of employment.

-- In addition, between 2023 and 2025 ArcelorMittal has committed to hire

any workers who remain under Ilva's extraordinary administration.

Legal completion of the transaction and formal commencement of AM

Investco's lease and purchase agreement for Ilva took place on November

1, 2018.

-- On September 5, 2018, ArcelorMittal announced the expiration and the

final results of its tender offers to purchase for cash, for a combined

aggregate purchase price (exclusive of accrued Interest) of up to

$750,000,000, its outstanding 7.0% notes due 2039 and 6.750% notes due

2041. ArcelorMittal purchased notes in an amount of $622 million in

connection with such tender offers ($428 million of the notes due 2039

and $194 million of the notes due 2041).

Regulatory filing

-- On August 3, 2018, ArcelorMittal published its half-year report for the

six-month period ended 30 June 2018. The report is available on

http://corporate.arcelormittal.com/

http://corporate.arcelormittal.com/ under Investors > Financial reports >

Half-year reports, and on the electronic database of the Luxembourg Stock

Exchange ( http://www.bourse.lu/ www.bourse.lu/). The report has also

been filed on Form 6-K with the U.S. Securities and Exchange Commission

(SEC) and is available on http://corporate.arcelormittal.com/

http://corporate.arcelormittal.com/ under Investors > Financial reports >

SEC filings.

Outlook and guidance

The following global apparent steel consumption ("ASC") figures reflect

the Company's 2018 estimates, which remain unchanged from those

presented in connection with the half year 2018 results announcement in

August 2018.

Market conditions remain favorable; the demand environment remains

positive (as evidenced by the continued readings from the ArcelorMittal

weighted PMI which signal expansion in demand) and together with the

benefits of structural supply side reform is supporting healthy steel

spreads.

Based on year-to-date growth and the current economic outlook,

ArcelorMittal expects global ASC to grow further in 2018 by between

+2.0% to +3.0%. By region: ASC in US is expected to grow +2.0% to +3.0%

in 2018, driven by demand in machinery and construction. In Europe, the

strength in machinery and construction end markets is expected to

support ASC growth of between +2.0% to +3.0% in 2018. In Brazil, 2018

ASC growth is forecast in the range of +5.5% to +6.5%. In the CIS, ASC

is expected to grow +2.0% to +3.0% in 2018 reflecting strong consumption,

particularly a rebound in auto sales and production in Russia. Overall,

World ex-China ASC is expected to grow by approximately +3.0% to +4.0%

in 2018. In China, overall demand is expected to grow by between +1.0%

to +2.0% in 2018, as real estate demand continues to surprise on the

upside and ongoing robust machinery and automotive demand, offset in

part by a slowdown in infrastructure.

The Company expects that certain cash needs of the business (excluding

working capital investment) will total approximately $5.8 billion in

2018. This includes capital expenditures of $3.7 billion; net interest

expenses of $0.6 billion reflecting the ongoing benefits of liability

management exercises completed in 2017 and 2018 and certain other cash

needs (primarily taxes) to total $1.5 billion (excluding an exceptional

item relating to a one-time litigation expense ($0.1 billion) and

premium expenses on the early redemption of bonds ($0.1 billion)).

Given the current market conditions the Company now expects a working

capital investment of approximately $3.0 billion to $3.5 billion for the

full year 2018, implying a significant release in 4Q 2018.

The Company will continue to invest in opportunities that will enhance

future returns. By investing in these opportunities with focus and

discipline, the cash flow generation potential of the Company is

expected to increase. Deleveraging remains a priority given the

Company's $6 billion net debt target. The Company has resumed dividends

to shareholders in May 2018 and bought-back $0.2 billion of shares in

March 2018. The Company is committed to an increase in shareholder

returns once the Group's net debt target of $6 billion is achieved.

ArcelorMittal Condensed Consolidated Statement of Financial Position(1)

Sep 30, Jun 30, Dec 31,

In millions of U.S. dollars 2018 2018 2017

--------------------------------------- ------- ------- -------

ASSETS

Cash and cash equivalents 2,482 3,100 2,786

Trade accounts receivable and other 4,561 4,839 3,863

Inventories 18,380 17,745 17,986

Prepaid expenses and other current

assets 2,799 2,802 1,931

Assets held for sale(11) 2,587 2,943 179

Total Current Assets 30,809 31,429 26,745

Goodwill and intangible assets 5,329 5,451 5,737

Property, plant and equipment 34,027 34,290 36,971

Investments in associates and joint

ventures 4,863 4,711 5,084

Deferred tax assets 7,487 7,496 7,055

Other assets 3,288 3,587 3,705

Total Assets 85,803 86,964 85,297

LIABILITIES AND SHAREHOLDERS' EQUITY

Short-term debt and current portion

of long-term debt 4,662 4,556 2,785

Trade accounts payable and other 11,797 12,418 13,428

Accrued expenses and other current

liabilities 4,864 4,893 5,147

Liabilities held for sale(11) 722 846 50

Total Current Liabilities 22,045 22,713 21,410

Long-term debt, net of current portion 8,280 8,963 10,143

Deferred tax liabilities 2,483 2,506 2,684

Other long-term liabilities 10,405 10,447 10,205

Total Liabilities 43,213 44,629 44,442

Equity attributable to the equity

holders of the parent 40,590 40,320 38,789

Non-controlling interests 2,000 2,015 2,066

Total Equity 42,590 42,335 40,855

Total Liabilities and Shareholders'

Equity 85,803 86,964 85,297

--------------------------------------- ------- ------- -------

ArcelorMittal Condensed Consolidated Statement of Operations(1)

Nine months

Three months ended ended

In millions of U.S. dollars Sep 30, Jun 30, Sep 30, Sep 30, Sep 30,

unless otherwise shown 2018 2018 2017 2018 2017

Sales 18,522 19,998 17,639 57,706 50,969

Depreciation (B) (653) (712) (690) (2,076) (2,021)

Impairment (B) (509) -- -- (595) (46)

Exceptional charges (B) -- -- -- (146) --

Operating income (A) 1,567 2,361 1,234 5,497 4,200

Operating margin % 8.5% 11.8% 7.0% 9.5% 8.2%

Income from associates,

joint ventures and other

investments 183 30 117 425 323

Net interest expense (152) (159) (205) (475) (635)

Foreign exchange and other

net financing (loss)/

gain (475) (390) 132 (1,039) 209

Income before taxes and

non-controlling interests 1,123 1,842 1,278 4,408 4,097

Current tax expense (206) (240) (116) (730) (449)

Deferred tax benefit /

(expense) 28 259 45 368 (102)

Income tax (expense) /

benefit (178) 19 (71) (362) (551)

Income including non-controlling

interests 945 1,861 1,207 4,046 3,546

Non-controlling interests

(income) / loss (46) 4 (2) (90) (17)

Net income attributable

to equity holders of the

parent 899 1,865 1,205 3,956 3,529

Basic earnings per common

share ($)(2) 0.89 1.84 1.18 3.89 3.46

Diluted earnings per common

share ($)(2) 0.88 1.83 1.18 3.87 3.45

Weighted average common

shares outstanding (in

millions)(2) 1,014 1,013 1,020 1,016 1,020

Diluted weighted average

common shares outstanding

(in millions)(2) 1,019 1,018 1,023 1,021 1,023

OTHER INFORMATION

EBITDA (C = A-B) 2,729 3,073 1,924 8,314 6,267

EBITDA Margin % 14.7% 15.4% 10.9% 14.4% 12.3%

------ ------ ------ ------ ------

Own iron ore production

(Mt) 14.5 14.5 14.2 43.5 42.9

Crude steel production

(Mt) 23.3 23.2 23.6 69.8 70.4

Steel shipments (Mt) 20.5 21.8 21.7 63.6 64.2

--------------------------------- ------ ------ ------ ------ ------

ArcelorMittal Condensed Consolidated Statement of Cash flows(1)

Nine months

Three months ended ended

Sept Sept

Sep 30, Jun 30, Sep 30, 30, 30,

In millions of U.S. dollars 2018 2018 2017 2018 2017

Operating activities:

Income attributable to

equity holders of the

parent 899 1,865 1,205 3,956 3,529

Adjustments to reconcile

net income to net cash

provided by operations:

Non-controlling interests

(loss) / income 46 (4) 2 90 17

Depreciation and impairment 1,162 712 690 2,671 2,067

Exceptional charges(4) -- -- -- 146 --

Income from associates,

joint ventures and other

investments (183) (30) (117) (425) (323)

Deferred tax (benefit)

/ expense (28) (259) (45) (368) 102

Change in working capital (1,713) (1,232) (801) (4,814) (3,530)

Other operating activities

(net) 451 180 (171) 770 (184)

Net cash provided by operating

activities (A) 634 1,232 763 2,026 1,678

Investing activities:

Purchase of property,

plant and equipment and

intangibles (B) (781) (616) (637) (2,149) (1,783)

Other investing activities

(net) 180 60 74 316 (116)

Net cash used in investing

activities (601) (556) (563) (1,833) (1,899)

Financing activities:

Net (payments) / proceeds

relating to payable to

banks and long-term debt (543) 474 587 194 604

Dividends paid (37) (101) (80) (188) (120)

Share buyback -- -- -- (226) --

Other financing activities

(net) (17) (21) 7 (58) (48)

Net cash (used in) / provided

by financing activities (597) 352 514 (278) 436

Net (decrease) / increase

in cash and cash equivalents (564) 1,028 714 (85) 215

Cash and cash equivalents

transferred (to)/from

assets held for sale -- (23) -- (23) 13

Effect of exchange rate

changes on cash (56) (104) 9 (143) 42

Change in cash and cash

equivalents (620) 901 723 (251) 270

Free cash flow (C=A+B) (147) 616 126 (123) (105)

------------------------------- ------ ------ ------ ------ ------

Appendix 1: Product shipments by region

(000'kt) 3Q 18 2Q 18 3Q 17 9M 18 9M 17

Flat 4,885 5,011 4,820 14,707 14,512

Long 774 969 984 2,664 2,658

NAFTA 5,512 5,803 5,655 16,874 16,684

Flat 1,695 1,494 1,766 4,589 4,812

Long 1,415 1,345 1,181 3,855 2,992

Brazil 3,097 2,831 2,940 8,411 7,788

Flat 6,855 7,553 7,098 22,112 21,957

Long 2,798 2,942 2,954 8,701 8,673

Europe 9,709 10,516 10,116 30,922 30,790

CIS 1,879 1,861 2,297 5,606 6,628

Africa 1,102 1,199 1,065 3,468 3,212

ACIS 2,986 3,057 3,362 9,072 9,840

--------- ----- ------ ------ ------ ------

Note: "Others and eliminations" are not presented in the table

Appendix 2a: Capital expenditures

(USDm) 3Q 18 2Q 18 3Q 17 9M 18 9M 17

NAFTA 155 110 95 425 282

Brazil 59 36 79 142 191

Europe 298 226 213 837 713

ACIS 141 117 114 375 262

Mining 116 119 132 342 316

Total 781 616 637 2,149 1,783

------- ----- ----- ----- ----- -----

Note: "Others and eliminations" are not presented in the table

Appendix 2b: Capital expenditure projects

The following tables summarize the Company's principal growth and

optimization projects involving significant capital expenditures.

Completed projects in most recent quarter

Segment Site / unit Project Capacity / details Actual

completion

Europe ArcelorMittal Modernisation Revamp finishing to 2Q 2018

Differdange of finishing achieve full capacity

(Luxembourg) of "Grey rolling of Grey mill at 850kt/y

mill"

Europe Gent & Liège Gent: Upgrade Increase 400kt in 2Q 2018

(Europe Flat HSM and new Ultra High Strength

Automotive UHSS furnace Steel capabilities

Program) Liège:

Annealing line

transformation

------- ----------------- ----------------- ------------------------ -----------

Ongoing projects

Segment Site / unit Project Capacity / details Forecasted

completion

NAFTA Indiana Harbor Indiana Harbor Restoration of 80" 2018(a)

(US) "footprint optimization HSM and upgrades at

project" Indiana Harbor finishing

ACIS ArcelorMittal New LF&CC 2&3 Facilities upgrade 2019

Kryvyi Rih (Ukraine) to switch from ingot

to continuous caster

route. Additional

billets of 290kt over

ingot route through

yield increase

Europe Sosnowiec (Poland) Modernization Upgrade rolling technology 2019

of Wire Rod improving the mix

Mill of HAV products and

increase volume by

90kt

NAFTA Mexico Build new HSM Production capacity 2020(b)

of 2.5Mt/year

NAFTA ArcelorMittal Hot Strip Mill Replace existing three 2020(c)

Dofasco (Canada) Modernization end of life coilers

with two states of

the art coilers and

new runout tables.

NAFTA Burns Harbor New Walking Two new walking beam 2021

(US) Beam Furnaces reheat furnaces bringing

benefits on productivity,

quality and operational

cost

Brazil ArcelorMittal Expansion project Increase hot dipped 2021(d)

Vega Do Sul / cold rolled coil

capacity and construction

of a new 700kt continuous

annealing line (CAL)

and continuous galvanising

line (CGL) combiline

Brazil Juiz de Fora Melt shop expansion Increase in meltshop On hold(e)

capacity by 0.2Mt/year

Brazil Monlevade Sinter plant, Increase in liquid On hold

blast furnace steel capacity by

and melt shop 1.2Mt/year;

Sinter feed capacity

of 2.3Mt/year

Mining Liberia Phase 2 expansion Increase production Under

project capacity to 15Mt/year review(f)

------- --------------------- ------------------------ --------------------------- -----------

a) In support of the Company's Action 2020 program that was launched

at its fourth quarter and full-year 2015 earnings announcement, the

footprint optimization project at ArcelorMittal Indiana Harbor is now

complete, which has resulted in structural changes required to improve

asset and cost optimization. The plan involved idling redundant

operations including the #1 aluminize line, 84" hot strip mill (HSM),

and #5 continuous galvanizing line (CGL) and No.2 steel shop (idled in

2Q 2017) whilst making further planned investments totalling $200

million including a new caster at No.3 steel shop (completed in 4Q 2016),

restoration of the 80" hot strip mill and Indiana Harbor finishing are

ongoing. The full project scope is expected to be completed in 2018.

b) On September 28, 2017, ArcelorMittal announced a major US$1 billion,

three-year investment programme at its Mexican operations, which is

focussed on building ArcelorMittal Mexico's downstream capabilities,

sustaining the competitiveness of its mining operations and modernising

its existing asset base. The programme is designed to enable

ArcelorMittal Mexico to meet the anticipated increased demand

requirements from domestic customers, realise in full ArcelorMittal

Mexico's production capacity of 5.3 million tonnes and significantly

enhance the proportion of higher added-value products in its product mix,

in-line with the Company's Action 2020 plan. The main investment will be

the construction of a new hot strip mill. Construction will take

approximately three years and, upon completion, will enable

ArcelorMittal Mexico to produce c. 2.5 million tonnes of flat rolled

steel, long steel c. 1.8 million tonnes and the remainder made up of

semi-finished slabs. Coils from the new hot strip mill will be supplied

to domestic, non-auto, general industry customers. The project commenced

late 4Q 2017 and is expected to be completed in the second quarter of

2020. The Company expects capital expenditures of approximately $350

million with respect to this programme in 2018.

c) Investment in ArcelorMittal Dofasco (Canada) to modernise the hot

strip mill. The project is to install two new state of the art coilers

and runout tables to replace three end of life coilers. The strip

cooling system will be upgraded and include innovative power cooling

technology to improve product capability. The project is expected to be

completed in 2020.

d) In August 2018, ArcelorMittal announced the resumption of the Vega

Do Sul expansion to provide an additional 700kt of cold-rolled annealed

and galvanised capacity to serve the growing domestic market. The

three-year investment programme to increase rolling capacity with

construction of a new CAL and CGL combiline (and the option to add a ca.

100kt organic coating line to serve construction and appliance segments),

and upon completion, will strengthen ArcelorMittal's position in the

fast growing automotive and industry markets through Advanced High

Strength Steel products. The investments will look to facilitate a wide

range of products and applications whilst further optimizing current

ArcelorMittal Vega facilities to maximize site capacity and its

competitiveness, considering comprehensive digital and automation

technology.

e) Although the Monlevade wire rod expansion project and Juiz de Fora

rebar expansion were completed in 2015, the Juiz de Fora melt shop

project is currently on hold and is expected to be completed upon Brazil

domestic market recovery.

f) ArcelorMittal Liberia has moved ore extraction from its depleting

DSO (direct shipping ore) deposit at Tokadeh to the nearby, lower

impurity DSO Gangra deposit with planned production of 5Mt in 2018. The

Gangra mine, haul road and related existing plant and equipment upgrades

have now been completed. Following a period of exploration cessation

caused by the onset of Ebola, ArcelorMittal Liberia recommenced drilling

for DSO resource extensions in late 2015. During 2016, the operation at

Tokadeh was right-sized to focus on its "natural" Atlantic markets. The

originally planned phase 2 project of 15Mtpa of concentrate sinter fine

ore product was delayed in August 2014 due to the declaration of force

majeure by contractors following the Ebola virus outbreak, and then

reassessed following rapid iron ore price declines over the ensuing

period since.

Now that mining at the Gangra deposit has commenced, ArcelorMittal

Liberia has launched a feasibility study to identify the optimal

concentration solution in a phased approach for utilising the

significant lower grade resources at Tokadeh. The results of the

feasibility study are expected at the end of 2018.

ArcelorMittal remains committed to Liberia where it operates a full

value chain of mine, rail and port and where it has been operating the

mine on a DSO basis since 2011. The Company believes that ArcelorMittal

Liberia presents a strong, competitive source of product ore for the

international market based on continuing DSO mining and subsequent shift

to a high grade, long-term sinter feed concentration phase.

Appendix 3: Debt repayment schedule as of September 30, 2018

(USD billion) 2018 2019 2020 2021 2022 >=2023 Total

Bonds -- 0.9 1.9 1.3 1.5 2.2 7.8

Commercial paper 1.0 0.5 -- -- -- -- 1.5

Other loans 1.6 0.8 0.2 0.4 0.2 0.5 3.7

Total gross debt 2.6 2.2 2.1 1.7 1.7 2.7 13.0

----------------- ---- ---- ---- ---- ---- ------ -----

Appendix 4: Reconciliation of gross debt to net debt

Sep 30, Jun 30, Dec 31,

(USD million) 2018 2018 2017

Gross debt 12,942 13,519 12,928

Gross debt held as part of the liabilities

held for sale 79 82 --

Gross debt (including those held

as part of the liabilities held for

sale) 13,021 13,601 12,928

Less:

Cash and cash equivalents (2,482) (3,100) (2,786)

Cash and cash equivalents held as

part of the assets held for sale (23) (23) --

Net debt (including those held as

part of the assets and the liabilities

held for sale) 10,516 10,478 10,142

------------------------------------------- ------ ------ ------

Appendix 5: Terms and definitions

Unless indicated otherwise, or the context otherwise requires,

references in this earnings release report to the following terms have

the meanings set out next to them below:

Apparent steel consumption: calculated as the sum of production plus

imports minus exports.

Average steel selling prices: calculated as steel sales divided by steel

shipments.

Cash and cash equivalents: represents cash and cash equivalents,

restricted cash and short-term investments.

Capex: represents the purchase of property, plant and equipment and

intangibles.

Crude steel production: steel in the first solid state after melting,

suitable for further processing or for sale.

EBITDA: operating income plus depreciation, impairment expenses and

exceptional income/ (charges).

EBITDA/tonne: calculated as EBITDA divided by total steel shipments.

Exceptional income / (charges): relate to transactions that are

significant, infrequent or unusual and are not representative of the

normal course of business of the period.

Foreign exchange and other net financing (loss) / gain: include foreign

currency exchange impact, bank fees, interest on pensions, impairments

of financial assets, revaluation of derivative instruments and other

charges that cannot be directly linked to operating results.

Free cash flow (FCF): refers to net cash provided by (used in) operating

activities less capex.

Gross debt: long-term debt, plus short-term debt.

Liquidity: cash and cash equivalents plus available credit lines

excluding back-up lines for the commercial paper program.

LTIF: lost time injury frequency rate equals lost time injuries per

1,000,000 worked hours, based on own personnel and contractors.

MT: refers to million metric tonnes

Market-priced tonnes: represent amounts of iron ore and coal from

ArcelorMittal mines that could be sold to third parties on the open

market. Market-priced tonnes that are not sold to third parties are

transferred from the Mining segment to the Company's steel producing

segments and reported at the prevailing market price. Shipments of raw

materials that do not constitute market-priced tonnes are transferred

internally and reported on a cost-plus basis.

Mining segment sales: i) "External sales": mined product sold to third

parties at market price; ii) "Market-priced tonnes": internal sales of

mined product to ArcelorMittal facilities and reported at prevailing

market prices; iii) "Cost-plus tonnes" - internal sales of mined product

to ArcelorMittal facilities on a cost-plus basis. The determinant of

whether internal sales are reported at market price or cost-plus is

whether the raw material could practically be sold to third parties

(i.e. there is a potential market for the product and logistics exist to

access that market).

Net debt: long-term debt, plus short-term debt less cash and cash

equivalents (including those held as part of assets and liabilities held

for sale).

Net debt/EBITDA: refers to Net debt divided by last twelve months EBITDA

calculation.

Net interest expense: includes interest expense less interest income

On-going projects: refer to projects for which construction has begun

(excluding various projects that are under development), even if such

projects have been placed on hold pending improved operating conditions.

Operating results: refers to operating income/(loss).

Operating segments: NAFTA segment includes the Flat, Long and Tubular

operations of USA, Canada and Mexico. The Brazil segment includes the

Flat, Long and Tubular operations of Brazil and its neighboring

countries including Argentina, Costa Rica and Venezuela. The Europe

segment comprises the Flat, Long and Tubular operations of the European

business, as well as Downstream Solutions. The ACIS segment includes the

Flat, Long and Tubular operations of Kazakhstan, Ukraine and South

Africa. Mining segment includes iron ore and coal operations.

Own iron ore production: includes total of all finished production of

fines, concentrate, pellets and lumps and includes share of production

(excludes strategic long-term contracts).

PMI: refers to purchasing managers index (based on ArcelorMittal

estimates)

Seaborne iron ore reference prices: refers to iron ore prices for 62% Fe

CFR China

Shipments: information at segment and group level eliminates

intra-segment shipments (which are primarily between Flat/Long plants

and Tubular plants) and inter-segment shipments respectively. Shipments

of Downstream Solutions are excluded.

Steel-only EBITDA: calculated as Group EBITDA less Mining segment

EBITDA.

Steel-only EBITDA/tonne: calculated as steel-only EBITDA divided by

total steel shipments.

Working capital change (working capital investment / release): trade

accounts receivable plus inventories less trade and other accounts

payable.

YoY: refers to year-on-year.

Footnotes

1. The financial information in this press release has been prepared

consistently with International Financial Reporting Standards ("IFRS") as

issued by the International Accounting Standards Board ("IASB") and as

adopted by the European Union. The interim financial information included

in this announcement has been also prepared in accordance with IFRS

applicable to interim periods, however this announcement does not contain

sufficient information to constitute an interim financial report as

defined in International Accounting Standard 34, "Interim Financial

Reporting". The numbers in this press release have not been audited. The

financial information and certain other information presented in a number

of tables in this press release have been rounded to the nearest whole

number or the nearest decimal. Therefore, the sum of the numbers in a

column may not conform exactly to the total figure given for that column.

In addition, certain percentages presented in the tables in this press

release reflect calculations based upon the underlying information prior

to rounding and, accordingly, may not conform exactly to the percentages

that would be derived if the relevant calculations were based upon the

rounded numbers. This press release also includes certain non-GAAP

financial measures. ArcelorMittal presents EBITDA, and EBITDA/tonne,

which are non-GAAP financial measures and defined in the Condensed

Consolidated Statement of Operations, as additional measures to enhance

the understanding of operating performance. ArcelorMittal believes such

indicators are relevant to describe trends relating to cash generating

activity and provides management and investors with additional

information for comparison of the Company's operating results to the

operating results of other companies. ArcelorMittal also presents net

debt and change in working capital as additional measures to enhance the

understanding of its financial position, changes to its capital structure

and its credit assessment. The Company's guidance as to its working

capital investment (or the change in working capital included in net cash

provided by operating activities) for the full year 2018 is based on the

same accounting policies as those applied in the Company's financial

statements prepared in accordance with IFRS. ArcelorMittal also presents

free cash flow, which is a non-GAAP financial measure defined in the

Condensed Consolidated Statement of Cash flows, because it believes it is

a useful supplemental measure for evaluating the strength of its cash

generating capacity. Non-GAAP financial measures should be read in

conjunction with, and not as an alternative for, ArcelorMittal's

financial information prepared in accordance with IFRS. Such non-GAAP

measures may not be comparable to similarly titled measures applied by

other companies.

2. At the Extraordinary General Meeting held on May 10, 2017, the

shareholders approved a share consolidation based on a ratio 1:3, whereby

every three shares were consolidated into one share (with a change in the

number of shares outstanding and the accounting par value per share).

3. On April 20, 2018, following the approval by the Brazilian antitrust

authority - CADE of the combination of ArcelorMittal Brasil's and

Votorantim's long steel businesses in Brazil subject to the fulfilment of

divestment commitments, ArcelorMittal Brasil agreed to dispose of its two

production sites of Cariacica and Itaúna, as well as some wire

drawing equipment of ArcelorMittal Brasil and ArcelorMittal

Sul-Fluminense. The sale was completed early May 2018 to the Mexican

Group Simec S.A.B. de CV. A second package of some wire drawing equipment

of ArcelorMittal Brasil and ArcelorMittal Sul-Fluminense were sold to the

company Aço Verde do Brasil as part of CADE's conditional approval.

4. In July 2018, as a result of a settlement process, the Company and the

German Federal Cartel Office agreed to a EUR118 million ($146 million)

fine to be paid by ArcelorMittal Commercial Long Deutschland GmbH ending

an investigation that began in the first half of 2016 into antitrust

violations as concerns the ArcelorMittal entities that has been under

investigation. The payment was made in August 2018.

5. On August 7, 2017, ArcelorMittal USA and Cliffs Natural Resources

("Cliffs") agreed that Cliffs would acquire ArcelorMittal USA's 21%

ownership interest in the Empire Iron Mining Partnership for $133 million

plus assumptions of all partnership liabilities. The payment of $133

million will be made in 3 equal installments with the first payment of

$44 million received in August 2017, the second payment received in

August 2018 and the final payments to be received in 2019.

6. On January 27, 2017 China Oriental completed a share placement to restore

the minimum 25% free float as per HKEx listing requirements. Following

the share placement, ArcelorMittal's interest in China Oriental decreased

from 47% to 39%, as a result of which ArcelorMittal recorded a net

dilution loss of $44 million.

7. On August 25, 2017, following a sales agreement signed on October 21,

2016, ArcelorMittal completed the sale of its 50% shareholding in

Kalagadi Manganese (Proprietary) Limited to Kgalagadi Alloys

(Proprietary) Limited for consideration to be paid during the life of the

mine, which is contingent on the financial performance of the mine and

cash flow availability. The investment classified as held for sale as of

December 31, 2016 had a nil carrying amount as it was fully impaired in

2015 but the Company recycled upon disposal accumulated foreign exchange

translation losses of $187 million in income from associates, joint

ventures and other investments.

8. Following the May 16, 2018 approval of the Extraordinary General Meeting

to convert the share capital of the ArcelorMittal parent company from

Euro to US dollar, the Euro denominated tax losses and the related

deferred tax asset (DTA) held by the ArcelorMittal parent company were

translated into US dollars. The Company designated its euro denominated

debt as a hedge of certain euro denominated net investments in foreign

operations. Following this change, periodic revaluations of such external

euro-denominated debt are recorded in other comprehensive income rather

than the statement of operations. The conversion of the euro denominated

DTA was effective as of January 1, 2018, whilst the impacts on euro

denominated debt has been applied prospectively from April 1, 2018. As a

result, the Company's statement of operations no longer has foreign

exchange exposure to euro denominated debt and DTA.

9. ArcelorMittal Mines Canada, otherwise known as ArcelorMittal Mines and

Infrastructure Canada.

10. On December 21, 2016, ArcelorMittal signed an agreement for a $5.5

billion revolving credit facility (the "Facility"). The agreement

incorporates a first tranche of $2.3 billion maturing on December 21,

2019, and a second tranche of $3.2 billion maturing on December 21, 2021.

The Facility may be used for general corporate purposes. As of September

30, 2018, the $5.5 billion revolving credit facility was fully available.

11. Assets and liabilities held for sale, as of September 30, 2018 and June

30, 2018, include the Ilva remedy package assets (as previously disclosed

in the 2Q 2018 earnings release), Macsteel investment (South Africa) and

carrying value of the USA long product facilities at Steelton

("Steelton"). Assets and liabilities held for sale, as of December 31,

2017, include the carrying value of Steelton and Frydek Mistek assets in

Czech Republic (which was sold in 1Q 2018).

12. Converted with the rate of 73.2 Indian rupees / $1

Third quarter 2018 earnings analyst conference call

ArcelorMittal management (including CEO and CFO) will host a conference

call for members of the investment community to discuss the third

quarter period ended September 30, 2018 on: Thursday November 1, 2018 at

10.30am US Eastern time; 2.30pm London time and 3.30pm CET.

The dial in numbers are:

-----------------------------------

Toll free dial Local dial in

Location in numbers numbers Participant

------------------

+44 (0)203 364

UK local: 0800 0515 931 5807 72199342#

------------------

US local: 1 86 6719 2729 +1 24 0645 0345 72199342#

------------------

US (New York): 1 86 6719 2729 + 1 646 663 7901 72199342#

------------------

France: 0800 914780 +33 1 7071 2916 72199342#

------------------

Germany: 0800 965 6288 +49 692 7134 0801 72199342#

------------------

Spain: 90 099 4930 +34 911 143436 72199342#

------------------

Luxembourg: 800 26908 +352 27 86 05 07 72199342#

------------------- ------------------ ------------------ ---------------

A replay of the conference call will be available for

one week by dialing: +49 (0) 1805 2047 088; Access

code 522468#

Forward-Looking Statements

This document may contain forward-looking information and statements

about ArcelorMittal and its subsidiaries. These statements include

financial projections and estimates and their underlying assumptions,

statements regarding plans, objectives and expectations with respect to

future operations, products and services, and statements regarding

future performance. Forward-looking statements may be identified by the

words "believe", "expect", "anticipate", "target" or similar

expressions. Although ArcelorMittal's management believes that the

expectations reflected in such forward-looking statements are reasonable,

investors and holders of ArcelorMittal's securities are cautioned that

forward-looking information and statements are subject to numerous risks

and uncertainties, many of which are difficult to predict and generally

beyond the control of ArcelorMittal, that could cause actual results and

developments to differ materially and adversely from those expressed in,

or implied or projected by, the forward-looking information and

statements. These risks and uncertainties include those discussed or

identified in the filings with the Luxembourg Stock Market Authority for

the Financial Markets (Commission de Surveillance du Secteur Financier)

and the United States Securities and Exchange Commission (the "SEC")

made or to be made by ArcelorMittal, including ArcelorMittal's latest

Annual Report on Form 20-F on file with the SEC. ArcelorMittal

undertakes no obligation to publicly update its forward-looking

statements, whether as a result of new information, future events, or

otherwise.

About ArcelorMittal

ArcelorMittal is the world's leading steel and mining company, with a

presence in 60 countries and an industrial footprint in 18 countries.

Guided by a philosophy to produce safe, sustainable steel, we are the

leading supplier of quality steel in the major global steel markets

including automotive, construction, household appliances and packaging,

with world-class research and development and outstanding distribution

networks.

Through our core values of sustainability, quality and leadership, we

operate responsibly with respect to the health, safety and wellbeing of

our employees, contractors and the communities in which we operate. For

us, steel is the fabric of life, as it is at the heart of the modern

world from railways to cars and washing machines. We are actively

researching and producing steel-based technologies and solutions that

make many of the products and components people use in their everyday

lives more energy efficient.

We are one of the world's five largest producers of iron ore and

metallurgical coal. With a geographically diversified portfolio of iron

ore and coal assets, we are strategically positioned to serve our

network of steel plants and the external global market. While our steel

operations are important customers, our supply to the external market is

increasing as we grow. In 2017, ArcelorMittal had revenues of $68.7

billion and crude steel production of 93.1 million metric tonnes, while

own iron ore production reached 57.4 million metric tonnes.

ArcelorMittal is listed on the stock exchanges of New York (MT),

Amsterdam (MT), Paris (MT), Luxembourg (MT) and on the Spanish stock

exchanges of Barcelona, Bilbao, Madrid and Valencia (MTS). For more

information about ArcelorMittal please visit:

https://www.globenewswire.com/Tracker?data=EgmiTFlRtUMy15eOBu6KU4URTyGSwtOrZ2_Z4YNwr5BqTTdMP28waD7r2UbsZzs9cH_z7-8NAt5JvdUit-fMAd5q8II56n6nvRQbsuO_KNI1MO4Op5ZFNTtt97GUDPtL

http://corporate.arcelormittal.com/

Enquiries

ArcelorMittal investor relations: Europe: +44 207 543 1128; Americas: +1

312 899 3985; Retail: +44 207 543 1156; SRI: +44 207 543 1156 and

Bonds/credit: +33 1 71 92 10 26.

ArcelorMittal corporate communications (E-mail:

https://www.globenewswire.com/Tracker?data=K3TVSxl1_xxgLpau7MeWA1ZSFn13kE-4HS51aL7x3jKhbD1thLpP4aYmvqmtiem0-WnswT0J5-6rtk2dukZbSgF_SAC15y6Hdsh0rs8__FA=

press@arcelormittal.com) +44 0207 629 7988. Contact: Paul Weigh +44 203

214 2419; France Tel: +33 153 70 94 17.

Attachment

-- ArcelorMittal reports third quarter 2018 and nine months 2018 results

https://prlibrary-eu.nasdaq.com/Resource/Download/bed824ec-1656-4f50-848b-9acbae0afaea

(END) Dow Jones Newswires

November 01, 2018 02:15 ET (06:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

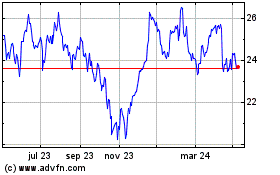

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

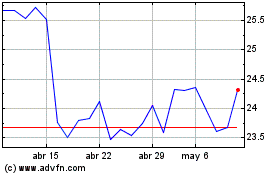

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024