BHP CEO Expects China to Use All Levers to Offset US Trade Conflict

07 Noviembre 2018 - 11:31PM

Noticias Dow Jones

By Rhiannon Hoyle

ADELAIDE, Australia--The chief executive of BHP Billiton Ltd.

(BHP.AU), the world's biggest mining company by market value,

Thursday signaled that he expects China to successfully tackle

external shocks from an escalating trade conflict with the U.S.

that's been taking an increasingly heavy toll on its

commodities-hungry economy.

China is "very active--more active than they've been for a

while--in looking at the kind of trade arrangements that may allow

them to trade with many, many other countries of the world to make

up for the shortfall they may suffer from the United States," BHP

Chief Executive Andrew Mackenzie told reporters after the miner's

Australian shareholder meeting.

BHP, which ships more than half of its cargoes to China, has

already trimmed its own forecasts for global growth over concerns

about the impact of U.S.-China trade tensions on both those

economies.

Mr. Mackenzie said he expects Beijing to "use all of the levers"

available to stimulate its domestic industries and build export

routes to other parts of the world.

Mr. Mackenzie said he'd spoken with Chinese President Xi Jinping

in a one-on-one meeting on a recent visit to China.

Former Treasury Secretary Henry Paulson on Wednesday cautioned

of a possible "long winter" in U.S.-China relations.

BHP has been running a conservative strategy in recent years

after a commodities downturn that hammered profits, making returns

to yield-hungry investors a top priority.

The miner last week said it would hand $10.4 billion to

shareholders via a stock buyback and special dividend, sparking a

recovery in its stock after the October stock-market selloff. That

represents the takings from the sale of its U.S. onshore shale

assets, mostly to BP PLC.

BHP is sticking with its conventional petroleum business, which

spans Gulf of Mexico and Trinidad and Tobago to Australia. The

company on Thursday said it has also won a couple of promising

exploration blocks in the offshore Orphan Basin in Eastern Canada,

with an aggregate bid of $625 million.

"It is an attractive business for our shareholders," BHP

Chairman Ken MacKenzie said, even as oil suffers its longest losing

streak since mid-2014. The market has sunk almost 20% since

breaking above $76 a barrel in early October, tied to worries over

slowing demand and record production from major oil exporters.

The sale of the U.S. onshore oil and gas fields was among the

demands of activist investor Elliott Management Corp., which has

also sought to convince BHP to collapse its dual-listed structure

in Australia and the U.K. While that option is kept under review,

there's no business case to unify the listings now, Mr. MacKenzie

said.

He also said he was happy with BHP's current executive team and

had no plans to change the management.

BHP was in the spotlight this week after a runaway train in

Australia on Monday forced operators to remotely derail the

locomotives in a remote part of the Outback. Train operations from

BHP's iron ore mines to port terminals on Australia's west coast

remain suspended.

BHP lost control of the train because of a systems issue

currently under investigation, said Mr. Mackenzie, who said he

couldn't yet provide further details on the likely cause.

Operators were monitoring the runaway train over its roughly

50-minute journey and derailed it "as soon as it became a risk to

bridges and trains in front," said Mr. Mackenzie.

"We let it go through a number of points in the hope it would

slow down on its own," he said.

BHP will disclose the financial hit from the derailment later,

but all contractual obligations are being met, with the miner

continuing to ship ore from stockpiles at its port facilities.

"We have about 130 people working night and day to get things

back to normal and we are reasonably confident we can resume our

shipments within about a week," he said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

November 08, 2018 00:16 ET (05:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

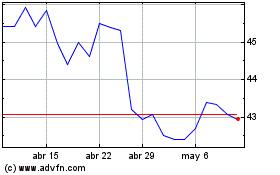

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

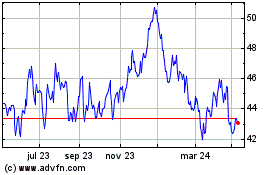

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024