Australian Dollar Higher After Strong Jobs Data

14 Noviembre 2018 - 8:08PM

RTTF2

The Australian dollar spiked up against its major counterparts

in the Asian session on Thursday, after a data showed that nation's

jobless rate dropped more than forecast in October, while

employment surged.

Data from the Australian Bureau of Statistics showed that

Australia's unemployment rate came in at a seasonally adjusted 5.0

percent in October.

That was unchanged from the September reading, although it was

beneath expectations for 5.1 percent.

The Australian economy added 32,800 jobs last month - beating

forecasts for 20,000 following the addition of 7,800 jobs in the

previous month.

Further underpinning the currency was rising risk appetite as

British Prime Minister Theresa May said she has obtained cabinet

support for her proposed Brexit deal to move forward.

The aussie climbed to a 6-day high of 82.74 against the yen and

a weekly high of 0.7282 against the greenback, from its early lows

of 82.09 and 0.7229, respectively. The next possible resistance for

the aussie is seen around 84.00 against the yen and 0.75 against

the greenback.

Reversing from its previous lows of 1.5650 against the euro and

0.9572 against the loonie, the aussie advanced to a 5-month high of

1.5546 and more than a 3-month high of 0.9641, respectively. If the

aussie rises further, 1.54 and 0.98 are possibly seen as its next

resistance levels against the euro and the loonie.

The aussie strengthened to a 3-day high of 1.0713 against the

kiwi and held steady thereafter. The aussie is seen finding

resistance around the 1.09 region.

Looking ahead, U.K. retail sales for October and Eurozone trade

data for September are due in the European session.

In the New York session, U.S. weekly jobless claims for the week

ended November 10, business inventories for September, retail sales

and import and export prices for October as well as Canada existing

home sales for October are set for release.

Federal Reserve Governor Randal Quarles will testify on banking

supervision and regulation before the Senate Banking Committee in

Washington DC at 10:00 am ET.

At 11:30 am ET, Federal Reserve Chair Jerome Powell will speak

about Hurricane Harvey recovery efforts at an event hosted by the

Federal Reserve Bank of Dallas in Houston.

Atlanta Fed President Raphael Bostic is scheduled to speak about

monetary policy at the Global Interdependence Center in Madrid at

1:00 pm ET.

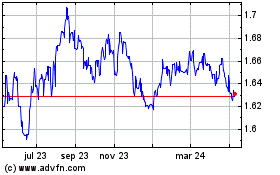

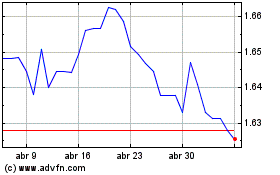

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024