Generali Eyes Growth and Expansion With Fresh Three-Year Strategy - Update

21 Noviembre 2018 - 3:42AM

Noticias Dow Jones

Adds CEO comments, analyst comments, share price, detail on

strategy

By Pietro Lombardi

Assicurazioni Generali SpA (G.MI) on Wednesday unveiled a

three-year strategy aimed at improving earnings and expanding in

selected markets, fueled in part by acquisitions.

"Generali will continue to focus on generating and managing

capital to fund growth opportunities in key markets and drive

innovation and digital transformation wherever we operate," Chief

Executive Philippe Donnet said in a statement ahead of the

company's investor day.

Specifically, Mr. Donnet said Generali would "expand operations

in high-potential markets and develop a global asset management

platform." Separately, he told the Financial Times that the company

would set aside up to 4 billion euros ($4.57 billion) to fuel

growth, both organically and through M&A.

The market received the 2019-2021 plan positively, with Generali

shares gaining 2.3% at 0900 GMT, compared with the 1.3% rise on

Italy's benchmark FTSE MIB index.

Generali sees earnings per share growing at an annual rate

between 6% and 8% through 2021 and targets a dividend payout range

between 55% and 65%. As part of the three-year strategy, it targets

an average return on equity of more than 11.5%.

The company delivered a plan above expectations, U.S. bank

Jefferies says. The EPS target "exceeds our expectations and, with

a high payout target of 55%-65%, this supports higher dividend

growth," it said.

Generali also plans to cut its debt by up to EUR2 billion by

2021, while growing earnings and investing EUR1 billion in

innovation and digital transformation.

Analysts widely expected news on debt reduction, with Credit

Suisse analysts recently saying they expected the company "to

announce substantial deleveraging at its investor day."

The insurer plans to reinforce its business in Europe, a region

that remains attractive, and "deliver profitable growth in Asia and

Latin America," it said.

In Europe "high private-wealth accumulation will support the

sale of Life and Asset Management products, while demographic

trends and reduced public spending will drive the development of

pension, health and welfare services," the company said.

In asset management, it also said it plans to "accelerate

expansion with disciplined acquisitions."

Last year Generali launched a strategy for its asset-management

unit focused on creating a multiboutique platform, and recently

bought Polish asset-management company Union Investment TFI.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

November 21, 2018 04:27 ET (09:27 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

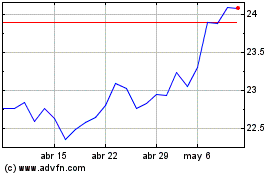

Generali (BIT:G)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

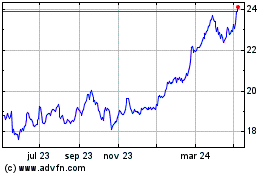

Generali (BIT:G)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024