Dollar Little Changed After Fed Minutes Released

29 Noviembre 2018 - 8:20AM

RTTF2

The dollar is turning in a mixed performance against its major

rivals Thursday afternoon, but remains little changed overall. The

currency has had little reaction to the release of the minutes from

the Federal Reserve's November policy meeting this afternoon.

Meanwhile, it was a rather active morning on the U.S. economic

front. After reporting an unexpected uptick in first-time claims

for U.S. unemployment benefits in the previous week, the Labor

Department released a report on Thursday showing another unexpected

increase in initial jobless claims in the week ended November

24th.

The report said initial jobless claims climbed to 234,000, an

increase of 10,000 from the previous week's unrevised level of

224,000. Economists had expected jobless claims to edge down to

220,000.

Personal income and spending in the U.S. both increased by more

than anticipated in the month of October, according to a report

released by the Commerce Department on Thursday.

The Commerce Department said personal income climbed by 0.5

percent in October after edging up by 0.2 percent in September.

Economists had expected income to rise by 0.4 percent.

Additionally, the report said personal spending advanced by 0.6

percent in October after rising by a revised 0.2 percent in the

previous month. Spending had also been expected to climb by 0.4

percent, matching the increase originally reported for

September.

Pending home sales in the U.S. unexpectedly showed a substantial

decrease in the month of October, according to a report released by

the National Association of Realtors on Thursday.

NAR said its pending home sales index plunged by 2.6 percent to

102.1 in October after climbing by 0.7 percent to an upwardly

revised 104.8 in September. With the steep drop, the index fell to

its lowest level since mid-2014.

The sharp pullback surprised economists, who had expected

pending home sales to rise by 0.5 percent, matching the increase

originally reported for the previous month.

The dollar climbed to an early high of $1.1348 against the Euro

Thursday, but has since retreated to around $1.1375.

Eurozone's economic sentiment weakened for an eleventh straight

month in November, but the pace of decline was less than expected,

helped by an improvement in morale in the industrial sector. The

economic sentiment indicator fell to 109.5, which was the weakest

reading since May 2017, when the score was 109, survey data from

the European Commission showed on Thursday.

The October reading was revised to 109.7 from 109.8. Economists

had forecast a score of 109.1 for November.

Germany's consumer price inflation slowed more-than-expected in

November, preliminary data from the Federal Statistical Office

showed on Thursday.

The consumer price index rose 2.3 percent year-on-year following

a 2.5 percent increase in October, which was the highest in over a

decade. Economists had expected 2.4 percent inflation for November.

In September, inflation was 2.3 percent.

Germany's unemployment rate unexpectedly fell to a record low in

November and the number of unemployed decreased more than expected,

despite a weaker economy.

The seasonally adjusted jobless rate dropped to 5 percent from

5.1 percent in October, figures from the Federal Employment Agency

showed on Thursday. Economists had expected the rate to remain

unchanged.

Germany's employment level in October hit a record high since

reunification and the ILO jobless rate eased from the previous

month, data from the Federal Statistical Office showed on Thursday.

The employment grew by 1.2 percent or 556,000 persons year-on-year

to over 45.1 million.

The buck has risen to around $1.2775 against the pound sterling

this afternoon, from an early low of $1.2850.

The greenback slid to a low of Y113.187 against the Japanese Yen

Thursday, but has since bounced back to around Y113.515.

Retail sales in Japan were up a seasonally adjusted 1.2 percent

on month in October, the Ministry of Economy, Trade and Industry

said on Thursday. That exceeded expectations for an increase of 0.4

percent following the 0.2 percent decline in September.

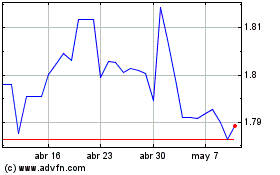

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024