EUROPE MARKETS: European Indexes Slump On Renewed China Slowdown Fears

10 Enero 2019 - 4:51AM

Noticias Dow Jones

By Emily Horton

All major European indexes were down on Thursday, after weak

economic data from China and the latest breakdown in talks over the

U.S. government shutdown combined to spook investors.

Mining stocks were struggling, but it was a better story for the

U.K.'s big retailers as Christmas sales announcements continued to

roll in.

What did markets do?

The Stoxx Europe 600 fell by 0.6% to 345.73, after finishing up

0.5% on Wednesday.

France's CAC 40 was the biggest regional loser on Thursday,

dropping by 0.8% to 4,773.32. The German Dax 30 lost 0.5% to

10,838.79, while the U.K.'s FTSE 100 dropped 0.5% to 6,875.07.

Italy's FTSE MIB Italy index lost 0.2%.

The euro slid to $1.1535 from $1.1545 late in New York on

Wednesday, while the pound dropped to $1.2758 from $1.2788.

What is driving the markets?

(http://www.marketwatch.com/story/us-gains-312000-jobs-in-final-month-of-2018-soaring-above-wall-street-forecast-2019-01-04)Consumer

and producer prices decelerated sharply in China

(http://www.marketwatch.com/story/chinas-sluggish-prices-raise-deflation-fears-2019-01-10-24851247)

last month, compounding the challenge for Beijing to boost sluggish

demand in a deepening economic downturn. This replaced earlier

investor optimism created by the progress being made in trade talks

between Washington and Beijing.

Another worry for investors is the partial U.S. government

shutdown, with the stalemate entrenched after President Donald

Trump walked out of his latest meeting with Democrats on Wednesday

(http://www.marketwatch.com/story/trump-today-president-keeps-border-emergency-option-on-table-as-he-meets-with-lawmakers-2019-01-09).

In France, industrial production unexpectedly fell in November

(http://www.marketwatch.com/story/french-industrial-production-falls-in-november-2019-01-10)

-- flashing another a warning sign from one of the world's major

economies. Production fell 1.3% in November, French statistics

agency Insee said Thursday, well short of analysts' expectations of

an increase of 0.1%.

In the U.K., an alliance of MPs came together on Wednesday to

force key amendments for the preparation of a possible 'no deal'

Brexit from the European Union

(http://www.marketwatch.com/story/brexit-brief-uk-business-secretary-warns-of-disaster-from-crash-out-exit-2019-01-10).

The amendments require Prime Minister Theresa May to produce a plan

B for Brexit within three days if she loses the crucial Jan. 15

parliamentary vote on her proposed exit deal.

What stocks are active?

Miners were under pressure on Thursday, with BHP Group PLC

(BHP.LN) losing 6% and Glencore PLC (GLEN.LN) down 1%.

German manufacturer Osram Licht AG (OSR.XE) was the biggest

loser on the Stoxx Europe 600, falling by 8%, a day after the

Federal Statistical Office announced poor export figures for

November

(http://www.marketwatch.com/story/german-exports-drop-underlining-slowdown-fears-2019-01-09).

Tesco PLC (TSCO.LN) gained 2% after it announced strong

Christmas sales results

(http://www.marketwatch.com/story/tesco-beats-on-christmas-sales-targets-on-track-2019-01-10)on

Thursday. Supermarket J Sainsbury PLC (SBRY.LN) also added 2%.

In banking stocks, Spain's Banco Santander SA. (SAN) gained

0.8%.

(END) Dow Jones Newswires

January 10, 2019 05:36 ET (10:36 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

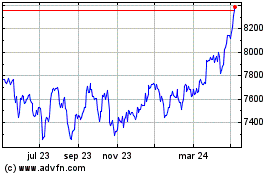

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

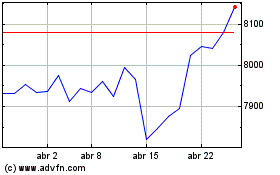

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024