EUROPE MARKETS: European Stocks Dragged South By Losses For Oil And Auto Companies

11 Enero 2019 - 8:19AM

Noticias Dow Jones

By Emily Horton

Pound strength weighs on FTSE 100

European markets slipped into the red on Friday, weighed by

negative headlines in the global auto sector and losses for oil

majors.

What did markets do?

Surrendering an earlier lead, the Stoxx Europe 600 fell 0.2% to

348.27 after finishing up 0.3% on Thursday. The index has gained

four of the past five trading days, and is poised to end the week

with a rise of over 1%.

Dogged by pound strength, the U.K.'s FTSE 100 went from a 0.8%

gain to a loss of 0.3%, at 6,925.16. The pound surged to $1.2812

from $1.2749 late Thursday in New York.

The Germany's Dax 30 and France's CAC 40 each lost around 0.6%

and Italy's FTSE MIB Italy dropped 0.4%.

The euro climbed to $1.1520 from $1.1500.

What is driving the markets?

Sterling spiked

(http://www.marketwatch.com/story/british-pound-climbs-as-likelihood-of-brexit-delay-rises-2019-01-11)

on a report in the Evening Standard that said Prime Minister

Theresa May's cabinet members saw the likelihood of a Brexit delay

rising. The U.K. Parliament is slated to vote on her Brexit deal on

Jan. 15, but market participants aren't sure she can shore up

enough votes. A stronger pound can weigh on the FTSE 100, as the

index's multinational companies generate most of their sales in

other currencies.

Read:British pound climbs as likelihood of Brexit delay rises

(http://www.marketwatch.com/story/british-pound-climbs-as-likelihood-of-brexit-delay-rises-2019-01-11)

The auto sector was under pressure after

(http://www.marketwatch.com/story/us-gains-312000-jobs-in-final-month-of-2018-soaring-above-wall-street-forecast-2019-01-04)Ford

Motor Co. (F) launched an overhaul of its European business on

Thursday

(http://www.marketwatch.com/story/ford-unveils-major-european-restructuring-2019-01-10).

It will include thousands of job cuts, plant closures and the

cancellation of low-profit models amid poor performance at the

global car maker, The Wall Street Journal reports

(https://www.wsj.com/articles/ford-announces-major-european-restructuring-11547117814).

In the U.S., President Donald Trump is digging his heels in over

the partial government shutdown. White House officials are divided

over whether the president should declare a national state of

emergency to secure funding for his U.S./ Mexico border wall, the

Journal reports

(https://www.wsj.com/articles/white-house-looking-into-diverting-army-corps-funds-to-build-wall-11547161664).

Despite the shutdown, trade talks between China and the U.S. are

still progressing, with China's top trade officials expected to

visit the U.S. later this month

(http://www.marketwatch.com/story/chinas-top-trade-official-expected-to-visit-us-for-trade-talks-mnuchin-says-2019-01-10)for

more negotiations.

What stocks are active?

Among heavily weighted auto stocks, Daimler AG (DAI.XE) fell 2%

and Volkswagen (VOW.XE) tumbled over 4%.

Major oil companies dragged on the main Stoxx index as crude

prices turned lower

(http://www.marketwatch.com/story/oil-prices-lifted-for-10th-day-as-dollar-softens-2019-01-11).

Royal Dutch Shell PLC A (RDSA.LN) (RDSA.LN) fell 0.5% and BP PLC

(BP.LN) (BP.LN) dropped 0.6%.

Health-care stocks logged losses, with UDG Healthcare PLC

(UDG.LN) off 6% and Eurofins Scientific S.E. (ERF.FR) down by

3%.

U.K. home builders were in the black after upbeat results from

(http://www.marketwatch.com/story/taylor-wimpey-expects-one-off-charge-over-pensions-2019-01-09)with

Taylor Wimpey PLC (TW.LN) on Thursday. Taylor Wimpey and Persimmon

PLC (PSN.LN) shares rose 5% each.

Cie. Financière Richemont SA (CFR.EB) gained 2% after reporting

revenue grew by 25% in the third quarter

(http://www.marketwatch.com/story/richemont-revenue-up-despite-yellow-vest-headwind-2019-01-11),

which was in line with expectations despite headwinds in some of

its markets.

(http://www.marketwatch.com/story/richemont-revenue-up-despite-yellow-vest-headwind-2019-01-11)

(END) Dow Jones Newswires

January 11, 2019 09:04 ET (14:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

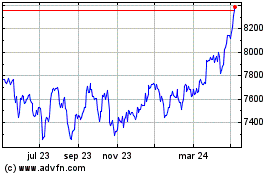

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

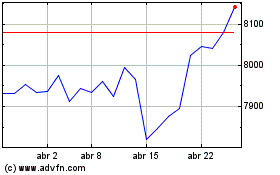

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024