Canadian Dollar Strengthens After Upbeat Inflation Data

18 Enero 2019 - 3:41AM

RTTF2

The Canadian dollar gained ground against its key counterparts

in the European session on Friday, after a data showed that the

nation's consumer inflation turned positive unexpectedly in

December, triggering hopes for a rate hike by the Bank of Canada in

coming months.

Data from Statistics Canada showed that the CPI rose 0.2 percent

on a seasonally adjusted monthly basis from last month, when it

fell a revised 0.1 percent. Economists had forecast a 0.4 percent

drop.

Core inflation, which excludes food and energy, improved 0.4

percent from 0.1 percent in the previous month.

On an unadjusted basis, consumer prices rose 2.0 percent

year-on-year in December, following a 1.7 percent increase in

November.

Oil prices rose as reports of progress in U.S.-China trade talks

helped ease global growth worries.

Crude for February delivery rose $0.63 to $52.70 per barrel.

The loonie traded mixed against its major counterparts in the

Asian session. While it rose against the yen and the greenback, it

held steady against the euro and the aussie.

The loonie strengthened to a 3-day high of 1.3232 against the

greenback, from a low of 1.3283 hit at 7:15 pm ET. On the upside,

1.30 is likely seen as the next resistance for the loonie.

The loonie advanced to a 2-day high of 1.5088 against the euro,

after having dropped to 1.5143 at 8:15 am ET. If the loonie rises

further, 1.49 is possibly seen as its next resistance level.

Data from the European Central Bank showed that Eurozone current

account surplus decreased in November, led by a decline in the

surplus in the visible trade and primary income accounts and

worsening of the deficit in the secondary income account.

The current account surplus declined to EUR 20 billion from EUR

27 billion in October. The surplus was EUR 35 billion in the same

month last year.

The loonie firmed to 82.69 versus the yen, its strongest level

since December 20, 2018. This follows a low of 82.11 touched at

6:15 pm ET. The loonie may possibly challenge resistance around the

84.00 area.

Data from the Ministry of Internal Affairs and Communications

showed that Japan consumer prices rose 0.3 percent on year in

December.

That was in line with expectations and down from 0.8 percent in

November.

Reversing from an early low of 0.9562 against the aussie, the

loonie edged up to 0.9522. The loonie is likely to test resistance

around the 0.94 area.

Looking ahead, the University of Michigan's preliminary consumer

sentiment for January is scheduled for release shortly.

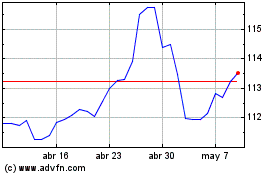

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024