Euro Climbs Amid Risk Appetite On Trade Optimism, China Data

20 Enero 2019 - 7:37PM

RTTF2

The euro strengthened against its major opponents in the Asian

session on Monday, as Asian shares rose following the gains on Wall

Street Friday amid optimism about U.S.-China trade talks as well as

positive data from China.

China GDP data came in line with expectations in the fourth

quarter, while industrial production and retail sales beat

expectations in December, separate data showed.

Investors cheered US President Donald Trump's remarks that trade

talks with China are progressing well.

Oil prices firmed as impressive China data suggested that the

nation's economic slowdown is likely not as steep as expected.

Further underpinning oil prices were supply cuts led by the

Organization of the Petroleum Exporting Countries.

The euro advanced to 1.1380 against the greenback, from a low of

1.1360 hit at 5:00 pm ET. On the upside, 1.15 is likely seen as the

next resistance for the euro.

The single currency appreciated to a 4-day high of 0.8849

against the pound, after falling to 0.8816 at 5:00 pm ET. If the

euro rises further, 0.90 is possibly seen as its next resistance

level.

The euro edged up to 1.1327 against the franc and 124.82 against

the yen, off its early lows of 1.1301 and 124.51, respectively. The

euro is likely challenge resistance around 1.15 against the franc

and 126.00 against the yen.

The common currency climbed to 4-day highs of 1.6938 against the

kiwi and 1.5905 against the aussie, from its early lows of 1.6813

and 1.5846, respectively. The euro is likely to test resistance

around 1.71 against the kiwi and 1.60 against the aussie.

Reversing from an early low of 1.5065 against the loonie, the

euro rose to 1.5101. The euro is seen finding resistance around the

1.53 region.

U.S. markets will remain closed in observance of Martin Luther

King Jr. Day.

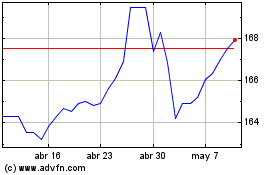

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs Yen (FX:EURJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024