IBM Beats Earnings Expectations Although Its Revenue Again Declines

22 Enero 2019 - 4:18PM

Noticias Dow Jones

By Jay Greene

International Business Machines Corp.'s revenue fell 3.5%, a

second consecutive quarterly drop that underscores significant

challenges the technology giant faces in recapturing growth.

Even so, IBM said it expects operating per-share earnings to hit

$13.90 in the current fiscal year, compared with $13.81 for 2018.

The company doesn't forecast revenue.

Shares rose 5% in after-hours trading after closing at

$122.49.

For the fourth quarter, revenue came in at $21.76 billion,

compared with $22.54 billion a year ago. IBM swung to a profit of

$1.95 billion from a $1.05 billion net loss a year earlier, when it

took a $5.5 billion charge related to the U.S. Tax Cuts and Jobs

Act of 2017.

The most recent quarter included a $1.9 billion charge largely

related to deferred taxes.

Analysts surveyed by Refinitiv had expected revenue of $21.71

billion. Other polls of Wall Street analysts had projected even

higher revenue; S&P Global Market Intelligence had estimated

$21.79 billion in revenue.

Chief Executive Ginni Rometty has struggled since taking over

the company in 2012 to turn around Big Blue's fortunes. Just 12

months ago, IBM triumphantly returned to growth after posting

nearly six years of shrinking revenue.

One hurdle IBM faced in the final months of 2018 was a tough

comparison to results from a year ago, when the company had

benefited from the recent introduction of a new mainframe system.

That business dropped 44% in the most recent quarter after growing

71% a year ago, finance chief James Kavanaugh said in an

interview.

Under Ms. Rometty, the company has been trying to boost a group

of fast-growing businesses it calls strategic imperatives. Those

businesses -- cloud computing and data analytics, among others --

grew 5% in the quarter to $11.5 billion, Mr. Kavanaugh said.

IBM moved to rev up those business in October, announcing plans

to buy Red Hat Inc. for about $33 billion. IBM is counting on the

deal, its largest ever, to increase its business of selling

so-called hybrid services in which companies run programs that use

computing resources from their own servers and web services from

IBM and others at the same time.

Mr. Kavanaugh said IBM still expects the Red Hat deal to close

in the second half of this year.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

January 22, 2019 17:03 ET (22:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

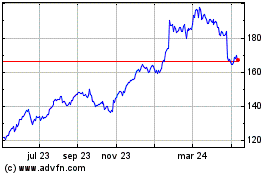

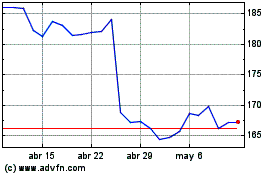

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

International Business M... (NYSE:IBM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024