Yen Weakens After BoJ Retains Monetary Policy; Trims Inflation Outlook

22 Enero 2019 - 8:40PM

RTTF2

The Japanese yen lost ground against its key counterparts in the

Asian session on Wednesday, after the Bank of Japan kept its

massive stimulus program unchanged and slashed inflation forecasts

primarily led by a fall in oil prices.

The policy board of the BoJ decided to purchase government bonds

so that the yield of 10-year JGBs will remain at around zero

percent.

The board retained the -0.1 percent interest rate on current

accounts that financial institutions maintain at the bank.

The BoJ will conduct purchases of Japanese government bonds in a

flexible manner so that the outstanding amount will increase at an

annual pace of about JPY 80 trillion.

The bank also lowered the inflation forecast for fiscal 2019 to

1.1 percent from 1.6 percent and to 1.5 percent from 1.6 percent

for fiscal 2020.

Core inflation forecast was cut to 0.9 percent from 1.4 percent

for fiscal 2019. For the fiscal 2020, core inflation projection was

trimmed to 1.4 percent from 1.5 percent.

Data from the Ministry of Finance showed that Japan posted a

merchandise trade deficit of 55.286 billion yen in December.

That missed expectations for a deficit of 35.3 billion yen

following the 737.7 billion yen shortfall in November.

Exports were down 3.8 percent, while imports advanced 1.9

percent.

Meanwhile, Asian stock markets were mostly lower amid worries

about global economic growth and the uncertainty over U.S.-China

trade talks. However, some of the markets have pared early

losses.

Media reports indicating that the Trump administration rejected

an offer from China for preparatory talks ahead of next week's

high-level trade negotiations dampened sentiment. However, White

House economic advisor Larry Kudlow has denied the reports.

The yen dropped to a 2-day low of 110.07 against the franc, from

a high of 109.55 hit at 5:15 pm ET. The next possible support for

the yen is seen around the 112.00 level.

Having climbed to 109.32 against the greenback at 5:15 pm ET,

the yen reversed direction and fell to a 5-day low of 109.79. If

the yen falls further, 111.00 is possibly seen as its next support

level.

The yen slipped to a 5-week low of 142.29 versus the pound and a

2-day low of 124.78 versus the euro, off its early highs of 141.61

and 124.21, respectively. The yen is seen finding support around

144.00 against the pound and 126.00 against the euro.

Reversing from its early highs of 81.85 against the loonie and

77.84 against the aussie, the yen edged down to 82.36 and 78.33,

respectively. The yen is poised to challenge support around 84.5

against the loonie and 79.5 against the aussie.

The yen weakened to an 8-day low of 74.39 against the kiwi,

after rising to 73.74 at 6:30 pm ET. On the downside, 76.00 is

likely seen as the next support for the yen.

Looking ahead, Bank of England Deputy Governor Ben Broadbent

will deliver a speech at London Business School at 4:30 am ET.

In the New York session, Canada retail sales and U.S. Federal

Housing Finance Agency's house price index for November are set for

release.

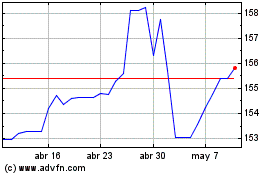

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024