P&G Raises Outlook After Another Quarter of Strong Sales--2nd Update

23 Enero 2019 - 8:18AM

Noticias Dow Jones

By Aisha Al-Muslim

Procter & Gamble Co. reported strong quarterly sales growth,

continuing a streak of robust gains and prompting the

consumer-products giant to raise its outlook for the year even as

one of its closest rivals reported weaker results.

The maker of Tide detergent and Gillette razors said organic

sales, a closely watched metric that strips out currency moves,

acquisitions and divestitures, rose 4% in the fiscal second

quarter. Organic sales were boosted by 1% due to higher

pricing.

Beauty products fueled the gains, with organic sales rising 8%,

but the company reported growth across a number of categories. Only

the Gillette razor business posted a decline in organic sales in

the latest quarter.

Rival Kimberly-Clark Corp., which makes Huggies diapers and

Kleenex tissues, reported falling profits in the same quarter as it

was squeezed by rising commodity costs and currency swings. The

smaller company said organic sales rose 3% from a year before.

Shares of P&G jumped 4% in premarket trading, while

Kimberly-Clark slipped 2%.

Despite a robust U.S. economy and strong consumer spending, the

companies have encountered increased competition, a consumer shift

toward smaller brands, and higher costs of raw materials and

transportation.

After trying to combat weak demand by lowering prices, P&G

changed course late last year, saying it would increase prices in

late 2018 and early 2019 for several products, including its

Pampers, Bounty, Charmin and Puffs brands. Kimberly-Clark and other

consumer-goods makers have followed P&G's lead on raising

prices.

So far, price increases on various products have been announced

but not fully implemented, P&G's finance chief, Jon Moeller,

said in conference call with reporters.

The organic growth in P&G's fiscal second quarter matched

the first quarter, which was the best growth rate in several years.

For a long stretch, P&G's quarterly organic sales had generally

risen 2% or less -- lackluster growth that attracted a proxy fight

from activist investor Trian Fund Management, whose co-founder

Nelson Peltz now holds a seat on the P&G board.

While sales rose for Tide detergent and Pampers diapers, organic

sales fell 3% in the grooming business, which includes the Gillette

brand. The established brand has faced competition from upstarts

and has resorted to lowering prices to maintain its leading market

share.

Last week, Gillette released a controversial ad campaign

invoking the #MeToo movement. The nearly two-minute ad posted

online after the second quarter ended. The ad received mixed

reactions from customers.

In the conference call, Mr. Moeller described the grooming

business as a "long-purchase cycle business" with some people going

as much as a year without buying shaving products. However, he

said, Gillette continues to grow sales and users.

Overall, P&G said profit rose 28% to $3.19 billion in the

second quarter, which ended Dec. 31.

Core earnings were $1.25 a share, beating the $1.21 a share

analysts polled by Refinitiv were looking for. Core earnings strip

out currency moves, acquisitions and divestitures.

Net sales were $17.44 billion, unchanged from the previous year,

but unfavorable foreign-exchange fluctuations hurt sales by 4%.

P&G increased the high end of its full-year forecast for

organic sales to rise 2% to 4%, compared with its prior estimates

of 2% to 3%.

Meanwhile, Kimberly-Clark reported quarterly earnings of $411

million, down 33% from a year earlier. Total sales fell 1% to $4.57

billion, hurt by currency swings.

In October, Kimberly-Clark said it was switching chief

executives in the midst of a restructuring program intended to

boost profits as the company struggled with weak sales.

Michael Hsu, the former president and chief operating officer,

who became chief executive earlier this month, said Wednesday that

the company expects 2019 to be challenging but "somewhat better

than in 2018."

--Robert Barba contributed to this article.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

January 23, 2019 09:03 ET (14:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

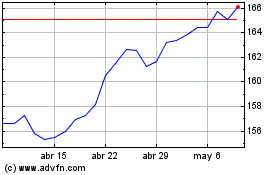

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

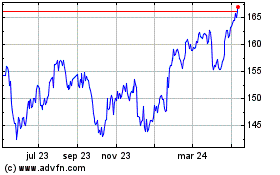

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024