Company's sales gains point to buoyant economy and some room to

raise prices

By Aisha Al-Muslim

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 24, 2019).

Procter & Gamble Co. reported strong quarterly sales,

continuing a streak of robust gains and prompting the

consumer-products giant to raise its outlook, while one of its

closest rivals posted weaker results.

Profit for the maker of Tide detergent and Pampers diapers rose

28% in the latest quarter, even as planned price increases were yet

to take full effect. "As commodity prices and foreign exchange

rates move, we will take pricing" higher, P&G finance chief Jon

Moeller said Wednesday during a call with analysts.

Kimberly-Clark Corp., whose products include Huggies diapers and

Kleenex tissues, said Wednesday its profit and sales dropped in

2018's final quarter because of rising commodity costs and currency

swings.

P&G joined several other major U.S. corporations this week

in reporting a bountiful finish to 2018. Many companies benefited

from a healthy U.S. economy and lower tax rates, which offset

concerns about trade tensions with China and, more recently, the

federal government shutdown.

Tech giant International Business Machines Corp. and industrial

conglomerate United Technologies Corp., which makes Otis elevators

and Pratt & Whitney jet engines, pointed to healthy spending by

their business customers. Shares of all three companies rallied

Wednesday on their latest results.

Executives at United Technologies said they had seen no impact

on their business from the U.S. government shutdown, and they

continue to forecast strong economic growth in the U.S. and

China.

"The U.S. again really, really pretty good outlook for this year

off the back of some strong orders that we saw in 2018," Chief

Executive Greg Hayes said during a conference call on

Wednesday.

For P&G, the gains came from household spending across a

number of categories, with beauty products leading the way. Organic

sales, a closely watched metric that strips out currency moves,

acquisitions and divestitures, rose 4% in its fiscal second

quarter, ended Dec. 31. Only its grooming business, which includes

the Gillette brand, posted a decline in organic sales in the

period.

The Gillette shaving brand has faced competition from upstarts

and has resorted to lowering prices to maintain its leading market

share. Last week, Gillette released -- to mixed consumer reactions

-- a campaign invoking the #MeToo movement.

In the conference call with reporters, Mr. Moeller said some

people go as long as a year without buying shaving products, making

for what he described as a "long-purchase-cycle business." He also

said the Gillette brand continues to add to its users and

sales.

Despite a robust U.S. economy and strong consumer spending,

household-goods stalwarts like P&G and Kimberly-Clark have

battled increased competition, a consumer shift toward smaller

brands, and higher costs of raw materials and transportation.

After addressing weak demand by lowering prices, P&G changed

course late last year, saying it would increase prices in late 2018

and early 2019 for several products, including its Pampers, Bounty,

Charmin and Puffs brands. Kimberly-Clark and other consumer-goods

makers have followed P&G's lead on raising prices.

Higher prices contributed a percentage point to P&G's

organic sales growth of 4% in the recent quarter.

So far, price increases on various products have been announced

but not fully implemented, Mr. Moeller said Wednesday, adding that

most of the increases will take effect in the current and next

quarter. He warned analysts that higher pricing "will increase

volume uncertainty and volatility."

The organic growth in P&G's fiscal second quarter matched

the first quarter, which was the best growth rate in several years.

For a long stretch, P&G generally logged growth of no more than

2% -- a performance that led to a proxy fight from activist

investor Trian Fund Management, whose co-founder Nelson Peltz now

holds a seat on the P&G board.

P&G on Wednesday said its profit rose to $3.19 billion in

the latest period. Net sales were flat at $17.44 billion, as

unfavorable foreign-exchange fluctuations cut into the total.

P&G said it expects organic sales growth for the full year of

between 2% and 4%, an improvement on its prior projection of 2% to

3%.

Kimberly-Clark posted quarterly earnings of $411 million, down

33% from a year earlier. Total sales fell 1% to $4.57 billion, hurt

by currency swings. Its organic sales rose 3%.

For 2019, Kimberly-Clark predicted organic sales would increase

2%. However, given planned price increases and fewer promotions,

volumes are likely to suffer, particularly with consumer tissue

products, executives said during a conference call.

In October, Kimberly-Clark said it was switching chief

executives in the midst of a restructuring program intended to

boost profits as the company struggled with weak sales. Michael

Hsu, the former president and chief operating officer who became

chief executive earlier this month, said Wednesday the company

expects 2019 to be challenging but "somewhat better than in

2018."

--Thomas Gryta contributed to this article.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

January 24, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

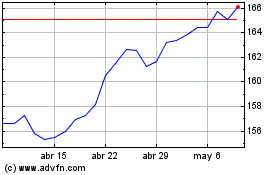

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

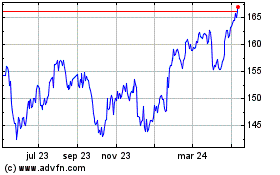

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024