AM Best Upgrades Credit Ratings of PMG Assurance Ltd.

24 Enero 2019 - 12:55PM

Business Wire

AM Best has upgraded the Financial Strength Rating to A

(Excellent) from A- (Excellent) and the Long-Term Issuer Credit

Rating to “a” from “a-” of PMG Assurance Ltd. (PMG) (Bermuda). The

outlook of these Credit Ratings (ratings) remains stable.

The ratings reflect PMG’s balance sheet strength, which AM Best

categorizes as very strong, as well as its strong operating

performance, limited business profile and appropriate enterprise

risk management.

The ratings also reflect PMG’s strategic position as the captive

insurance company for the Sony Group, whose ultimate parent is Sony

Corporation (Sony) [NYSE: SNE]. PMG is a pure captive of Sony, and

its role is to meet certain global insurance requirements and

provide risk management services to Sony Group members. The rating

upgrades reflect the improved credit risk profile of Sony, which

has experienced a positive trend over the past several years. Sony

has made improvements in terms of its earnings quality, increased

cash flow and a significant reduction to debt.

PMG’s strengths are derived from its underwriting focus,

conservative operational strategy and emphasis on risk management

controls. PMG writes predominantly commercial property and marine

for Sony, and employee benefits coverage for Sony employees. PMG’s

balance sheet strength is assessed as very strong, as evidenced by

its risk-adjusted capitalization, excellent liquidity and

conservative investment strategy. PMG’s operating performance

continues to be strong, with favorable net income in four of the

past five years predominantly from net underwriting income. The

captive is susceptible to volatility in earnings due to the low

frequency and high severity losses it insures; however, PMG

mitigates its exposures through the use of a comprehensive

reinsurance program.

AM Best remains the leading rating agency of alternative risk

transfer entities, with more than 200 such vehicles rated in the

United States and throughout the world. For current Best’s Credit

Ratings and independent data on the captive and alternative risk

transfer insurance market, please visit

www.ambest.com/captive.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Understanding Best’s Credit Ratings. For

information on the proper media use of Best’s Credit Ratings and AM

Best press releases, please view Guide for Media - Proper

Use of Best’s Credit Ratings and AM Best Rating Action Press

Releases.

AM Best is a global rating agency and information provider

with a unique focus on the insurance industry. Visit

www.ambest.com for more information.

Copyright © 2019 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190124005704/en/

Charlie SmentkowskiFinancial Analyst+1 908 439

2200, ext.5684charlie.smentkowski@ambest.com

Susan MolineuxDirector+1 908 439 2200, ext.

5829susan.molineux@ambest.com

Christopher SharkeyManager, Public Relations+1

908 439 2200, ext. 5159christopher.sharkey@ambest.com

Jim PeavyDirector, Public Relations+1 908 439

2200, ext. 5644james.peavy@ambest.com

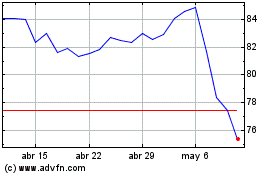

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Sony (NYSE:SONY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024