By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Some of the world's biggest consumer-goods suppliers are taking

aim at packaging. Companies including Procter & Gamble Co.,

Nestlé SA, PepsiCo Inc. and Unilever PLC say they'll start selling

some products in glass, steel and other containers designed to be

returned and refilled, reports the WSJ's Saabira Chaudhuri. It's a

plan to eliminate plastic waste that would reverberate across their

supply chains. The efforts could reduce waste from single-use

packaging, and the companies hope it lures eco-conscious consumers,

provides important data and fosters brand loyalty. The idea seems

to face long odds, though there is history here: Refillables once

dominated industries such as beer and soft drinks but lost out to

single-use containers. The new effort takes in products including

shampoo, laundry detergent and cereal. Some stores sell such goods

in bulk with reusable containers, but the practice is a niche

without large-scale distribution channels.

The corporate alarms over Brexit are growing louder. Aircraft

manufacturing giant Airbus SE sharpened its threat to move

operations out of the U.K. if politicians can't strike a deal for

an orderly departure from the European Union, the WSJ's Robert Wall

and Max Colchester report, raising the prospect of a big shift in

high-value aerospace supply chains. Airbus Chief Executive Tom

Enders calls the lack of clarity for businesses as the March 29

deadline nears a "disgrace," and some corporate managers are

starting to take their own actions. P&O, the once-iconic

British shipping giant now owned by Dubai's DP World, says it would

re-flag its English Channel ferries in Cyprus. A shift in the

aerospace industry would sting more. The sector is among the

country's biggest exporters, but even British aircraft engine maker

Rolls-Royce Holdings PLC says it could shift some operations to

Germany depending on the Brexit terms.

Global energy markets may have to brace for another shift in oil

supply chains. The economic slowdown taking hold in China will

likely curb the country's appetite for gasoline this year, the

WSJ's Kevin Kingsbury writes, leading to a likely flood of exports

to the rest of Asia. That could pressure margins for the region's

refiners but may boost some tanker operators who have been looking

for more stability in volatile international crude markets. Chinese

demand has been a key support for oil prices, and import volumes

rose at double-digit rates in 2017 and 2018, as car ownership and

industrial use both grew. Car sales fell last year for the first

time in nearly 30 years, however, and could decline again this

year. Official fuel-export quotas, which include diesel and

kerosene, jumped 35% last year, and China may raise them again so

refiners can maintain production.

SUPPLY CHAIN STRATEGIES

Walmart Inc. is sending a new warning signal to the U.S.

trucking industry . The retailer plans to add around 900 drivers to

its sprawling U.S. private-fleet operations after hiring about

1,400 truckers last year. The hiring effort comes in a trucking

sector that added nearly 37,000 jobs last year as freight demand

heated up and carriers raised pay and incentives for drivers. The

Dallas Morning News reports Walmart's new hiring effort includes

higher compensation that will take average annual pay to $87,500.

The bigger impact on the market may come in a streamlined

"on-boarding" process aimed at getting new hires on the road

faster. It's a sign Walmart sees greater private-fleet operations

as a long-term solution to the capacity and service concerns of

2018. With dedicated fleet operations growing rapidly at some

trucking companies, Walmart doesn't appear to be alone in that

decision.

QUOTABLE

IN OTHER NEWS

An index of U.S. business trends slipped 0.1% in December.

(WSJ)

The number of Americans filing new applications for unemployment

benefits fell to the lowest level since 1969. (WSJ)

Mexico's gasoline prices are declining despite a fuel shortage.

(WSJ)

Some U.S. airlines warned of growing delays and more canceled

flights if the partial federal government shutdown drags on

further. (WSJ)

American Airlines Group Inc. swung to a fourth-quarter profit

and cargo revenue rose 3% as higher pricing offset a traffic

decline. (WSJ)

Southwest Airlines' fourth-quarter cargo revenue was flat at $45

million while passenger revenue rose sharply. (WSJ)

Huawei Technologies Co. unveiled a chipset for 5G devices even

as it faces a growing backlash from Western governments. (WSJ)

China's state-owned Silk Road Fund denied it has been in talks

with smartphone parts supplier Japan Display Inc. over a potential

investment. (WSJ)

Moody's says Sears Holdings Corp.'s plan to shutter more stores

will hurt struggling lower-tier regional malls most. (WSJ)

Starbucks Corp. boosted sales at U.S. cafes 4% in the past

quarter. (WSJ)

Bristol-Myers Squibb Co. swung to a fourth-quarter profit as it

worked toward the planned acquisition of rival Celgene Corp.

(WSJ)

U.S. Commerce Secretary Wilbur Ross says Washington and Beijing

are "miles and miles" from resolving their trade dispute. (South

China Morning Post)

Amazon.com Inc. is testing a wheeled robotic delivery vehicle it

calls Scout. (Seattle Times)

Japanese auto makers face roughly $1.37 billion per year in new

tariffs under Brexit. (Nikkei Asian Review)

Union Pacific Corp.'s fourth-quarter net profit rose 29% and

international intermodal revenue soared 21% during the full year.

(Progressive Railroading)

Norfolk Southern Corp.'s fourth-quarter profit jumped 44% on

strong pricing. (Associated Press)

Transport equipment maker Wabash National Corp. sold its

aviation and truck business to Garsite Progress. (Inside Indiana

Business)

Chinese oil company Sinopec produced its first batch of

low-sulfur marine fuel. (Ship & Bunker)

Libya's two governing authorities will jointly support the

construction of a deep-sea port near the city of Susah. (Libya

Herald)

Cosco Shipping Ports is buying a controlling stake in Peru's

Chancay terminal and will work with Volcan Compañía Minera to

expand the site. (Seatrade Maritime)

Belgian tanker operator Euronav NV's fourth-quarter profit

tumbled despite a strong improvement in crude carrier rates.

(Shipping Watch)

The Dutch Spliethoff Group bought five cargo vessels from

bankrupt operator Hansa Heavy Lift. (TradeWinds)

Freight forwarder Kuehne + Nagel International AG won't

challenge rival DSV A/S's bid to take over Panalpina. (Lloyd's

List)

Several cargo airlines are adding to their freighter fleets this

year. (The Loadstar)

Discount retailer Ollie's Bargain Outlet Inc. is planning a

large distribution center south of Dallas. (Dallas Morning

News)

Ryder System, Inc. is expanding its COOP truck-sharing platform

into South Florida. (DC Velocity)

Digital supply chain startup Citizen Reserve will work with RFID

tag manufacturer Smartrac. (TechCrunch)

ABOUT US

Paul Page is editor of WSJ Logistics Report. Follow him at

@PaulPage, and follow the entire WSJ Logistics Report team:

@CostasParis, @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 25, 2019 09:27 ET (14:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

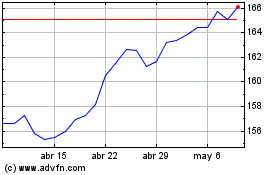

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

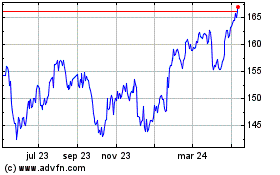

Procter and Gamble (NYSE:PG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024