By Thomas Gryta and Miriam Gottfried

General Electric Co.'s lending business, GE Capital, has run up

deep losses in recent years, but it also contains one of the

embattled conglomerate's best assets: the world's biggest

aircraft-leasing operation. Now, several potential suitors are

circling the unit.

The interest comes as GE sells off businesses to chip away at

its more than $100 billion in debt. Among those that have expressed

interest in buying some or all of the aircraft-leasing operation,

called GE Capital Aviation Services, are investment firms Apollo

Global Management LLC, Blackstone Group LP and KKR & Co.,

people familiar with the situation said.

The operation owns and manages nearly 2,000 planes and

helicopters that it leases to more than 200 carriers, ranging from

giant American Airlines Group Inc. to Jet Airways Ltd in India. It

generates a stream of cash that has helped prop up the rest of the

troubled GE Capital.

A sale could help GE eliminate up to $40 billion in debt, much

of which is associated with the aircraft operation, according to

analysts. But it also would leave a shrunken GE Capital with few

profitable businesses at a time when it is plugging a $15 billion

hole in its insurance reserves.

In October, Chief Financial Officer Jamie Miller said GE hadn't

made decisions or plans to do anything with the aircraft unit. "We

receive inbounds on this business all the time," she said,

referring to interest from potential buyers. "As we think about the

timing and the pace of execution on our overall plan, that is

something we could think about."

The aircraft unit's large finance operation doesn't fit into the

conglomerate's strategic shift away from lending.

GE Chief Executive Larry Culp and company directors are still

trying to find a way to neutralize the problems in GE Capital,

including the option of winding down the entire operation, as GE

splits apart its manufacturing operations, people familiar with the

matter said.

The situation is emblematic of the Gordian knot that is GE

today: It can cut debt by selling its most valuable pieces, but

then it will lose their future earnings while its core power

business is losing money.

"Just shrinking the balance sheet, but leaving still plenty of

debt/insurance liabilities and money-losing businesses that don't

have much value does little to solve the problem," JPMorgan analyst

Stephen Tusa said earlier this month.

GE expects to close the sale of its railroad transportation unit

next month, is selling down its stake in oil field firm Baker

Hughes and is preparing to spin off its health-care division.

Danaher Corp., a conglomerate that early last year approached GE

about buying part of the health unit, recently expressed renewed

interest, people familiar with the matter said.

When the company reports fourth-quarter results Thursday,

investors will be looking to Mr. Culp to discuss his latest

thinking on the turnaround plans, the strategy to pay down debt and

profit targets for the year.

The aircraft-leasing unit has about $41 billion in assets, and

accounted for more than half of GE Capital's $9.1 billion in 2017

revenue. As of the end of September, it had made commitments to buy

aircraft with a listed value of more than $38 billion.

Divesting the unit would take away a major source of cash and a

tool previously used to help the company sell its jet engines.

Aviation lease experts said the heavy debt a buyer would have to

take on to acquire the operation likely crimps the list of

candidates.

AerCap Holdings NV, the GE unit's biggest rival, has signaled it

would prefer to buy back its own stock than do a deal. Air Lease

Corp. Executive Chairman Steven Udvar-Házy this month told an

industry conference that to acquire the unit "will require a lot of

money, both debt and equity. I think it is a challenging

opportunity."

Analysts have conflicting views on the attraction of the

portfolio. Nicholas Heymann, an analyst at William Blair & Co.,

expects many interested bidders and a valuation that could exceed

$40 billion. Ratings agency Fitch assumes any sale would be about

$40 billion, with the proceeds paying down debt within GE

Capital.

Some bankers have said, based on prior transactions in the

industry, the overall value of any deal would be less than that.

The equity value -- or the net proceeds to GE after debt relief --

could be below $10 billion, they said. Apollo's interest in the

leasing unit was earlier reported by Bloomberg News.

John Inch, an analyst with Gordon Haskett Research Advisors,

said the value of the operation in a sale is difficult to estimate,

and a buyer may not want parts of it, including its helicopter

operations. It is difficult to estimate the amount of cash a sale

would produce, partly because the value of the underlying leases

and debt isn't known, he said.

"I think maybe $5 to $6 billion in proceeds. But it could be

zero," he said.

Nathan Flanders, a credit analyst at Fitch Ratings, said the

size and order book of the unit would be attractive to those

looking to enter the leasing business, including private-equity

firms, insurance companies, pension funds and sovereign-wealth

funds. "It is a plug-and-play platform for the buyer," he said,

adding that it may not be as attractive to those in the business

already.

One hitch in any deal is that a buyer would need to raise the

full price in cash because the leasing unit doesn't have debt of

its own to transfer with the sale. Instead, its debt is under GE,

which means a buyer would have to pay cash, then raise new debt

with its newly acquired assets.

"It adds risk," Mr. Flanders said. "It could be another hurdle

for potential buyers to raise that much debt for the business."

--Robert Wall and Dana Mattioli contributed to this article.

Write to Thomas Gryta at thomas.gryta@wsj.com and Miriam

Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

January 30, 2019 19:42 ET (00:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

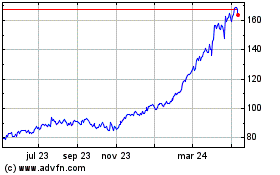

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

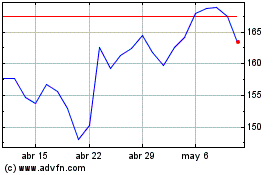

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024