TIDMIII

RNS Number : 6000O

3i Group PLC

31 January 2019

31 January 2019

3i Group plc

FY2019 Q3 performance update

Another good quarter for 3i despite market volatility

* Increase in NAV per share to 802 pence (30 September

2018: 776 pence) and total return of 13.9% for the

nine months to 31 December 2018 driven by good growth

in the quarter from Action, 3i Infrastructure plc

("3IN"), Aspen Pumps and Audley Travel

* Completed the refinancing of Aspen Pumps which,

together with the distribution from Audley Travel,

returned cash of GBP74 million to 3i. In addition,

announced the sale of OneMed on 18 January 2019, with

expected realisation proceeds of c.GBP100 million

* Announced a EUR56 million further investment in Hans

Anders to support its acquisition of 'eyes+more' and

completed four bolt-on acquisitions in Aspen Pumps,

Cirtec Medical and Royal Sanders

* Strong performance from 3iN continued with a further

6% increase in its share price

Simon Borrows, Chief Executive, commented:

"This was another good quarter for 3i, during a period of

significant market volatility. Our Private Equity portfolio

performed well, with Action, Aspen Pumps and Audley Travel

generating good growth, and 3iN continued its strong run. Our

balance sheet is well funded but we remain cautious about the

pricing of private investments in the current environment and have

continued to focus on bolt-on acquisitions. As we approach the

close to our financial year we remain confident that our

diversified portfolio is well positioned to deliver further good

growth and withstand market turbulence in these uncertain political

and economic times."

Private Equity

Portfolio performance

The Private Equity portfolio generated solid returns in the

quarter. Action finished the year strongly with an excellent

December contributing to revenue growth of 23% and very good

cashflow for the year. With the stabilisation of supply chain

performance in France in the final months of 2018, French

like-for-like sales growth improved significantly in the December

trading period. The new distribution centre at Belleville, near

Lyon, has now opened and is delivering to its first French stores

and the new DC at Peine in Germany will commence operations in late

February. Construction of the new DC at Osla in Poland is well

underway. Action opened 230 net new stores in the year and will

announce its 2018 results in March 2019.

We continue to see good earnings growth across the portfolio

more generally, with assets such as AES, Audley Travel, Aspen

Pumps, Formel D, ICE and Royal Sanders performing well. Our

buy-and-build strategy for assets such as Cirtec Medical and Ponroy

Santé also generated good earnings growth. However WP, our

international supplier of plastic packaging solutions, incurred

higher expenses in the quarter due to increased resin costs and

negative foreign exchange movements.

Equity markets were particularly volatile this quarter, with the

FTSE All-share falling 11% and the STOXX Europe 600 falling 12%.

Our long standing policy of adjusting the multiples we use to value

our unquoted portfolio to take account of longer term sector

averages and other factors has helped to mitigate the impact of

weak markets. Basic-Fit's share price declined by 12% in the

quarter. The combined impact of the decline in Basic-Fit's share

price and the reductions in multiples was c.GBP115 million in the

quarter.

Private Equity investments

We continue to see some interesting investment opportunities but

we remain disciplined on price and continue to focus on

acquisitions for our portfolio companies. In December 2018, we

announced Hans Anders' acquisition of 'eyes + more'. To support

Hans Anders' investment, 3i invested EUR56 million in January 2019.

In addition, and without requiring funding from 3i, Cirtec Medical

completed the acquisitions of Metrigraphics and Cactus

Semiconductor, Aspen Pumps acquired Advanced Engineering and Royal

Sanders completed its acquisition of McBride's European personal

care liquids business.

Private Equity realisations

We generated GBP74 million of cash from Aspen Pumps and Audley

Travel, GBP18 million of which was recognised as cash income and

the remainder as realisation proceeds.

Private Equity Realisation proceeds

GBPm

------------------------------------------------------------------------------------- ---------------------

Aspen Pumps 48

Audley Travel 8

Other 2

------------------------------------------------------------------------------------- ---------------------

Total Q3 FY2019 realised proceeds 58

------------------------------------------------------------------------------------- ---------------------

H1 FY2019 realised proceeds 1,052

------------------------------------------------------------------------------------- ---------------------

Total realised proceeds as at 31 December 2018 1,110

------------------------------------------------------------------------------------- ---------------------

Scandlines reinvestment (529)

------------------------------------------------------------------------------------- ---------------------

Total realised proceeds, net of the Scandlines reinvestment, as at 31 December 2018 581

------------------------------------------------------------------------------------- ---------------------

In January 2019, we announced the sale of OneMed, one of the

last investments in Eurofund V, for proceeds of c.GBP100 million.

At 31 December 2018, OneMed was held on an imminent sales basis and

valued at GBP100 million, compared to its 30 September 2018

valuation of GBP51 million.

Infrastructure

The Infrastructure business had another good quarter. Our

investment in 3iN performed very strongly as its share price

increased by 6% to 258.5 pence due to a strong set of half-year

results and a well positioned portfolio. This generated unrealised

value growth of GBP39 million for 3i, in addition to dividend

income of GBP12 million.

The infrastructure market remains active and our Infrastructure

team is working on a pipeline of interesting investment

opportunities in Europe and North America.

Total return and NAV position

We recognised a GBP57 million gain on foreign exchange in the

quarter, as both the US dollar and euro strengthened against

sterling. Based on the balance sheet at 31 December 2018, a 1%

movement in the euro and US dollar would result in a total return

movement of GBP43 million and GBP11 million respectively. The

diluted NAV per share increased to 802 pence (30 September 2018:

776 pence) or 787 pence after deducting the 15 pence per share

interim FY2019 dividend, which was paid on 9 January 2019.

Top 10 investments by value at 31 December 2018

Valuation Valuation

Valuation Valuation Sep-18 Dec-18

basis currency GBPm GBPm Activity in the quarter

----------- ----------- ---------- ---------- ------------------------------------------------

Action Earnings EUR 2,381 2,540

----------- ----------- ---------- ---------- ------------------------------------------------

3iN Quoted GBP 659 698 Accrued a GBP12 million FY2019 interim dividend

----------- ----------- ---------- ---------- ------------------------------------------------

Scandlines DCF EUR 521 529 Received a GBP6 million dividend

----------- ----------- ---------- ---------- ------------------------------------------------

Audley Travel Earnings GBP 258 261 Distributed GBP25 million of cash to 3i

----------- ----------- ---------- ---------- ------------------------------------------------

Cirtec Medical Earnings USD 239 252 Acquired Cactus Semiconductor and Metrigraphics

----------- ----------- ---------- ---------- ------------------------------------------------

Q Holding Earnings USD 239 242

----------- ----------- ---------- ---------- ------------------------------------------------

WP Earnings EUR 259 241

----------- ----------- ---------- ---------- ------------------------------------------------

Basic-Fit Quoted EUR 256 228

----------- ----------- ---------- ---------- ------------------------------------------------

Hans Anders Earnings EUR 203 198

----------- ----------- ---------- ---------- ------------------------------------------------

Smarte Carte DCF USD 180 186

----------- ----------- ---------- ---------- ------------------------------------------------

The 10 investments in this table comprise 73% (30 September

2018: 73%) of the total Proprietary Capital portfolio value of

GBP7,320 million (30 September 2018: GBP7,119 million).

Balance sheet

At 31 December 2018 net cash was GBP628 million. The 15 pence

FY2019 interim dividend of GBP145 million was paid on 9 January

2019.

- ENDS -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 31 December 2018 in this update have been calculated at a currency exchange

rate of EUR1.1152:GBP1 and $1.2753:GBP1 respectively. At 31 December 2018, 62% of the Group's

net assets were in euro and 14% were in US dollar.

2. At 31 December 2018 3i had 973 million diluted shares.

3. Action was valued using a post discount run-rate EBITDA multiple of 16.5x based on its run-rate

earnings to 31 December 2018.

For further information, please contact:

Silvia Santoro

Group Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com.

All statements in this performance update relate to the three

month period ended 31 December 2018 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2018 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFITLAIIVIA

(END) Dow Jones Newswires

January 31, 2019 02:00 ET (07:00 GMT)

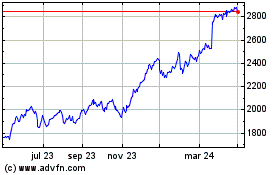

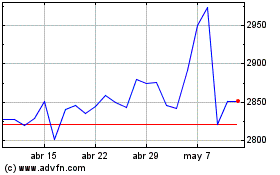

3i (LSE:III)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

3i (LSE:III)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024