By David Benoit

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 31, 2019).

Accounting giant KPMG LLP has been blessing the books of General

Electric Co. for 110 years, but the audit currently under way holds

significant risks for both companies.

KPMG is under fire for a string of audit failures and scandals,

highlighted again Friday in a set of scathing reports by the

nation's top accounting regulator, which is demanding KPMG increase

its skepticism and improve the quality of work, particularly at

big, complicated clients like GE.

A tough audit is the last thing GE needs right now. Investors

have already been concerned about more unknowns bubbling up. The

conglomerate is trying to increase cash, pare debt and return to

growth. More bad news could hamper those efforts or provide

evidence for investigators from the Securities and Exchange

Commission and the Justice Department, which are probing GE's

accounting decisions.

GE is set to release its fourth-quarter numbers on Thursday. As

with most quarterly earnings, those numbers won't be officially

audited. But, in one of the biggest and most lucrative audits of

any company, hundreds of KPMG partners and staff are poring over

GE's books in preparation for the company's annual audited results,

likely released in late February.

KPMG hasn't been named in the GE investigations, but the Public

Company Accounting Oversight Board, or PCAOB, released several

reports Friday calling into question KPMG's work on similar

issues.

The reports said PCAOB found problems in nearly half of the 103

KPMG audits it inspected from 2016 and 2017 and said improvements

it ordered in prior years hadn't been made. The regulator also

disclosed new details on the impact of leaks from the PCAOB about

what audits would be reviewed, which helped KPMG prepare for the

annual inspections.

KPMG said in a letter to PCAOB that it has taken significant

steps, including management and board changes, to improve its

processes.

A spokesman said it couldn't comment on GE specifically but that

"We are confident that our audits and reviews were appropriately

performed in accordance with applicable professional standards, and

we stand behind our work."

The PCAOB reports don't name specific clients of the auditor,

and it wasn't clear if the regulator had inspected or found any

issues with KPMG's work related to GE, which said it doesn't

believe its audit is involved.

But the reports criticize how KPMG policed its clients over the

accounting questions that are central to the GE probes: How did GE

decide when to book revenue and how to value assets, and why were

the assumptions behind those decisions too optimistic?

GE has said it is cooperating with the probes and that it hasn't

found evidence of wrongdoing. The company said it would consider

new auditors for 2020.

GE has said the government investigators are looking at how it

booked revenue from service contracts in its power business, which

builds turbines used by electricity generators and sells longtime

contracts to service them.

In the PCAOB reports, the most frequent area of trouble was

KPMG's work on how clients decided to book revenue, which came up

18 times in 103 audits.

The investigators are also looking at a $22 billion write-down

GE took on its 2015 acquisition of French company Alstom's power

business.

The PCAOB four times faulted KPMG for the work it did while

checking clients' assumptions when assigning value to acquired

assets.

In another thread of the auditing probes, GE is facing scrutiny

over a $15 billion increase to its reserves for long-term care

insurance policies, which cover care like nursing homes and proved

more expensive than much of the industry expected. GE has said the

need for more reserves was discovered following a sudden spike in

claims that differed from historical trends.

In the 2017 report, the PCAOB cited KPMG for failing to

adequately test an insurance client's use of historical data to

estimate future insurance claims.

For KPMG, the report was the latest blow to its reputation amid

many scandals, including the leak from the PCAOB about audit

reviews. Three people, including a former KPMG partner, have

pleaded guilty to criminal charges; two other former partners still

face charges.

The regulator said that leak led to a review of 10 new KPMG

audits from 2016. The inspections turned up problems in nine of

those audits.

No matter what happens with the SEC and Justice Department

investigations or the current audit, KPMG's bottom line is already

likely to take a hit.

GE paid KPMG $142.9 million in 2017, the biggest total audit fee

for any company regulated by the SEC, according to Audit Analytics.

The fee was higher than in recent years due to work done on GE's

efforts to break off assets. GE has been one of the 10 most

lucrative audits in each of the past five years, Audit Analytics

data said.

The GE audit was so important to KPMG that roughly 400 partners

worked on it last year, according to GE's financial disclosures.

But the importance of GE to KPMG raised questions among investors

about auditor independence, and whether the accounting firm would

stand up to GE's aggressive accounting maneuvers.

The pressure was clear inside KPMG, where people who worked

there said a well-known phrase among executives was, "you don't

want to be the partner who lost the GE account."

Thomas Gryta contributed to this article.

Write to David Benoit at david.benoit@wsj.com

(END) Dow Jones Newswires

January 31, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

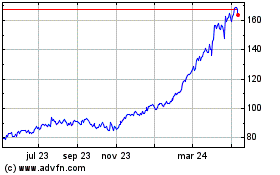

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

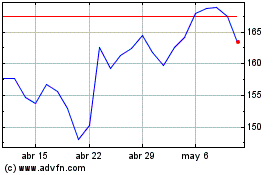

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024