Euro Lower After Eurozone GDP Data

31 Enero 2019 - 12:41AM

RTTF2

The euro slipped against its major counterparts in the European

session on Thursday, as a data showed that Eurozone economy

expanded at a slower pace annually in the fourth quarter,

triggering worries about anemic growth across the currency

bloc.

Preliminary data from the statistical office Eurostat showed

that gross domestic product rose 1.2 percent in the fourth quarter

after a 1.6 percent increase in the previous three months. The

annual growth figure matched economists' prediction.

Gross domestic product grew 0.2 percent from the third quarter,

when the economy expanded at the same pace. The growth rate was in

line with economists' expectations.

The statistical office also reported that the euro area

unemployment rate for December was 7.9 percent, unchanged from

November and in line with economists' expectations.

Data from the Federal Statistical Office showed that Germany's

retail sales declined sharply in December, defying expectations for

further increase.

Retail sales fell 2.1 percent year-on-year, after a 1.9 percent

increase in November. Economists were looking for a 1.5 percent

gain.

The latest decrease was the biggest since a 3 percent slump in

September.

Meanwhile, European stocks rose as a dovish turn in the Fed's

policy statement and higher oil prices helped investors shrug off

weak manufacturing data from China as well as mixed earnings

reports.

U.S.-China trade negotiations enter their second day with a

common statement expected after the talks conclude.

The euro showed mixed trading against its major counterparts in

the Asian session. While it rose against the greenback and the

pound, it held steady against the yen and the franc.

Having climbed to an 8-day high of 0.8765 against the pound at

9:45 pm ET, the euro reversed direction and declined to 0.8732.

Next key support for the euro is possibly seen around the 0.86

mark.

The euro fell to 1.1472 against the greenback, after rising to

near a 3-week high of 1.1514 at 2:15 am ET. The euro is likely to

test support around the 1.13 mark, if it drops again.

The euro depreciated to a 6-day low of 124.58 against the yen,

from a high of 125.30 hit at 10:30 pm ET. On the downside, 122.00

is likely seen as the next support for the euro.

Data from the Ministry of Economy, Trade and Industry showed

that Japan industrial production fell a seasonally adjusted 0.1

percent on month in December.

That exceeded expectations for a decline of 0.5 percent

following the 1.0 percent drop in November.

Moving away from a session's high of 1.1429 hit at 2:30 am ET,

the euro weakened to 1.1393 against the Swiss franc. The euro is

poised to challenge support around the 1.10 level.

The euro fell back to 1.6615 against the kiwi, heading closer to

pierce a 1-1/2-month low of 1.6600 touched at 7:15 pm ET. The euro

is seen finding support around the 1.64 level.

The single currency edged down to 1.5073 against the loonie,

following an advance to 1.5114 at 2:15 am ET. The next possible

support for the euro is seen around the 1.49 level.

The euro slipped to 1.5779 against the aussie, its lowest level

since January 18. Further downtrend is likely to take the euro to

support around the 1.55 level.

Data from the Australian Bureau of Statistics showed that

Australia import prices climbed 0.5 percent on quarter in the

fourth quarter of 2018.

That beat forecasts for an increase of 0.3 percent following the

1.9 percent jump in the three months prior.

Looking ahead, Canada GDP data for November, U.S. weekly jobless

claims for the week ended January 26 and Chicago PMI for January

are set for release in the New York session.

Deutsche Bundesbank President Jens Weidmann will speak in

Mannheim at 11:00 am ET.

The Bank of Canada Deputy Governor Carolyn Wilkins will deliver

a speech about the labor market and monetary policy at the Toronto

Region Board of Trade at 12:30 pm ET.

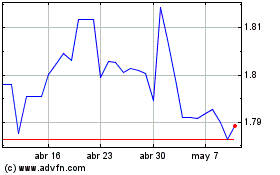

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Abr 2023 a Abr 2024