BP Board Supports Proposed Vote on Climate-Change Shareholder Resolution

01 Febrero 2019 - 3:29AM

Noticias Dow Jones

By Dieter Holger

--BP's board supports a vote on a proposed shareholder

resolution requiring disclosure of more metrics on climate

change

--Shareholders are expected to vote at the company's next annual

general meeting, in mid-May

BP PLC's (BP.LN) board supports a proposed vote on a shareholder

resolution that would require the company to disclose metrics on

its efforts to combat climate change, the company said Friday.

This follows pressure from a coalition of more than 300

investors managing $32 trillion in assets.

If the resolution is approved, BP would disclose how it

evaluates the impact of its investments in oil-and-gas exploration,

acquisition and development on the climate; its anticipated levels

of investment in oil, gas and other energy sources; the estimated

carbon intensity of its energy products; and its targets to reduce

its greenhouse gas emissions.

The company's climate strategy and metrics would appear in an

annual report, with the first due out early 2020, the company

said.

"We believe our strategy is consistent with the Paris goals," BP

chairman Helge Lund said. "The additional reporting specified in

the resolution will build on BP's history of progressive action in

this area."

The proposal is part of a growing trend among investors to

demand more action and disclosure on climate goals from energy

companies. Investors, in partnership with investor group Climate

Action 100+, persuaded Royal Dutch Shell PLC (RDSB.LN) to agree

late last year to halve its carbon footprint by 2050.

It isn't currently possible to determine if BP's energy projects

are in line with the Paris Climate Agreement of keeping global

warming below 2 degrees Celcius, the investors said in a statement

in support of the resolution.

"This limits investors' ability to appraise the attractiveness

of the company as an investment proposition," the investors

said.

BP shareholders are expected to vote on the resolution at the

next annual general meeting, in mid-May, the company said.

Negotiations between BP and the investors on the resolution

began in the fourth quarter of 2018, the company said.

In 2018, BP was embroiled in an environmental disaster after the

Deepwater Horizon explosion in the Gulf of Mexico, which spilled

around 5 million barrels of oil into the Gulf of Mexico and led to

a settlement of $20.8 billion.

Write to Dieter Holger at dieter.holger@dowjones.com

(END) Dow Jones Newswires

February 01, 2019 04:14 ET (09:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

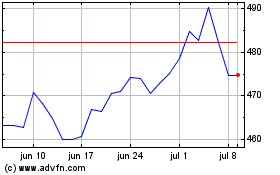

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024