Exxon Mobil 4Q Gets Boost From Natural Gas -- Energy Comment

01 Febrero 2019 - 7:53AM

Noticias Dow Jones

Exxon Mobil Corp. (XOM) Friday reported a 72% jump in adjusted

earnings in the fourth quarter amid higher natural- gas prices and

liquids volume growth.

On its upstream results:

"Crude prices weakened in the fourth quarter, while natural gas

prices strengthened with higher LNG prices and increased seasonal

demand. Natural gas volumes were supported by stronger seasonal gas

demand in Europe. Permian unconventional production continued to

ramp up in the fourth quarter, with production up more than 90

percent from the same period last year."

On its downstream results:

"Industry fuels margins weakened during the quarter due to lower

seasonal gasoline demand and increased supply. The company captured

benefits from North American crude differentials with its

integrated logistics and manufacturing capabilities. Overall

reliability remained strong during a quarter with higher levels of

scheduled maintenance activity."

On its chemical results:

"Chemical margins weakened during the quarter with lengthening

supply from recent capacity additions. Sales growth from

investments resulted in the highest annual volumes in over ten

years. Turnaround activities were completed at the Singapore

chemical plant during the fourth quarter."

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

February 01, 2019 08:38 ET (13:38 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

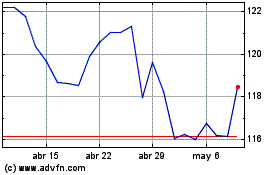

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

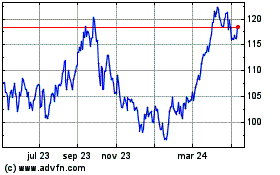

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024