Dollar Mixed After U.S. Nonfarm Payrolls Data

01 Febrero 2019 - 3:37AM

RTTF2

The U.S. dollar turned mixed against its key counterparts in the

European session on Friday, following the release of mixed U.S jobs

data for January, which showed much higher than expected job growth

last month, while the jobless rate ticked up.

Data from the Labor Department showed that the U.S. employment

jumped much more than expected in the month of January, although it

showed a substantial downward revision to the pace of job growth in

December.

The Labor Department said non-farm payroll employment surged up

by 304,000 jobs in January compared to economist estimates for an

increase of about 165,000 jobs.

But the previous month's jobs growth was downwardly revised to

222,000 jobs from the initially reported 312,000 jobs.

The unemployment rate unexpectedly inched up to 4.0 percent in

January from 3.9 percent in December. Economists had expected the

unemployment rate to be unchanged.

Traders await ISM manufacturing PMI, construction spending and

University of Michigan's consumer sentiment due shortly for

directional clues.

The two-day U.S.-China trade talks ended on a positive note and

suggested that U.S. delegation will visit China in mid-February for

a new round of trade talks.

While China promised to "substantially" expand purchases of U.S.

goods, U.S. President Donald Trump said the trade dispute would

hopefully be resolved before the March 1 deadline.

The currency rose against its major counterparts in the Asian

session, with the exception of the euro.

The greenback advanced to a 2-day high of 109.08 against the

yen, from a low of 108.72 touched at 8:45 pm ET. The greenback is

seen finding resistance around the 111.00 level.

The latest survey from Nikkei showed that Japan's manufacturing

sector continued to expand in January, albeit at a slower pace,

with a manufacturing PMI score of 50.3.

That's down from 52.6 in December, although it remains above the

boom-or-bust line of 50 that separates expansion from

contraction.

The greenback fell to 1.1486 against the euro, after rising to a

2-day high of 1.1434 at 12:30 am ET. Next key support for the

greenback is likely seen around the 1.16 region.

Survey data from IHS Markit showed that Eurozone manufacturing

sector moved closer to stagnation in January amid a modest gain in

output and a sharp fall in new orders.

The final Eurozone manufacturing Purchasing Managers' Index

dropped to 50.5, in line with the flash estimate, from 51.4 in

December. A PMI reading above 50 suggests growth in the factory

sector.

The U.S. currency held steady against the pound, after having

climbed to an 8-day high of 1.3043 at 5:00 am ET. The pair finished

Thursday's trading at 1.3106.

Survey data from IHS Markit showed that UK manufacturing growth

slowed more-than-expected in January to its lowest level in three

months.

The IHS Markit/CIPS Purchasing Managers' Index for manufacturing

fell to 52.8 from 54.2 in December. Economists had forecast a score

of 53.5.

Although the greenback briefly spiked up against the franc

immediately after the data, it retreated in a short while and was

trading at 0.9938. The currency had set a 2-day high of 0.9958 at

2:00 am ET. At yesterday's close, the pair was worth 0.9941.

The U.S. construction spending for December, ISM manufacturing

index and University of Michigan's final consumer sentiment index

for January are scheduled for release shortly.

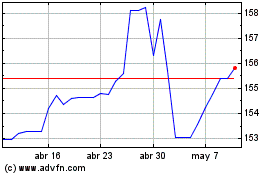

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs Yen (FX:USDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024