Dow Climbs on Strong Earnings Reports From Exxon, Chevron

01 Febrero 2019 - 2:29PM

Noticias Dow Jones

By Avantika Chilkoti and Corrie Driebusch

Big gains by energy behemoths Exxon Mobil and Chevron lifted the

Dow Jones Industrial Average Friday, putting the index on pace for

its sixth consecutive week of gains.

January's nonfarm payrolls report also buoyed stocks after

showing employers added more jobs than anticipated and unemployment

held near historic lows.

The strong report, along with a tick up in wages, supports the

newfound optimism in the U.S. economy that has washed over the

stock market in the new year. Fears of an economic slowdown late

last year have been eased by better-than-feared corporate earnings,

a more accommodative Federal Reserve and signals of strength from

the labor market.

The blue-chip index added 30 points, or 0.1%, a day after

closing out its strongest January in 30 years. Shares of Exxon and

Chevron both climbed 3.1% after posting some of their biggest

annual profits in years.

Earlier gains in the S&P 500 and Nasdaq Composite

disappeared in afternoon trading, however. The S&P 500 fell

0.1%, while the Nasdaq Composite declined 0.3%, both hurt by big

declines in shares of Amazon.com. The retailer's shares fell 5.3%

after the company cautioned that its spending is likely to increase

this year and government restrictions in India could weaken its

revenue there.

All three indexes are still on track for gains of at least

1%.

The past week ushered in a big batch of corporate earnings, and

with just under 50% of the companies in the S&P 500 having

reported results, 70% have reported stronger-than-expected profits,

according to FactSet. Companies in the index are on track to post

year-over-year earnings growth of 12%, which on one hand marks the

index's fifth straight quarter of double-digit earnings growth, but

also is the first time growth has fallen below 20% since the fourth

quarter of 2017, FactSet data show.

Data from the Labor Department also has painted a better picture

than many investors anticipated heading into the new year. U.S.

nonfarm payroll numbers rose a seasonally adjusted 304,000 in

January, the unemployment rate rose to 4.0% and average hourly

wages for private-sector workers grew 3.2% from a year earlier,

data released Friday showed. Economists surveyed by The Wall Street

Journal forecast that employers added 170,000 jobs during the month

and the unemployment rate was steady at 3.9%.

U.S. government bond prices fell on the jobs report. The yield

on the 10-year U.S. Treasury note, which moves inversely to prices,

rose to 2.691%, from 2.636% ahead of the data and 2.631% on

Thursday.

The strong data follows Federal Reserve Chairman Jerome Powell's

comments Wednesday that the case for raising rates "has weakened

somewhat," which eased concerns about monetary policy in the

world's largest economy. The juxtaposition of Mr. Powell's remarks

and the stronger-than-expected jobs report has some analysts

speculating the Fed may have been too quick to cool its pace of

interest-rate increases.

However, even as January's employment numbers looked good, the

Labor Department revised figures for December, lowering payroll

gains. Also, the unemployment rate ticked up and the labor-force

participation rate remains only modestly above multidecade lows

touched in 2015.

Overall, stock investors viewed the report as a positive, and

shares of a broad swath of companies from industrial firms to

technology heavyweights climbed.

With January over and the recent Fed meeting and jobs report

complete, investors said the big overhang for stocks is ongoing

discussions between the U.S. and China as the two countries try to

reach a trade agreement.

"The single most important thing now is the negotiations with

China," said Brian Rose, senior economist Americas at UBS Global

Wealth Management. "This is a big risk for the economy and stock

market."

Comments from President Trump on Thursday suggested another

high-level meeting with Chinese President Xi Jinping was in the

cards as negotiations continued.

"If we have a Cold War between China and the U.S. like we had

with Russia and U.S., then we have a problem," said Didier Rabattu,

head of equities at Lombard Odier Investment Managers, who said he

is optimistic that tensions will calm in the coming weeks. "Trump

is going to make a trade deal with Xi in the short term for a

simple reason: He has made one or two political mistakes recently;

the shutdown with the wall was a mistake."

In Europe, the Stoxx Europe 600 added 0.3%. Asian markets were

mixed, with China's Shanghai Composite up 1.3%, Japan's Nikkei up

0.1% and Hong Kong's Hang Seng Index down marginally.

In commodities markets, U.S. crude oil added 2.8% to $55.29 a

barrel.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com and

Corrie Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

February 01, 2019 15:14 ET (20:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

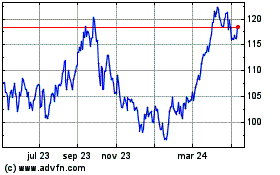

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

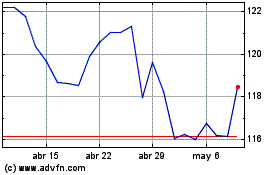

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024